Explainer: How are petroleum prices calculated?

Since mid-February, global oil prices have begun to tumble, mainly due to the outbreak of the coronavirus

March 03, 2020

In the last one year, the federal government has been pushing up petroleum prices almost every month, making life difficult for commuters. But there was a valid reason to do so.

The price of oil, internationally, was just as eye-watering. As global oil production nosedived in 2019, its wholesale cost shot up. The Organisation of Petroleum Exporting Countries (OPEC) and its allies began cutting oil output to boost up prices. Then, there were the US sanctions on Iran and Venezuela and the unrest in Libya.

However, since mid-February, global oil prices have begun to tumble, mainly due to the outbreak of the coronavirus. Increased travel restrictions have resulted in the reduced demand for oil. According to media reports, other factors driving down oil prices are concerns for climate change and the push to explore renewable energy options.

So why haven’t local oil prices fallen just as drastically?

Read also: Govt slashes price of petrol by Rs5

According to The News, the Oil and Gas Regulatory Authority had calculated the reduction in petrol, diesel and kerosene prices to be on the higher side — around nine per cent. But the government decided to reduce the price of high speed diesel by only three percent. On the other hand, it pushed up the levy on petroleum products to meet its revenue shortfall.

Which brings us to the question: How are petrol prices even calculated?

The price of petrol is the sum of taxes and commissions. There is the base price of petrol per litre. Add to that the Petroleum Development Levy (PDL), a tax collected by the central government. After the PDL, other additions are the oil marketing companies profit of Rs2-3 per litre, the dealer's profit, who is selling at the petrol pumps, which is an estimated Rs2-2.5, import tax of one per cent, a variable transportation charge, and finally the General Sales Tax (GST).

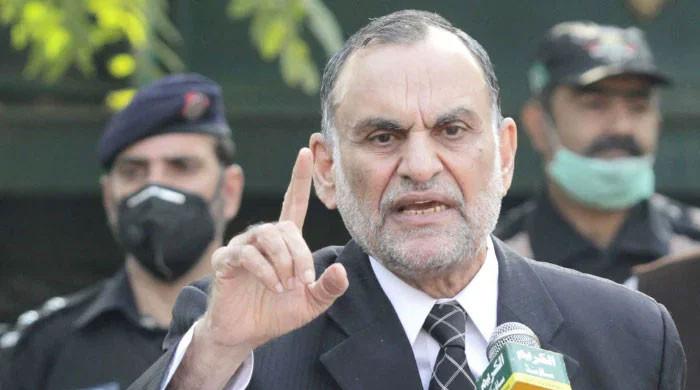

Read also: Government, opposition senators trade barbs over increase in petroleum levy

Previous governments would increase the GST to meet the government’s revenue deficit. However, in May 2019, the levy, which otherwise remained fixed at Rs12 per litre, was changed for the first time in several years.

One reason for the uptick in the levy is that this amount goes directly to the Centre, while the amount collected from the GST largely ends up with the provinces.