Sugar inquiry commission report may drop bombshell on many bigwigs

The report will be presented to Prime Minister Imran Khan any time in the next 72-hours

May 21, 2020

The Sugar Inquiry Commission (SIC) has prepared its final report, which recommends serious action against some four dozen key middlemen, unregistered buyers, entities and sugar barons accused of earning illegal profits in the tens of billions of rupees through unjustified price hikes, benami transactions, tax evasion, suspicious sugar export deals, illegal power production, misuse of subsidy and purchasing sugarcane off the books.

The SIC, over 63 days of marathon proceedings, confronted over 220 individuals after March 18, 2020, revealed officials associated with the commission. They said they were now giving final touches to the report. According to our sources, the report may consist of an executive summary (150-pages) with some four volumes and more than 4,000 pages, including supporting documents.

The SIC is providing a record of the unnatural growth of the assets of sugar mill owners, their suspicious cane and sugar businesses, as well as mill owners’ alleged connivance with middlemen and sugar dealers/buyers/exporters, revealed the officials. The report will be presented to Prime Minister Imran Khan any time in the next 72-hours.

The SIC has divided its findings into multiple categories, ie: a forensic analysis of all sugar and cane dealings of millers buyers and growers; fake entries in the books maintained by cane sellers and buyers; forensic analysis of all accounts and benami transactions attributable to millers; analysis reports of transactions worth Rs700 billion of the top 350 cash depositors among buyers and millers’ employees; and the alleged tax evasion record of millers.

It also contains an evaluation of the records of entities and individuals under investigation by the Securities and Exchange Commission of Pakistan (SECP), the State Bank of Pakistan (SBP), the National Accountability Bureau (NAB), the Federal Board of Revenue (FBR) and the Anti-Corruption Department Punjab; an examination of the record of subsidy given to all 36 sugar mills by the Ministry of Finance and provinces in the past 10 years; and an analysis of sugar export records taken from the ministries of commerce and industries and the record of an ongoing investigation against three mill owners.

The commission reportedly focused on the JDW Group's sugar mills, which are owned by Pakistan Tehreek-e-Insaf leader Jahangir Khan Tareen; Alliance Sugar Mill Pvt Ltd, owned by Federal Minister Makhdoom Khusro Bakhtiar’s family; Al-Arabia Sugar Mills Pvt Ltd, owned by Salman Shahbaz Sharif; Hunza Sugar Mills Ltd, owned by Chaudhry Idrees and Chaudhry Waheed; Al-Moiz Industries, owned by Shamim Khan — a cousin of Jahangir Khan Tareen — and his son, Nauman Khan; and a few other sugar mills.

Informed officials stated that the commission has discussed the role of former Prime Minister Shahid Khaqan Abbasi, ex Commerce Minister Khurram Dastgir Khan, Chief Minister Sindh Murad Ali Shah, Chief Minister Punjab Usman Buzdar, ex-Chief Minister Punjab Shahbaz Sharif, the poor performance of SECP, FBR and CCP, and the incompetency of the ministries of industries and commerce, which allegedly led to the sugar crisis.

The inquiry commission also focused on the role of Planning Minister Asad Umar, Advisor to Prime Minister on Commerce Razzak Dawood, nine sugar mill owners and more than 70 employees of the sugar mills by evaluating their role and responsibility.

The commission also recorded statements of all stakeholders of the All Pakistan Sugar Mills Association, commerce groups and owners of different mills.

The investigators focused on the doubling of the production capacity of mills, establishment of units in cotton-growing areas and the issuance of suspicious licenses for the installation of new units, revealed officials.

The probe commission provided the reasons for the sudden increase in sugar price by collectively implicating millers, middlemen, brokers and sugar buyers and pointing out the failures of regulators like the concerned ministries, CCP and local administration in controlling the hike.

The probe commission has traced out 330 buyers who were involved in 'suspicious benami transactions' worth Rs362 billion, which apparently pertained to undocumented or out of the books sale of some 6.4 MMT of sugar by mills owners in the past five years, disclosed the officials.

