ADB says Pakistan's GDP to shrink, inflation to be in double digits for 2020

ADB notes growth in South Asia will decelerate to 4.1% in 2020 and then recover to 6.0% in 2021

April 03, 2020

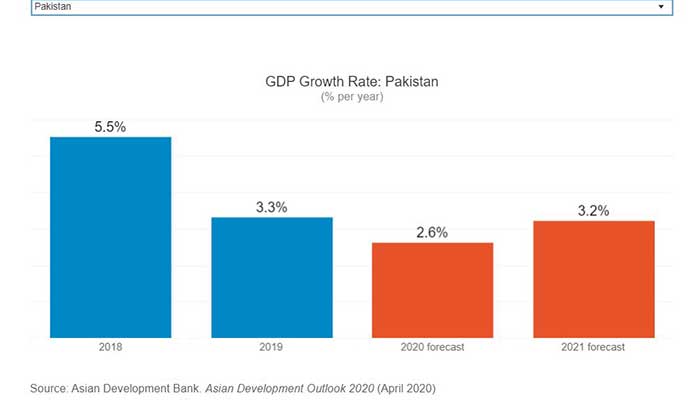

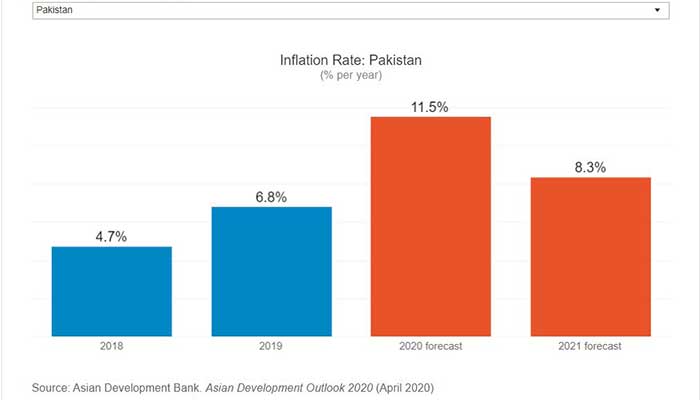

Pakistan’s GDP growth rate will shrink to 2.6% from 3.3%, while inflation will remain around 11.5% for 2020, the Asian Development Bank (ADB) projects in its latest report released on Friday.

The Asian Development Outlook (ADO) 2020 report noted that Pakistan, compared to other South Asia countries, will “struggle this year with double-digit inflation”, which is expected to clock in around 11.5% compared to 6.8% in 2019.

The report said that the inflation would be fueled by escalating food prices, scheduled hikes to utility rates, and domestic currency depreciation.

“Inflation is projected to accelerate to 11.5% in FY2020, reflecting a sharp rise in food prices in the first part of the fiscal year and a 9.8% drop in the value of the local currency against the US dollar in the first 7 months of FY2020,” said a press release issued by ADB.

“Leaving aside external upheaval, growth in Pakistan will slow as agriculture stagnates, notably affecting cotton output, and as stabilisation efforts constrain domestic demand,” said the report.

However, ADB noted that the “intended correction of macroeconomic imbalances” in the country may restore confidence in the economy and bring later benefits. Therefore, it has forecast that the country’s GDP will rise to 3.2% in 2021.

Also read: Signs of economic stabilisation emerging in Pakistan: ADB

ADB noted that agriculture is expected to see slow growth in fiscal year (FY) 2020 as the worst locust infestation in over two decades damages harvests of cotton, wheat, and other major crops.

It expects modest growth in some export-oriented industries, such as textiles and leather. But, large-scale manufacturing, which provides over half of industrial production, will likely to contract, as it did in the first half of FY2020.

ADB also stated that the current coronavirus outbreak will also pose an additional downside risk to growth prospects as it will further dampen consumer demand, exporters, businesses and industries.

The State Bank of Pakistan, the central bank, raised its policy interest rate by a cumulative 575 basis points to 12.25% at the end of FY2019 to counter inflationary pressures. Following the decline in global oil prices and expected sluggish demand under COVID-19, the State Bank of Pakistan reduced it in two steps to 11.00% in March 2020.

However, the bank noted that inflation rate would come down to single-digit figures in 2021 to 8.3%, as the SBP will have to account for this in its next monetary policy decision to increase credit to the private sector and boost economic activity.

The current account deficit is expected to continue narrowing to 2.8% of the gross domestic product in FY2020 based on the reduction in trade deficit resulting from exchange rate depreciation and the imposition of regulatory duties to contain import demand, the ADB report noted.

The report noted that the present macroeconomic challenges facing Pakistan underscore the importance of further strengthening social protection, health, education systems, and providing much-needed relief to the most vulnerable families.

“Pakistan's strong and decisive policy measures have started to yield positive results in reversing macroeconomic imbalances and narrowing current account deficits,” said ADB Country Director for Pakistan Xiaohong Yang.

Also read: FDI inflows into Pakistan likely to increase: Asian Development Bank

The ADB representative for Pakistan stated that Pakistan's economy is in better shape than before but emphasised that the country needs to work together to tackle the new challenges posed by COVID-19 — including uncertain short-term growth prospects — and its related socio-economic repercussions.

“The government’s emergency package and extensive use of Ehsaas will be vital to blunting the detrimental impacts of the pandemic, particularly on the poor and vulnerable,” said the country director.

Growth and Inflation in South Asia

The ADB in the report noted that growth in South Asia will decelerate to 4.1% in 2020 and then recover to 6.0% in 2021, largely tracking the trend in the dominant Indian economy.

The lender noted that GDP performance will remain strong in Bangladesh, which is forecast to grow by 7.8% this year even as global demand pulls back, and continue to accelerate in Bhutan both this year and next as a new 5-year plan strengthens government spending, and despite lower tourist arrivals.

Also read: Pakistan in talks with IMF for additional $1.4bn amid coronavirus crisis: Hafeez Shaikh

“The Maldives and Sri Lanka are less sheltered from global efforts to limit the spread of COVID-19, which are forecast to cause the tourism-dominated economy of Maldives to contract by 3.0% in 2020 before surging back in 2021,” said the bank.

The ADB stated that inflation in the subregion will soften to 4.1% in 2020 as food inflation will ease in India with improved agriculture. It noted that “unusually low inflation” will continue in the Maldives with subsidies and price controls on basic goods joined by anticipated deterioration in demand.