No tax deduction on mobile phone top-ups until SC orders: sources

The 15 day period, during which no deduction had to be made on mobile phone recharge, expired midnight on Friday

June 29, 2018

KARACHI: Cellular services providers will continue providing customers with 100 per cent credit on every mobile phone recharge until the Supreme Court announces its final verdict in the case, sources informed Geo News Thursday.

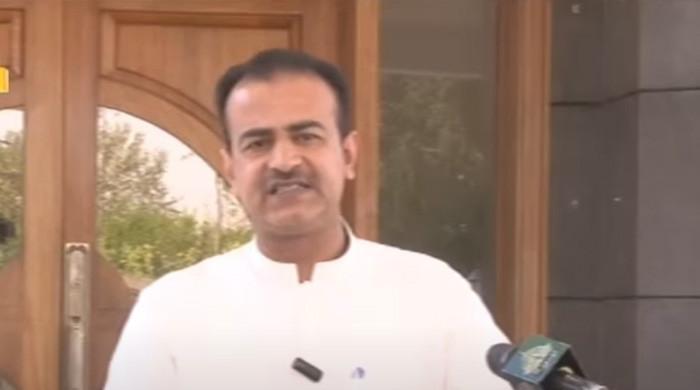

Sources said the decision was made at a meeting of tax authorities and representatives of cellular services companies, presided over by the attorney general of Pakistan on Thursday.

The 15 day period, during which no deduction had to be made on mobile phone recharge, expired midnight on Friday.

Officials of the Federal Board of Revenue (FBR) briefed the meeting, during which the officials said the revenue authority did not direct services providers for not deducting tax on mobile top-ups, according to sources. The companies decided not to deduct tax in the light of the apex court's orders.

The FBR would still not issue any directives whether or not to deduct tax and services providers had to decide about it in view of the Supreme Court's orders, the sources quoted FBR officials as saying.

The officials also said the cellular services companies would be answerable before the apex court with regard to the matter, according to sources.

On June 11, the Supreme Court had ordered a suspension in deduction of taxes on prepaid scratch cards.

Chief Justice of Pakistan Justice Saqib Nisar had ordered the suspension while heading a three-judge bench hearing a suo motu case regarding an increase in taxes on prepaid cards at the top court’s Lahore Registry.

Chief Justice of Pakistan Justice Saqib Nisar had ordered the suspension while heading a three-judge bench hearing a suo motu case regarding an increase in taxes on prepaid cards at the top court’s Lahore Registry.

“Taxes should be taken from users whose mobile phone usage is above the set limit,” Justice Nisar had remarked during the hearing.

Services providers had then decided not to deduct tax on mobile phone top-ups for a period of 15 days, until the FBR and services providers formulate a new policy in this regard.

Previously, customers would receive Rs64.28 on the recharge of Rs100 prepaid card, after deduction of federal excise duty, income tax and sales tax.