NAB to pay Rs8.3 billion after losing case to Broadsheet LLC in UK

Broadsheet LLC was hired by NAB during Musharraf’s era to trace assets in UK and US of over 200 Pakistanis

December 27, 2018

LONDON: The National Accountability Bureau (NAB) is set to foot the bill of over $45 million (approximately Rs6.238 billion) after losing a major case at the London Court of International Arbitration (LCIA) to asset recovery firm Broadsheet LLC.

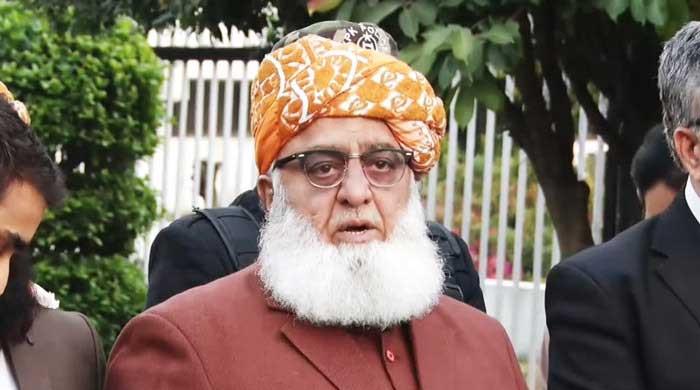

Broadsheet LLC was hired by NAB during former president Pervez Musharraf’s era to trace assets in the UK and US of more than 200 Pakistanis (called ‘targets’ in the contract) including generals, politicians and businessmen with Benazir Bhutto, Asif Ali Zardari and Nawaz Sharif as the chief targets. Broadsheet LLC alleges that NAB terminated it in 200.

Although, Broadsheet failed to produce any kind of evidence of wrongdoing against Nawaz Sharif’s sons, Hasan and Hussain Nawaz, it is now set to make a new claim against NAB for a $25 million fine imposed on the former premier by the accountability court in Al-Azizia reference verdict. The total cost to NAB will be over $60 million when all costs, damages and fines are taken into consideration.

As per papers seen by The News, the total amount payable by NAB stands at around $60 million (approximately Rs8.317 billion) on various counts, and any attempt by accountability watchdog to wriggle its way out could only increase fines, costs and interests.

It all started in 2000 — a year after Pervez Musharraf took over in a military coup and established NAB to investigate corruption allegations against public officials, including the Sharifs. Musharraf’s government entered into an agreement with the Isle of Man-registered Broadsheet LLC in early 2000 with the task to help track down assets of Nawaz and more than 200 other politicians, generals and officials at its own expense — in return for 20 per cent of any sums recovered from the designated targets.

The News has seen the papers which show that the NAB has been held responsible for contractual damages and breach of contract from the day it signed the contract to trace assets of ‘target’ Pakistanis.

The total award to Broadsheet against NAB is $21,589,460 against the following targets: Schon Group: $48,760 interest from 1 Jan 2013; Lakhani: $25,000, 1 July 2005; Kasmi: $85,600, 1 July 2005; Lt Gen Zahid Ali Akbar: $381,600, 1 Jan 2016; Sherpao: $210,000, 1 Jan 2018; Ansari: $180,000 (1 Jan 2005), $158,500 (1 Feb 2007) and $1,089,460; Sharif Avenfield ($1,500,000) and Sharif (other assets) $19,000,000.

The arbitration order says that “the parties are requested to calculate the amount of interest from the above dates to the date of this award (December 17, 2018) and although dates of all the ‘targets’ for interest rate application have been given, no dates have been given against the work carried out against Nawaz's sons. It’s understood that Broadsheet started work against Sharifs as the first targets immediately after signing the contract in 2003.

A source told this correspondent that other than the above costs, Broadsheet would claim $10 million from NAB in litigation and case costs after the decision is in its favour. In addition, Broadsheet will seek 7 per cent interest rate and the total amount in interest rate will be around $6 million. The source said that Broadsheet will further seek around $6 million from NAB after Nawaz’s conviction and fine imposition claiming that the assets recovery firm was the first to initiate work on his alleged assets and provided paperwork to the accountability bureau.

The source revealed that NAB’s defence law firm Allen & Overy LLP has been paid, so far, £11 million (approximately Rs1.92 billion) and £2.5 million (approximately Rs437 million). These costs could go up if NAB continues to seek services of this firm or any other. Another hearing is set to take place in London after a month from now in which the schedule of payments will be decided.

Litigation against NAB and Broadsheet LLC has been going on for several years but the last hearing took place in end July.

Colorado businessman Jerry James formed Broadsheet LLC as an offshore company. He filed for liquidation proceedings in the Isle of Man in 2005, before being dissolved and then revived. He then established a Colorado company with the same name and negotiated an agreement with NAB in 2008 to settle the dispute for $2.25 million. NAB made two payments after that: £2.25 million was paid to another law firm and £1.5 million was pad to Jerry James and in the later deal, then High Commissioner Abdul Basit was a witness. NAB paid $ 1.5 million to Jerry James despite the knowledge that Broadsheet had gone into liquidation and Jerry James did not represent the appointed liquidator.

Broadsheet argued that NAB broke terms of the contract and entered into agreements with the ‘targets’ without notifying it and therefore depriving it of the share as agreed. In August 2016, the international tribunal judge Sir Anthony Evans upheld Broadsheet’s arguments that the 2008 settlement was not binding on it and it was established that James had no authority to act on the company’s behalf at the time. It was also ruled that Pakistan is liable to pay damages as NAB wrongfully repudiated an asset recovery agreement with the Broadsheet and breached contract. It said that the payment agreement between NAB and Jerry James was a sham. It was declared that Broadsheet was entitled to damages but the full extent will be determined later.

The matter reached the Supreme Court of Pakistan after Broadsheet LLC requested the apex court to release a copy of Volume-X of the joint investigation team (JIT) report on Panama Papers. Both Attorney General for Pakistan (AGP) Anwar Mansoor Khan and Prosecutor General NAB Asghar Haider opposed the contention of Broadsheet regarding obtaining Volume-X of the JIT report.

Latif Khosa, the counsel for Broadsheet LLC, argued if Volume-X of the JIT report is not provided then it would have a negative impact on the arbitration pending before Sir Anthony Evans, sole Arbitrator of International Arbitration in the United Kingdom.

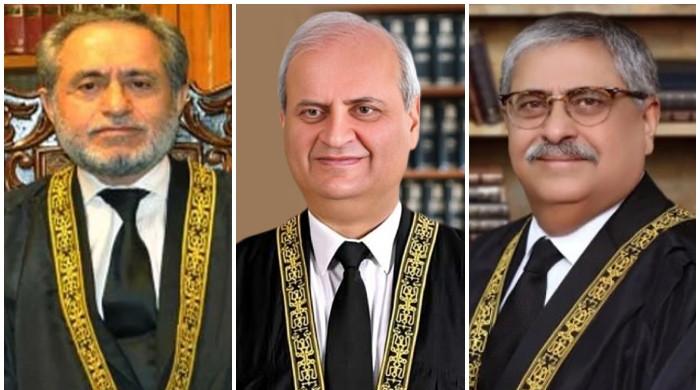

However, Justice Azmat Saeed said that a three-member bench on 10-07-2017 while hearing the Panama Leaks case had passed the order that Volume-X of the JIT report would remain confidential.

Originally published in The News