Unexplained Wealth Orders unlikely to affect Pakistanis who have already invested in UK

UWOs are investigative tools in the UK to try and help tackle the perception that the UK is a place where money-laundering takes place through corrupt means

February 08, 2018

LONDON: A new law called Unexplained Wealth Orders (UWO) that allows UK authorities to freeze and recover property if individuals cannot explain why they own assets worth more than their income and how they have acquired them legally is designed as a ‘forward looking’ law which will primarily deal with cases that arise in future, rather than going back beyond six years, leading law experts have confirmed.

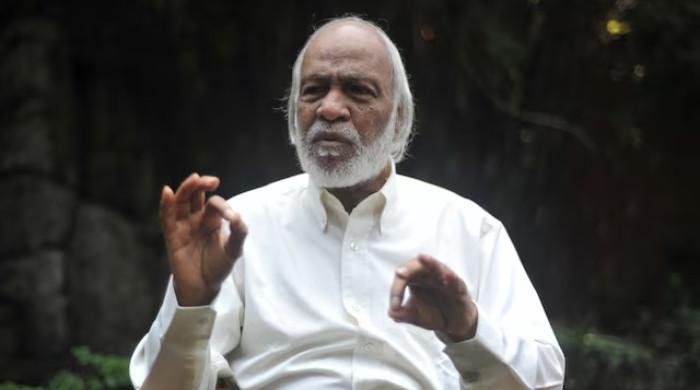

Craig Weston and Barrister Zarif Khan are two leading lawyers, who have extensive experience of dealing with high-profile corporate, money-laundering and financial cases among others.

Both lawyers agreed that the UWOs are investigative tools in the UK to try and help tackle the perception that the UK is a place where money-laundering takes place through corrupt means.

Khan said that the UWO is “more of a future legislation rather than going back, let’s say 5 or 10 or 20 years. It’s to deal with the people who come to the UK from now onwards with what’s known as unexplained wealth”.

Barrister Khan added: “The only other legislation that comes near it is the Proceeds of Crimes Act (POCA) which can only go back six years so it will be very surprising if it can go back beyond six years even though its arguable as the legislation doesn’t define the period of time as to how far it can go back. The interesting part would be if you are caught tomorrow and you may have to explain where has your wealth come from in the last few years. Anything beyond this period is going to be difficult and that’s arguable in the way that the information isn’t available or somebody has died or the asset has been inherited.”

“The reality of this legislation is that its retrospective, which means the investigative agencies can go far back but my sense is that they are not going to be trawling back over 10 or 20 or 30 years, they are likely to be looking at a similar period of six years. The UWOs are going to come into effect going forward, it will act as a deterrent rather than anything else," said Craig Weston

"Powers are there but there will need to be a trigger event and the trigger event is not in the legislation but it could be the purchase of a new property or when an enforcement agency is going to be interested in where someone buys a new property, sells a yacht or buys an art piece or does something with his assets. That’s how you are going to come to the attention of an enforcement authority,” he said, adding that those already sitting on their assets have nothing to worry about.

Weston said the UWOs are going to be used by investigative agencies to look into new purchase of assets in the UK, however they have powers to entertain Mutual Legal Assistance (MLA) from abroad but they would have to consider “whether a UWO from the UK would further the UK interests and the UK could ask for MLA form foreign legislations.

Both Khan and Weston agreed that the UWOs will mainly target those individuals who are suspected of involvement in criminality or have funds at their disposals and happen to be falling in the category of politically exposed persons (PEPS).

Craig added that the new powers are related to non-European Union PEPs, will not apply to British nationals and will affect PEPs from abroad who mainly buy new properties or do some kind of activity with the old assets and it also targets relatives and associates of PEPs.

Craig Weston further said this is not aimed or designed to deter the investment in the UK but to make investors and PEPs from Russia and Middle East more cautious and “what it might also do is to make them slightly more structured and help them to produce an audit trail which can be provided to an enforcement authority if the UK authority seeks it.

He said there is no chance that there will be many UWOs against foreigners interested in buying UK properties.

Weston also said that the UWO powers are designed to bring the high-net individuals seeking to buy properties in London such as Russian oligarchs and oil-rich Arab sheikhs and ministers, advisors or other individuals who have been in government positions and held prominent portfolios and the people linked to them.

“We will see the enforcement agencies coming into action through UWO when these individuals buy new properties and if there are suspicions about the payments being made. The enforcement authorities will use these powers when there is a risk of criminal conviction and where there is a huge disparity between the known wealth of an individual, unknown sources of income and the value of the assets being purchased.

Barrister Khan added that it’s argued that Britain’s economic situation would have been worse off if foreign investors had not pumped money into its economy in the last few decades on a large scale and that fact can’t be denied that Britain has been taken out of recession through heavy cash flow from abroad – from Russians, Arabs and Chinese.

Khan was sure that the investors and the PEPs will find ways around the UWO because “there’s a whole industry which helps in getting away with such laws and the fact is, there is already a lot of legislation already available around”.

He said the government is trying to appease concerns about London being the haven of laundered wealth and to tell the world that it is doing something about criminals and PEPs.

“The existing money-laundering legislation is the real bite and that is wide enough to capture anyone who is involved with unexplained wealth”.

An Unexplained Wealth Order is a civil, investigative power, which requires people to explain the ownership of certain assets - but does not alone allow for a seizure and only enforcement agencies (National Crime Agency, HMRC, and the Financial Conduct Authority) can apply for an Unexplained Wealth Order.

After the UWO came into implementation earlier this month, Transparency International called for inquiry into several properties under UWO including three flats owned by former premier Nawaz Sharif’s sons in Mayfair but a detailed study of the law shows that UWOs are highly unlikely to affect Sharifs and other prominent Pakistanis from politics and business such as Pervez Musharraf, Rehman Malik, Jahangir Tareen, Aleem Khan, Miah Mansha, Malik Riaz and others.

The money invested by Pakistanis in London is only a tiny fraction of what investors from Russia, China and the Middle East have poured into London, buying everything from luxury properties to entire companies and the provenance of some of those funds has been questioned by transparency campaigners – the investment amounts to tens of billions.