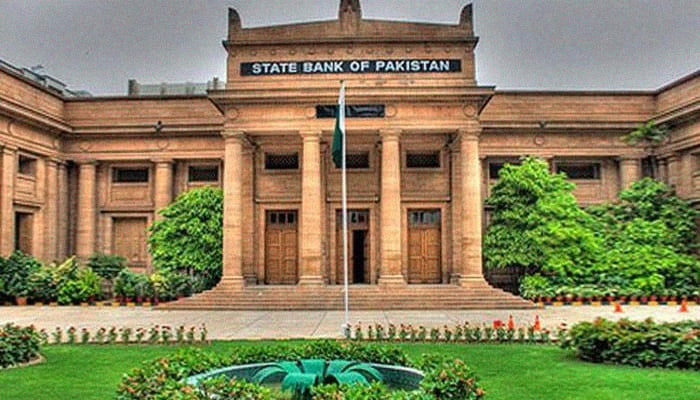

SBP slashes benchmark interest rate to 12.5%

SBP also announced that loans to import medical equipment would be provided at 3%

March 17, 2020

KARACHI: The State Bank of Pakistan (SBP) on Tuesday announced a 75-basis-point decrease in the benchmark interest rate, effectively bringing it down to 12.5%, much to the disappointment of traders and the business community, who were expecting a bigger reduction of at least 200-300 basis points.

The SBP also announced that loans to import medical equipment would be provided at 3% as it was crucial to control coronavirus pandemic as soon as possible. It added that it would offer lending at zero interest rate to financial institutions providing loans for similar purposes.

Earlier today, the Pakistan Stock Exchange's benchmark KSE-100 Index had stumbled 3.17% to close at 32,616 points despite an earlier prediction it would end on a positive note over the policy rate cut forecast. The PSX had on Monday suffered the worst single-day dive in its history.

Following the meagre rate cut, Karachi Chamber of Commerce and Industry (KCCI) President Agha Shahab Ahmed Khan said Pakistan's traders and the businesspersons "faced challenges everywhere".

"We had consistently pushed recommendations to bring the interest rate to single digits," he said.

The economy, Khan added, was running on revenue generation and collection and the PTI government needed to offer some kind of support to the business community.

'Committed suicide'

The KCCI top official criticised the smaller than expected reduction, saying it was better to take decisions keeping in mind ground realities.

"What needs to be done is not being done," he complained.

Stock trader and business magnate Arif Habib termed the policy rate cut "depressing", saying the government was choosing not to see its finances and was instead 'committed to economic suicide'.

"They first committed suicide by devaluation [of currency] and they have now committed suicide by not reducing the interest rate [adequately]," he added.

Habib explained that the government could have saved Rs300 billion if it reduced the interest rate by 1%; had it been brought down by 2%, the impact on the budget would have been Rs600 billion annually.

"The government will only earn revenue if the businesses keep running," he said.

Business community 'has lost trust in govt'

Irked by the development, the business magnate asked: "Why doesn't the government's monetary police committee understand this?"

Topline Securities Chief Executive Mohammed Sohail noted that the coronavirus pandemic had triggered a slowdown.

"A bigger interest rate cut would have provided stimulus to the economy and it was a great opportunity to restore traders' trust," he said.

"Ever since the incumbent government came into power, the business community has lost its trust in the leadership," he added.

KCCI Senior Vice President Khurram Shahzad termed it a "conservative decision" and said there was a lot of space for a reduction in the policy rate.

"The SBP could have reduced it by 100-150 basis points," he mentioned. At least "20 countries have introduced a major cut in the policy rate to help common people", he added.