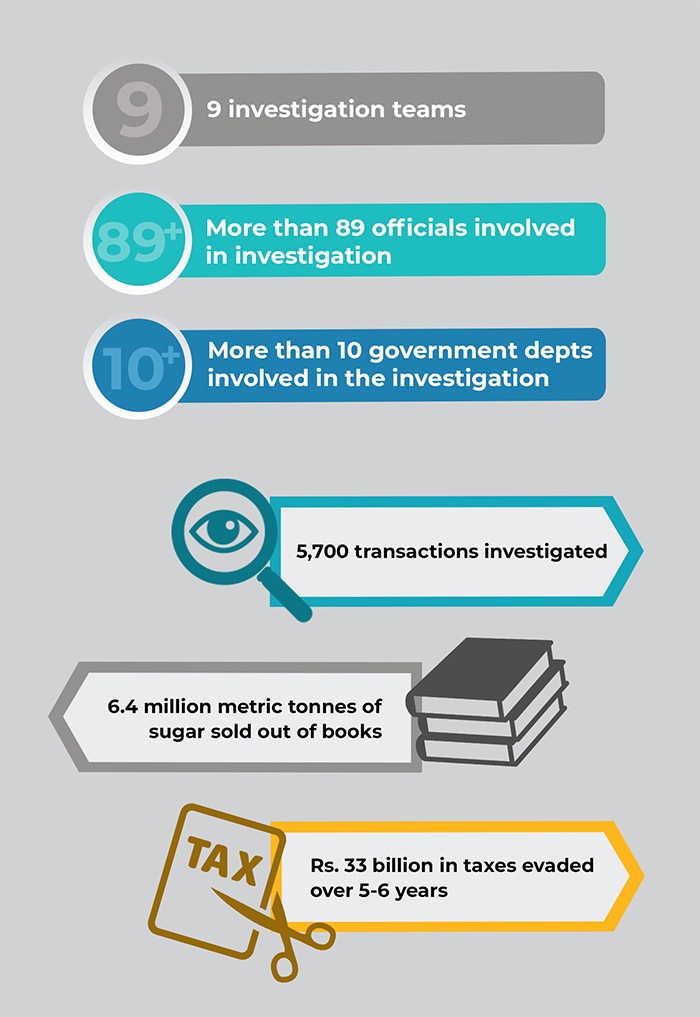

Nine investigation teams engaged more than 89 officials from the Federal Investigation Agency (FIA), SECP, NAB, CCP, FBR, SBP, Ministries of Finance, Industries and Commerce, Anti-Corruption Department Punjab, Intelligence Bureau (IB) and local administration from six different districts to get the task done.

The teams visited all nine sugar mills, where they found serious irregularities in the record of the sale of sugar, which pointed to the malpractices of hoarding and manipulation of supply to the market to maximise profiteering, officials said.

The teams, during physical verification of stock, found stock in excess of what was shown in the books in an apparent attempt to dodge sales taxes, added the officials.

Two team members also submitted their separate notes/observations with the commission's report. The observations are about the situation at the spot while conducting operations at Alliance Sugar Mills Pvt. Ltd and JDW sugar mills, officials said.

The SIC’s findings have striking similarities with the fake accounts case when it comes to tracing benami transactions where the millers did transactions worth tens of billions of rupees on the names of either their frontmen or low-grade employees, added the officials.

