President Mamnoon issues ordinance approving tax amnesty scheme

The scheme, unveiled on April 5, seeks to broaden government's revenue base

April 09, 2018

ISLAMABAD: President Mamnoon Hussain on Sunday issued the Foreign Assets (Declaration and Repatriation) Ordinance bringing into effect a tax amnesty scheme announced by the prime minister earlier this week.

The ordinance encompasses assets obtained on installments, declaration of property as per the "fair market value" and its confiscation by the government in case of violation, declared and undeclared foreign assets, including "real estate, mortgaged assets, stock and shares, bank accounts, bullion, cash, jewels, paintings, accounts and loan receivables, beneficial ownership or beneficial interests or contribution in offshore entities and trusts."

It said the officials appointed by the government for the implementation of the ordinance would be empowered. The provisions of the ordinance shall apply to all citizens of Pakistan wherever they may be, except "holders of public office, their spouses and dependent children."

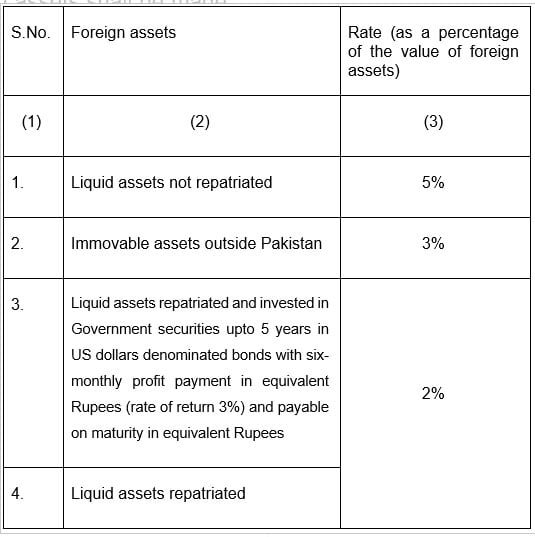

The foreign assets declared and repatriated into Pakistan within the due date shall be chargeable to tax at the rates specified in the Table below:

The particulars of any person making a declaration under the ordinance, or any information received in any declaration made under the ordinance, shall be confidential.

Prime Minister Shahid Khaqan Abbasi had unveiled a five-point tax reforms package on Thursday, which included a tax amnesty scheme for undeclared foreign and domestic assets, and reduction in income tax rates.

The prime minister launched the amnesty scheme and reforms package in a last-ditch attempt at broadening the government's revenue base, merely 55 days before the end of the government's tenure.

Five-point tax reforms package

⯈ CNIC (Computerised National Identity Card) number to become NTN tax number.

⯈ Reduction of income tax rates:

-Tax exemption on annual income up to Rs1.2m

-5% tax on annual income between Rs1.2 and Rs2.4mn

-10% tax on annual income between Rs2.4 and 4.8mn

-15% tax on annual income above Rs4.8mn

⯈ One-time tax amnesty scheme:

Citizens can declare previously undeclared:

-Local liquid assets at 5% penalty;

-Foreign cash assets at 2% penalty;

-Assets/fixed property abroad at 3%;

-Dollar accounts can be declared and kept abroad at 5% penalty

⯈ Property sector tax reform:

The government says most tax evasion occurs in real estate transactions. There are huge gaps in property values and the amounts at which they are registered, said the prime minister.

-1% Advance Income tax on all property transactions

-Advance tax to be adjusted in income tax liability

-Federal govt to recommend maximum 1% local, provincial taxes

-Govt can buy property by paying 100% above declared value

⯈ Monitoring of taxpayers:

Govt to monitor financial records of citizens and issue notices if it finds tax evasion. Parliament to decide penalties.

Tax evasion has been rampant in Pakistan, where only 1 percent of the adult population pays tax.

Announcing that all 120 million national identity card holders would be assigned tax numbers, Abbasi had told a news conference in Islamabad: "If you don't pay taxes, Pakistan will not be sustainable."

He had said that politically exposed persons (PEPs) and their families were not eligible to benefit from the scheme — valid till June 30.

"Under the amnesty plan, all Pakistanis will be able to declare their unreported income and assets and bring their money into the tax base after paying a 5 percent one-off penalty," Abbasi had said.

'Scheme doesn't violate money laundering laws'

Adviser to the prime minister on Finance Miftah Ismail assuaged the concerns of the Financial Action Task Force (FATF) on Saturday and assured the tax amnesty scheme does not violate money laundering laws.

“Pakistan’s tax amnesty scheme adheres to all international anti-money laundering laws,” the adviser on finance said while speaking to Geo News.

Ismail shared that he has received an e-mail from the global money-laundering watchdog, FATF, calling for global needs and the agreed-upon guidelines to be respected.

“The FATF has stressed upon strict monitoring of money laundering and terrorist financing activities,” the Pakistani premier’s financial adviser said.

Ismail further said he has not responded to the email as yet.