Sale of illegal cigarettes continues unabated in Pakistan

SBP report suggests primary reason behind increase in sale is the significant increase in FED rates

February 11, 2020

The State Bank of Pakistan’s quarterly report, released on Monday, shows that the sale of illegal cigarettes in the country has increased significantly since the imposition of the Federal Excise Duty (FED).

According to an investigative report aired by Geo News on 'Aaj Shahzeb Khanzada Kay Sath', “The [official] output of the cigarette industry declined by 35.5% during the first quarter of the ongoing fiscal year (Q1-FY20) as compared to positive growth of 4.4% in the corresponding period last year.”

The primary reason for this drop in official output was the significant increase in FED rates on the top two tiers of manufacturers and the elimination of the third tier of locally produced cigarettes, the report said.

The report stated that the increase in FED had negative implications for the growth of the formal cigarette industry, as it pushed consumers towards cheaper alternatives in the form of counterfeits and cigarettes smuggled from abroad.

When shopkeepers in Karachi, Lahore and Peshawar were approached and asked if they were aware they were selling illegal cigarettes which were not duty paid, shopkeepers said they were selling them because their customers demanded them.

“This is the requirement of the consumer,” a shop owner said.

He added that it was the government’s job to keep a check on contraband. “If the government was so concerned about generating revenue, maybe they should check where these are produced.”

Read also: How the tobacco mafia in Pakistan steals billions from the exchequer

“The dealers come to us and sell us at low prices and we sell them [forward],” he added.

When asked if someone from the government had ever approached him for selling illegal cigarettes, he replied in the negative.

Cigarette packets are also being sold at lower prices than the minimum price set by the PTI government through the introduction of new taxes this year.

Officially, the lowest cost of a packet of cigarettes is fixed at around Rs63, from which the tobacco companies are bound to pay at least Rs42 in taxes to the government.

Instead, cigarettes are being illegally and openly sold for Rs30-40 per packet in major cities across Pakistan.

A shopkeeper, when asked at what price he was selling cigarettes for below Rs60, responded with: “Rs35 to Rs40.”

Another said there had been an increase in the sale of illegal cigarettes in the last six months and that there had been no action over cigarettes being sold for less than Rs60.

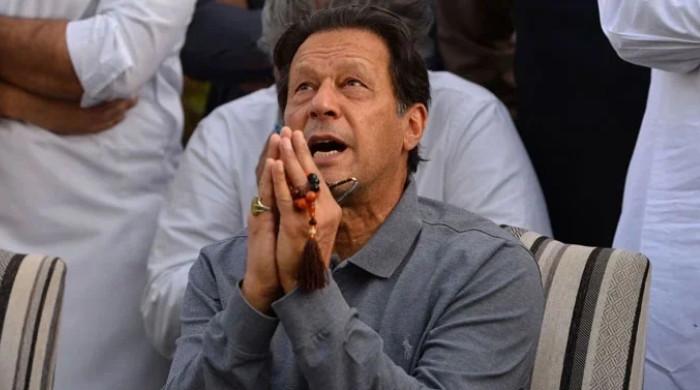

Powerful PTI members involved in tax fraud

Last year, an investigative report aired on Geo News had revealed that cigarette manufacturers across the country were evading millions of rupees in taxes through fraudulent methods in connivance with government officials, opposition members, and individuals of investigative agencies.

The collusion of influential industrialists and politicians, including ones from the PTI government at the centre and the Khyber Pakhtunkhwa province, as well as officers from investigative agencies, has made the tax evasion possible and cost the national exchequer billions.

Geo News reports mentioned that powerful members of the PTI who own factories that manufacture seven different brands of cigarettes sold in local markets are involved in evading taxes imposed on them by their own government.

The report further claimed that the PTI members have pressured the government to overlook their tax evasion with the help of their own influence, as well as the influence of opposition politicians working as partners with them, as well as officials from different investigative agencies.