Why did Bitcoin break a three-year-high price record?

Currently just shy of Rs3 million, Bitcoin has set its sights to its all-time high, gaining more than 16% this week

November 20, 2020

KARACHI/LONDON: Bitcoin, a cryptocurrency that people around the world invest in by buying and selling it online, surged 4.5% past Rs2,982,510 ($18,600) on Friday to close at a three-year high of just under $20,000.

Currently just shy of Rs3 million, Bitcoin has set its sights to its all-time high, having registered a more than a 16% gain — biggest weekly gain since June 2019 — this week. It is also up over 160% this year.

What really is driving the cryptocurrency's rally at the moment and bringing it back into the headlines? An inflation hedge? Another currency? Or maybe another niche asset to take a punt on?

Just earlier today, the chief investment officer of New York-based global investment management firm BlackRock, Inc., Rick Rieder, hinted that Bitcoin could replace gold.

Check out today's gold prices in Pakistan here

According to CNN Business, Rieder told CNBC that he believed that Bitcoin is "a durable mechanism that could take the place of gold to a large extent".

That, he reasoned, is "because it's so much more functional than passing a bar of gold around", validating the cryptocurrency's role in the mainstream financial world.

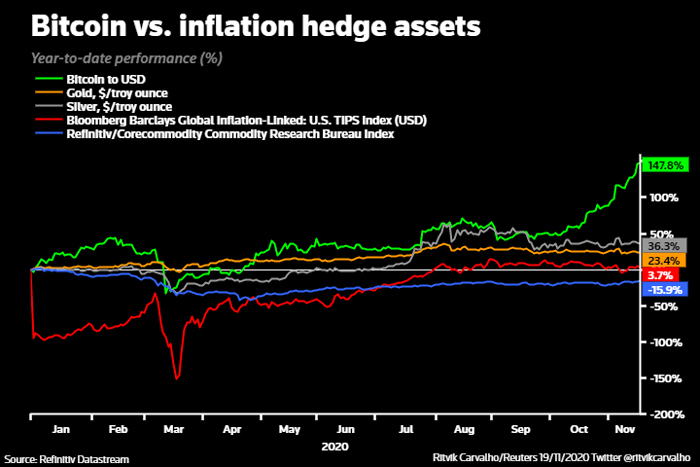

Bitcoin was "outperforming nearly all assets considered to be its rivals in the year to date", Market Watch noted.

In addition, Cointelegraph reported that two capital and investment management companies, Morgan Creek and Exos Financial, had filed a new Bitcoin (BTC) fund with the US Securities and Exchange Commission (SEC) on Thursday, which, if approved, "will offer institutional investors another way to long the flagship cryptocurrency without the volatility of owning it outright".

During trading today, other major cryptocurrencies — including ethereum and Ripple's XRP, which often move in tandem with bitcoin — rose 7.2% to $505.2 and 3% to $0.31, respectively.

Risk-on trade

With governments and central banks around the world pouring in cash from the money-printing presses and spending taps to fight the damage caused by the coronavirus pandemic, the resulting liquidity ends up lifting assets from emerging currencies and junk bonds to bitcoin and stocks.

At the world’s largest digital currency manager, Grayscale, the assets under management (AUM) shot up to a record $10.4 billion — up over 75% from September 2020 — while its bitcoin fund is up 85%. CoinShares, a smaller rival, said its AUM rose more than 150% this year alone to $1.3 billion.

Broadly speaking, higher savings rates inundated investment funds with money, potentially sparking a larger interest in bitcoin as a portfolio diversifier.

According to JPMorgan analyst Nikolaos Panigirtzoglou, there are signs of family offices — which manage money for wealthy people — allocating towards the cryptocurrency.

Security against inflation?

Similarly, as governments and central banks raised their defence walls in the battle against coronavirus and dived into full-fledged stimulus mode, some market observers and analysts think that Bitcoin is useful in guarding against inflation, especially considering that its supply is capped at 21 million, which provides it an innate value.

JPM’s Panigirtozoglou said some of the people who earlier bought gold as a hedge inflation risk may now be turning to cryptocurrency.

"There is a reassessment of Bitcoin about its value here as an alternative currency, as an alternative to gold," he said.

However, Bitcoin’s gains outstrip those of gold — 20% or so — whereas an inflation-linked government bonds index is up 4%.

Moreover, its rally has sped up over the past few weeks even as gold has flatlined and the resurgent pandemic made a growth and inflation recovery a distant prospect.

Convenience in terms of volatility

Interestingly, however, some of the Bitcoin's gain may be due to the fact that it's becoming accepted more around the world — both as a payments system and by a broader range of investors.

The chief executive officer of cryptocurrency lending platform Celsius Network, Alex Mashinsky, said Bitcoin "has gotten to a place where institutional investors, banks, and family offices are legitimately pondering involvement as a defence against currency devaluation”.

Since last month, when PayPal said it would open its network to cryptocurrencies, meaning users could spend bitcoin at its 26 million merchants, Bitcoin has jumped by half, fanning hopes it could catch on as a way to pay.

Mashinsky observed that Bitcoin's 2017 rally was led by retail investors who were early adopters but now that major players such as LINE Corp and PayPal are involved this time around, "we can expect more stability than the 2017 bubble".

"This isn’t a gold rush anymore,” he added.

Furthermore, traders who consider that bigger investors participated more point to the lower levels of volatility than during the 2017 bubble. During the period between end of June and mid-November — a period when bitcoin prices nearly doubled — the 10-day price swings against the dollar were well under historical averages.

In this regard, Andrea Leccese — associated with the cryptocurrency fund Bluesky Capital — said: "It’s still largely retail but it’s becoming more efficient [and] mature and I see more professional participants."

The end, according to many, does not seem to be in sight as crypto fans see Bitcoin shooting past the $20,000 mark.

"There is little to suggest this rally has run out of steam and all signs point to a run at the all-time high in the near future," Denis Vinokourov, head of research at Bequant in London, said, as per Bloomberg.

The top boss of the largest Bitcoin exchange-traded product explained that given the new entrants and bigger market players turning their attention to cryptocurrencies, it "can further expand the base of investors participating in this asset class".

"We’re very, very encouraged by the prospects for this space overall," Michael Sonnenshein, managing director at Grayscale Investments, stated, as per the publication.

($1 = Rs160.35)

—Additional input from Reuters