PSX closes mixed Tuesday session with 163-point fall

October 26, 2021

- KSE-100 index slips 0.36% to touch 45,255.97 points by the end of today's session.

- A host of financial results announced during the day failed to entice market players, who refrained from taking fresh positions.

- During the day, technology, exploration and production, and banking sector stocks remained in the red.

KARACHI: The Pakistan Stock Exchange (PSX) ended another session in the red on Tuesday — the third day running — with the benchmark KSE-100 index shedding over 160 points.

Concerns arising from delays in an International Monetary Fund (IMF) decision on Pakistan's loan programme and depreciating rupee against the US dollar shattered investors' confidence. Widespread uncertainty about economic recovery exacerbated the market’s decline.

Moreover, reports that inflation has reached its highest levels in 70 years during the three-year tenure of the PTI government, with food prices doubling, further added fuel to the downtrend.

A host of financial results announced during the day failed to entice market players, who refrained from taking fresh positions.

During the day, technology, exploration and production and banking sector stocks remained in the red.

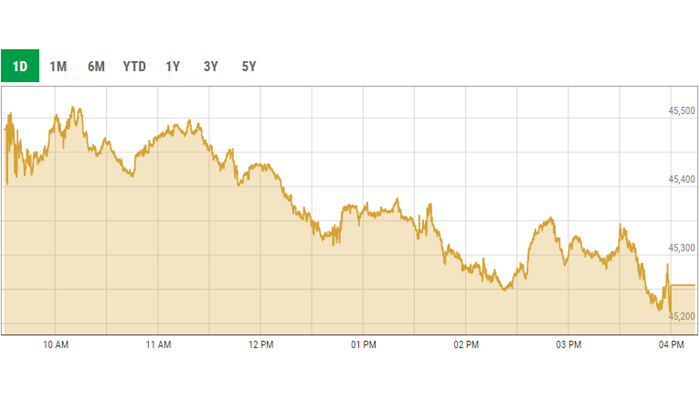

The benchmark touched the day's high at 45,516.77 points but failed to sustain the bullish momentum. It went on to touch a low of 45,213.62 points during intra-day.

The KSE-100 index oscillated between red and green zones as investors awaited corporate results for the year ended June 30, 2021, in certain sectors.

The index slipped 0.36% to touch 45,255.97 points by the end of today's session.

A report from Topline Securities noted that another lacklustre session was observed at the PSX where the bourse witnessed range-bound activity.

“Investors’ sentiment remained low today in absence of any positive trigger as no progress was seen on IMF programme front,” it said, adding that there are no updates on Saudi oil deferral payment facility as well.

Hum Network Limited was the volume leader with 24.9 million shares, gaining Rs0.14 to close at Rs6.84. It was followed by Ghani Global Holdings with 8.4 million shares, gaining Rs0.25 to close at Rs29.9, and Lotte Chemical Pakistan with 8 million shares, gaining Rs0.04 to close at Rs15.42.