PML-N govt presents fifth budget with Rs5.1 trillion outlay

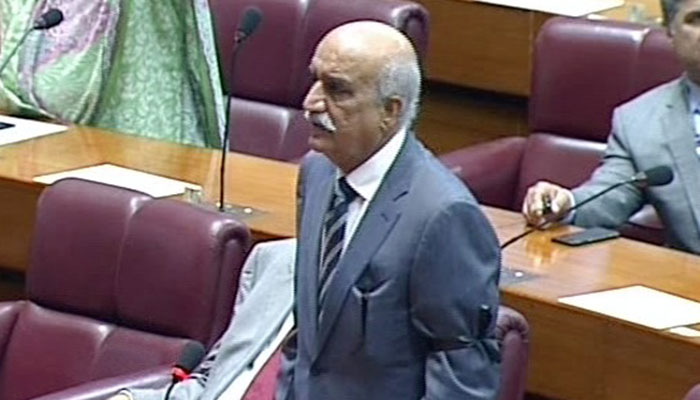

Finance minister began speech after opposition leader's remarks criticising the government

May 26, 2017

ISLAMABAD: The Pakistan Muslim League – Nawaz (PML-N) government on Friday presented its fifth and possibly last budget before general elections in 2018, earmarking a total of Rs 4,757 billion in expenditures for the next fiscal year.

"For the first time in Pakistan's history, an elected prime minister and finance minister are presenting their fifth budget. This shows the strengthening of democracy in the country," the minister said as he began presenting budget on the floor of the National Assembly.

Pakistan was on the verge of defaulting in 2013 and the economy was declared unstable on the basis of macroeconomic indicators, recalled Dar.

"Today, the country's foreign exchange reserves are adequate enough for four months of imports. The supply of gas has improved, and load shedding has been completely halted for the industries. Inshallah, load shedding will end for good come next year," he added.

The finance minister claimed the PML-N government had turned the economy around since it came to power in 2013.

"Today, reputable organisations like PricewaterhouseCoopers are saying that Pakistan will enter the G-20 group of nations in the near future," claimed Dar.

The GDP growth rate was 5.3% in the outgoing fiscal year — the highest in ten years, he stated, adding that it was for the first time that Pakistan's economy had grown to over $300 billion. "This shows the strengthening of the economy," said Dar.

Govt to keep inflation under 6%, budget deficit at 4.1%

Announcing details of the budget strategy, the finance minister said the government was aiming to keep inflations rate under six percent, and budget deficit at four percent.

"The government followed a policy of fiscal consolidation because of which fiscal deficit reduced from 8.2% to the current year's 4.2%. This was achieved through higher revenue collection through improved administration and broadening of the tax base, undoing decades-old concessionary SRO and curtailing non-development expenditure of the government," said Dar.

"In fiscal year 2012-13, FBR collection was Rs.1,946 billion. For the current year the target is Rs.3,521 billion. This represents a historic increase of 81% in the last 4 years with average annual growth of 20%.

"Tax to GDP ratio, which was 10.1% in fiscal year 2012-13, is likely to increase to 13.2% this year," said Dar, adding the government was targeting tax to GDP ratio of 13.7% in the year 2017-18.

He said the PML-N administration was targeting increase in real GDP growth to 6%, taking investment to GDP ratio to 17%, net public debt to GDP ratio below 60% of GDP, and keeping foreign exchange reserve levels adequate enough to cover a minimum of 4 months of imports.

The foreign exchange reserves stand today at $16 billion, which come up to $21 billion after adding the bank reserves, he stated.

Tax collection target for the upcoming fiscal year has been set at Rs3,521 billion, he added.

Announcing further measures in the budget, the finance minister said the minimum wage for unskilled workers would be raised from Rs14,000 to Rs15,000.

The minister said that Rs121 billion will be allocated for the Benazir Income Support Programme, which is three times its allocation in the 2013 budget.

The minister said an investment of Rs97 billion is being undertaken in the Pakistan Stock Exchange.

He also said that women will be given representation in listed companies as well as representation in boards of governors.

The government is aiming to achieve a tax revenue target of Rs4,330 billion, with Rs4,013 billion in taxes collected by the Federal Bureau of Revenue (FBR), and Rs317 billion in other taxes. The non-tax revenue is targeted at Rs979.9 billion.

