Federal Cabinet approves tax amnesty scheme

Amnesty scheme cannot be availed by individuals holding government positions after 2000

May 14, 2019

ISLAMABAD: The federal cabinet on Tuesday approved a tax amnesty scheme allowing citizens to declared previously undisclosed assets in a bid to identify high earners for more efficient tax collection.

The announcement for the approval of the scheme, made by the Prime Minister's Adviser on Finace Hafeez Sheikh, comes shortly after Pakistan reached a new agreement with the International Monetary Fund (IMF) securing a $6 billion bailout for the cash-strapped economy as the country struggles to stave off a looming balance-of-payments crisis amid low growth, soaring inflation, and mounting debt.

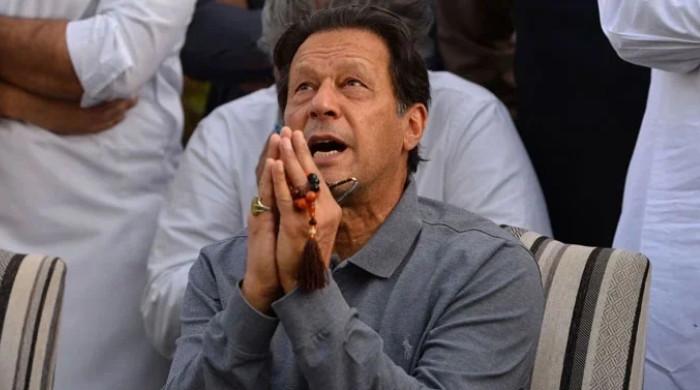

The amnesty scheme was approved in a session of the federal cabinet chaired by the Prime Minister in Islamabad earlier today.

Speaking to reporters at a press conference, Finance Adviser Hafeez Sheikh said the objective of the amnesty scheme was not revenue generation but formalisation and documentation of the black economy.

"We have tried our best to make this scheme as simple as possible so people do not have problems understanding it and implementation is seamless," he said. "The philosophy is not to threaten or intimidate people but to encourage businessmen."

He said that every Pakistani citizen — except for public office holders and their dependents — could avail this scheme to declare all previously undisclosed assets either abroad or in Pakistan.

Announcing the particulars, he said that citizens could use the scheme to whiten previously undeclared assets abroad by paying a 4% tax.

He said that a condition to declaring cash was that the amount be kept in a Pakistani bank account. He said that those who wish to keep the money abroad after getting it whitened would have to pay 6% tax.

For declaring properties, he said that value on which tax would be charged would be the market value, given that it is not less than 1.5 times the FBR-assigned value.

Hafeez said the deadline of June 30 would not be extended and that the scheme was the last opportunity for Pakistani citizens to declare previously undisclosed assets before the law takes its course.

He said that the scheme would also facilitate holders of benami (nameless) accounts and properties in declaring their assets before they are confiscated under a new law for benami assets, which also carried the possibility of prison sentences.

He reiterated that it was the last chance for tax avoiders "to try and come and avail this opportunity" before the law takes its course.

According to details, the amnesty scheme recommends the following:

- 5 per cent tax on individuals declaring assets by June 30, 2019

- 10 per cent tax on individuals declaring assets by September 30, 2019

- 20 per cent tax on individuals declaring assets by December 31, 2019

- 30 per cent tax on individuals declaring assets by March 31, 2020

- 40 per cent tax on individuals declaring assets by June 30, 2020

- Recommendation for investment in Pakistan Banao Certificates for those declaring assets abroad

- Recommendation for tax amnesty scheme for real estate sector

- 1 per cent tax on those declaring property by June 30, 2019

- 2 per cent tax on those declaring property by September 30, 2019

- 4 per cent tax on those declaring property by December 31, 2019

- The scheme will also be applicable on benami accounts

- 3 per cent tax on undeclared sales

- The scheme cannot be availed by individuals holding government positions after 2000

- The scheme will not be applicable on cases being heard in court

According to sources, the cabinet was also briefed on proposed measures to control prices of essential commodities amid rising inflation. It also discussed the $6 billion bailout package agreed upon with the International Monetary Fund.

A day ago, newly appointed chairman of the Federal Board of Revenue (FBR) Shabbar Zaidi said the government's focus was to enhance the tax net to improve the economy.

He said he would try to make changes in the tax collection system, adding that data from non-filers would be collected to include them into the tax net.

Observers view the scheme as the government's attempt to broaden its revenue base in a country where barely one percent of the adult population pay taxes.

The amnesty scheme is due to take effect before the annual budget, which is going to be the first biggest challenge for the new government of Prime Minister Imran Khan.

Economists say the budget is likely to reveal the biggest ever fiscal deficit, with revenue collection facing a shortfall of nearly 500 billion rupees ($3.54 billion).