New Year to bring additional Rs155 billion tax burden

FBR has drafted a supplementary bill recommending an increase in tax duty on imported luxury cars, sales tax

December 30, 2018

ISLAMABAD: The New Year is expected to dawn with a heavier tax burden for Pakistanis as the Federal Board of Revenue (FBR) prepares a summary for the imposition of additional Rs155 billion taxes from January 2019, sources informed Geo News.

The FBR in its supplementary bill draft has recommended an increase in the tax duty on imported luxury cars, and uniformity on General Sales Tax on all items.

The department has also recommended an increase in sales tax from 5 percent to 22 percent.

It has further suggested a decrease in the customs duty on the raw materials to be used in the export-oriented industries.

FBR to launch action against tax evaders

In its latest measure to tighten noose around tax evaders, the FBR has established a special departmental to probe as many as 20 biggest tax evaders.

The department will begin probe for tax recovery from January 1, 2019. The FBR has been directed to ensure tax recovery within a month.

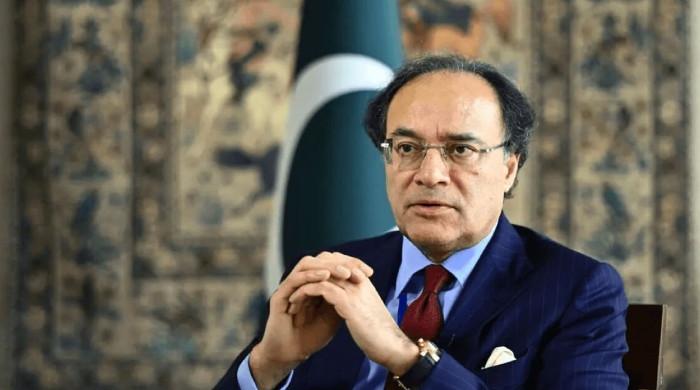

Finance Minister Asad Umar, earlier, presented the supplementary finance bill in the National Assembly in September, announcing cuts in planned development spending and a tax increase for higher earners.

"The country stands at the same place where it was after five years," the finance minister had lamented, adding that the fiscal deficit might reach to 7.2 per cent [2,900 billion rupees] in FY19. Umar had also recalled that the current account deficit increased from 2.5 billion dollars in 2012-13 to 18 billion dollars in FY18.

"In the five-year term [of the Pakistan Muslim League-Nawaz government], foreign debt increased by 34 billion dollars, while foreign exchange reserves continued to decline speedily," Umar said.