On the expenses side, the government allocated Rs3,477 billion for ‘current expenditure’, and Rs1,275 billion for development expenditure.

The budgeted current expenditure includes Rs1,363 billion in interest payments, Rs248 billion in pensions, Rs920 billion for defence affairs and services, Rs430 billion for grants and transfers, Rs138 billion in subsidies, and Rs378.8 billion for the running of the government.

Talking about the exports sector, which has showed a negative growth, the minister revealed that the customs duty on the export of raw hides has been suspended. He announced similar measures for stamping foil.

The minister also informed the House that the present housing shortage in the country is one million, and increasing annually by 0.3 million units. He thus announced a 40% government guarantee on loans up to Rs10,000 from banks and other financial institutions for housing purposes.

The sales tax on the commercial import of fabric will be set at 6%.

The minister also announced the setting up of an Information Technology Park in Islamabad in collaboration with South Korea.

Majority of population is under 20 years of age, thus our focus is on them, said the minister.

An allocation of Rs49 billion has been made for the health sector.

'10,000MW to be added to national grid by 2018'

Highlighting the energy sector reforms, Dar said 10,000MW will be added to the national grid by 2018. "Load shedding will be history," he claimed.

The minister added that 15000MW will be added to the grid in later years.

An amount of Rs180 billion has been earmarked for CPEC-related development projects in the country.

The Karachi Operation which began on the premier's orders in 2013 has borne fruit, said the minister, adding that the nation is proud of the army for defeating the enemy after the government launched Operation Zarb-e-Azb in June 2014. "No army has sacrificed against terrorism as much as the Pakistan Army has," he stated.

In recognition of these sacrifices, a special raise of 10% allowance apart from salaries will be provided for them, he declared. The minister also announced a special welfare package for the families of martyrs from the armed forces, police and other security agencies.

Moreover, an increase of 10% in the salaries of government employees and as much increase in pension of retired employees has been announced.

The minister also declared a decrease in the withholding tax for registration of vehicles for filers of tax returns. Registrations of 850cc vehicles will now cost Rs7,500, 1,000cc vehicles will now cost Rs15,000 and that of 1,300cc will cost Rs25,000. There has obviously been no decrease for non-filers, the minister commented.

Corporate tax brought down to 30%

Talking about the corporate tax, Dar said it has been brought down from 35% to 30% as promised by the government.

The minister also presented the proposal to raise the customs duty on electronic cigarettes from 3% to 20%.

A raise in the regulatory duty on betel nut from 10% to 25% has been proposed along with a Rs200/kilogramme regulatory duty on the import of paan.

The minister also presented a recommendation to end the 5% regulatory duty on the import of raw materials related to the poultry industry. He also informed of a reduction in customs duty in the poultry business from 11% to 3%.

Special persons will get a 2% job quota in listed companies as per the newly passed companies act, the minister announced.

The minister also proposed a uniform regulatory tax of 9% on the telecommunications sector and announced relief package on duty for electric cars.

The budget of the Pakistan Baitul Maal is to be raised from Rs4 billion to Rs6 billion.

The government is also set to launch a scheme for the payment of HBFC loans for widows. The scheme is valid for widows who have not remarried.

Ruckus mars start of budget session

The assembly session formally started with prayers at the Parliament House around 4:45pm for the presentation of the federal budget.

The National Assembly was already in session from May 23.

After being allowed to address the House by the speaker, Opposition Leader Khursheed Shah referred to the incident in the capital’s Red Zone earlier in the day when farmers from various areas of Punjab gathered to protest the ‘unfair’ policies of the budget.

Shah said that he was speaking on behalf of all opposition members and claimed that they intend to walk out in protest of the treatment meted out to the farmers.

The opposition leader said that the farmers were only asking for their rights and should not have been shelled or baton-charged by the police.

“This is injustice to the most important class of the society, they fill our food basket,” he said.

Shah further said that several ruling party members with a background in agriculture also do not agree with the government’s policies on agriculture but they are bound not to speak.

“What’s the difference between a democratic government and a dictatorship?” said Shah, adding that it is the tactic of authoritarian regimes to suppress voices demanding their rights.