Taxes levied on petroleum when prices decrease globally: CJP

During a hearing CJP sought explanation over increase in taxes on petroleum products by relevant authorities

May 09, 2018

ISLAMABAD: The Supreme Court has sought explanation from relevant departments over imposition of taxes on petroleum products, observing that taxes are levied whenever relief has to be provided to the public.

During a hearing on Wednesday, Chief Justice of Pakistan Justice Saqib Nisar remarked that prices of petroleum products in Pakistan seldom go down when there is a decrease in the international market, as the government keeps imposing taxes.

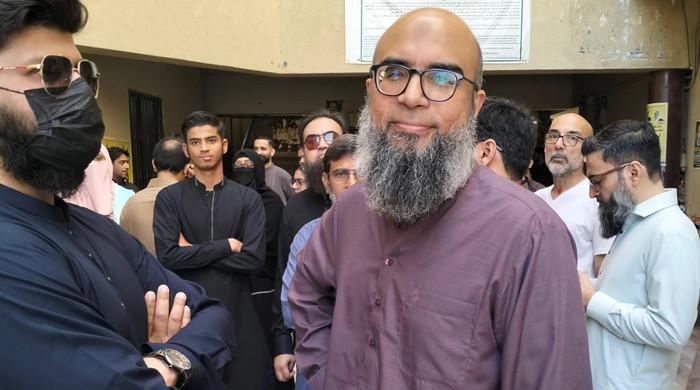

Since Additional Attorney General Nasar was also present in the court, Justice Ijaz-ul-Ahsan questioned him on type of taxes applicable on petroleum products and price of petroleum in international market.

The additional attorney general told the court sales taxes on petroleum products in Pakistan are lowest in the region, adding that India levied 27% taxes on its petroleum products. To this, the chief justice remarked that taxes between India and Pakistan incomparable justice like the information technology sector of both the countries was.

The chief justice then sought an explanation over imposition of taxes on petroleum products from relevant departments, adjourning the hearing for a week.

Following the announcement of budget for fiscal year 2018-19, the government recommended an increase of nearly 200% in petroleum levy.

Under the Finance Bill 2018, tax on diesel, petroleum, crude oil and high-octane fuel would be increased from Rs10 per litre to Rs30. The same increase would be imposed on the levy of light speed diesel and gasoline, while levy on local liquefied petroleum gas could go up by 328%.