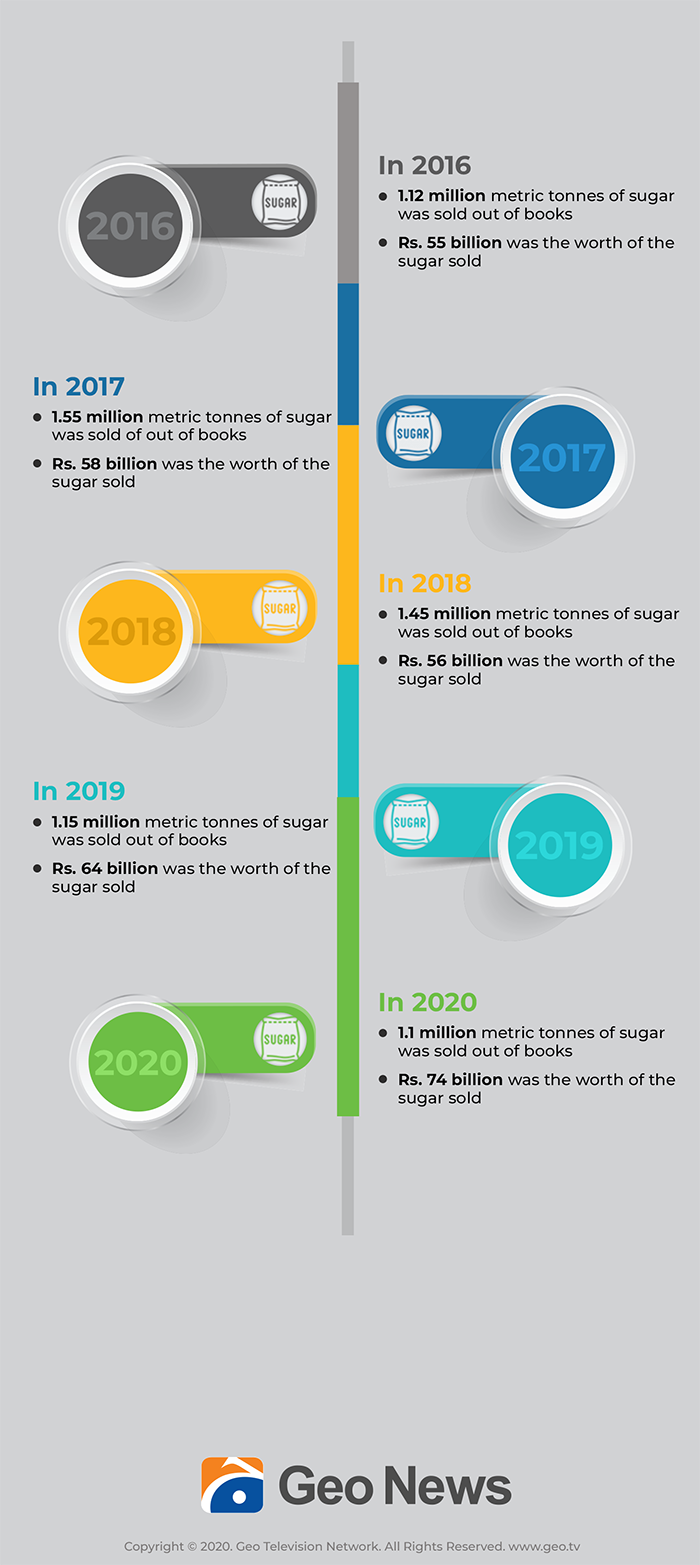

The commission’s forensic teams examined around 5,700 main transactions, which showed that around 6.4 MMT sugar was sold out of the books collectively by allegedly evading tax of around Rs33 billion in five or six years, officials revealed. An estimated 1.12 MMT sugar worth Rs55 billion was sold out of the books in 2015-16; 1.55 MMT sugar worth Rs58 billion in 2016-17; 1.45 MMT sugar worth Rs56 billion in 2017-18; 1.15 MMT sugar worth Rs65 billion in 2018-19; and 1.1 MMT sugar worth Rs75 billion in 2019-2020, revealed the officials.

A special chapter in the report focused on subsidies, revealing that 24 sugar mills in Punjab exclusively received Rs11.8 billion in freight subsidies from the federal and Punjab governments in 2017 and 2019 combined.

Official data submitted to the commission probing the sugar crisis revealed that nearly Rs9.4 billion was released in 2017—under the subsidy scheme on exports announced by then prime minister Shahid Khaqan Abbasi and the then chief minister Punjab Shehbaz Sharif, according to data prepared by the SBP for the inquiry commission.

The commission also focused on the subsidy given by the government of Sindh and the role of Chief Minister Murad Ali Shah, first as Finance Minister Sindh in 2015 and then as Chief Minister in the previous term. The matter has been discussed in detail, as some nine sugar mills owned by the Omni Group remained the major beneficiary of Sindh's sugar subsidy, which was around Rs8.4 billion in the past five years, according to officials.

The SIC in its findings further observes that either the investigation would be further referred to NAB or it is up to the Prime Minister of Pakistan to decide in light of the commission’s recommendations.

The commission comprised DG FIA Wajid Zia, head of the commission; SECP senior officer Bilal Rasool; DG Anti-Corruption Department Punjab Gohar Nafees; DDG IB Ahmad Kamal; Joint Director SBP Majid Chaudhry and DG Directorate General of Intelligence and Investigation FBR Dr Bashirullah Khan.

The commission had 19 Terms of Reference with a primary focus on ascertaining the reasons for the hike in sugar prices. The commission has also investigated whether the minimum support price of sugarcane was sufficient. The commission also probed market manipulation/cartelization by sugar mills and who the real beneficiaries of such increases are. The commission members also probed the justification of sugar exports along with the subsidy given on export and its impact and beneficiaries.