Bilawal for the first time officially included into fake accounts probe

NAB summons PPP chairman on Friday, ex-president Asif Ali Zardari called up on May 23

May 16, 2019

ISLAMABAD: The National Accountability Bureau (NAB) has for the first time officially included Pakistan Peoples Party chairman Bilawal Bhutto Zardari into fake accounts probe for Opal-225, a joint venture of Zardari Group Ltd.

For investigation, the NAB's Combined Investigation Team has summoned the PPP chairman to explain "how the JV Opal-225, without conducting any legitimate business, paid Rs1.2 billion laundered kickbacks to Zardari Group".

"NAB CIT summoned him [Bilawal] in Opal-225 case — it is one of key cases associated with fake bank accounts. Before this he [Bilawal] was summoned in Park Lane Ltd case," a senior NAB official, who is now part of the investigation, told this correspondent. Bilawal has been summoned by the NAB in this case as he is the director of Zardari Group Ltd, he added.

In this investigation, wherein Asif Ali Zardari was summoned on May 16, NAB official further revealed that it transpired that payment amounting to Rs800 million was deposited from Opal-225 bank account into two alleged ‘fake accounts’ (M/s Dream Trading and M/s Ocean Enterprises) in the month of May/June 2013. The Opal-225 (referred in tax record is a joint investment of Zardari Group Ltd) was initiated on October 15, 2011, the probe further revealed. The said plot is property of Zardari Group and its value was reported on June 30, 2010 as Rs1.7 million.

On this issue when ex-president Zardari was asked about ventures of Zardari Group by the NAB, sources told Geo News, Zardari responded to NAB team saying, "JV (joint venture) agreement which is private construction agreement of Zardari Group and has no connection with the alleged fake bank accounts. The matter is civil transacting wherefrom no public money or misuse of authority in involved. No loss to national exchequer. Since September 2008 when I became president of Pakistan, I am only a shareholder of Zardari Group Ltd. Since then, I have no concern with day-to-day affairs of Zardari Group." NAB sources told Geo News that the former president has also been summoned again in Opal-225 and Park Lane Pvt Ltd cases again on May 23.

However, the property was commercialised and the value was revised upwards the next year, in disregard to the generally accepted valuation methods, to Rs3.4 billion (1980 times) on June 30, 2011, before it was committed to Opal-225 next year, the investigation revealed. The CIT also found out that as per JV agreement para 3 (iii) Zardari Group Ltd. received a sum of around Rs500 million (March-May 2011), for no plausible reason from its partner and scaled down the share of its investment in Opal-225 to Rs2.8 billion.

During tax year 2014, when Opal-225 filed its tax returns and final accounts for the first time, the share of investment of Zardari Group (Pvt.) Ltd in the venture was further scaled down to Rs2.1 billion. The reason of this scale down reflected in the statement of final accounts was shown as drawings from the capital by Zardari Group Ltd amounting to Rs1.22 billion (including the earlier withdrawal of Rs562 million) against its own investment. From 2011 to 2013, the project did not generate requisite revenues.

Moreover, even as per the venture arrangement, it was a JV project which had to pay and its partner group, as a business entity, was not obliged to any such payment to Zardari Group Ltd.

The analysis of Opal-225 accounts, as NAB investigation suggested, further revealed that another amount of Rs3.1 billion has been advanced against land. It is pertinent to mention here that only land committed for this venture is plot no 225 E1 Lines, Raja Ghazanfar Ali Khan Road, Saddar, Karachi Cantonment owned by Zardari Group Ltd, which had already invested in the same plot at the value of Rs3.4 billion in the Opal-225. Again, this advance against land to the tune of Rs3.1 billion, which was not due to be paid to anyone, seems to be another amount paid to Zardari Group Ltd, in addition to the already paid Rs1.22 billion. Investigation further revealed that a land valued at Rs1.72 million generated at least Rs4.3 billion within a couple of years, without the need of any dividends from the project, which could have been acquired only through the construction and sale of the project (flats, shops and offices etc) in the market.

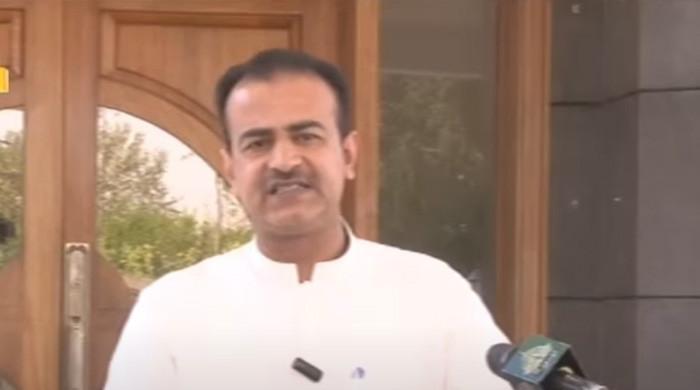

Farooq H. Naek, top counsel for Zardari, Faryal Talpur and Bilawal, said they had submitted their response before the NAB team. They are fighting their case on legal grounds and all allegations leveled against his clients were baseless and have no legal standing.

"Finally, we would win these cases as they all are allegations. It is political victimisation," Naek said.