No more extension in date to file income tax returns, FBR says

Tax authority has received around 1.5m tax returns so far compared to last year's 2.9m

December 08, 2020

ISLAMABAD: The Federal Board of Revenue says it will not be granting any more extensions to file income tax returns even after receiving less than 1.5 million returns.

Chief commissioners, however, have been told to allow returns if someone seeks to file them after December 8, 2020.

“The FBR has received around 1.5 million tax returns so far,” a top official of the FBR confirmed to The News on Monday.

Last fiscal year, 2.9 million returns were filed. The government reportedly believes that the number of returns filed are significantly lower this time because of the difficulty of filing taxes during the second wave of the COVID-19 pandemic.

Read more: Pakistan Tax Bar Association appeals FBR to extend deadline for filing income tax returns

FBR’s Monday announcement was clear that no extension will be given to file annual income tax returns after the last date, which is today (December 8).

One request for extension addressed to the chief commissioner of inland revenue concerned could cover multiple taxpayers provided it contains taxpayers’ names, their CNIC/NTN and identification of jurisdiction.

FBR clarified that the option to file online requests will remain available. All chief commissioners have been directed to grant extensions generously and submit a report on total extension requests received and granted by the chief commissioner to the FBR Headquarters by December 10, 2020.

Read more: FBR says December 8 last date to file income tax returns

Clarifying its earlier circular issued on December 4 and after requests received from the Pakistan Tax Bar, various chambers of commerce and industry, trade bodies and sections of the media to extend the last date to file income tax returns, the FBR has facilitated the taxpayers by issuing directions to all inland revenue field formations to establish Help Desks to receive manual requests for extension in filing tax returns.

PTBA asks for extension in deadline to file returns

The Pakistan Tax Bar Association had appealed on Monday to the FBR chairperson to extend the deadline to filetax returns by 60 days, i.e. until January 31, 2021.

In a letter written to the FBR chairperson, PTBA President Aftab Hussain Nagra said the last date should be extended as there are lockdowns in many parts of the country due to the second wave of the coronavirus.

He added that tax filers living in those areas are facing difficulty which is why the deadline should be extended.

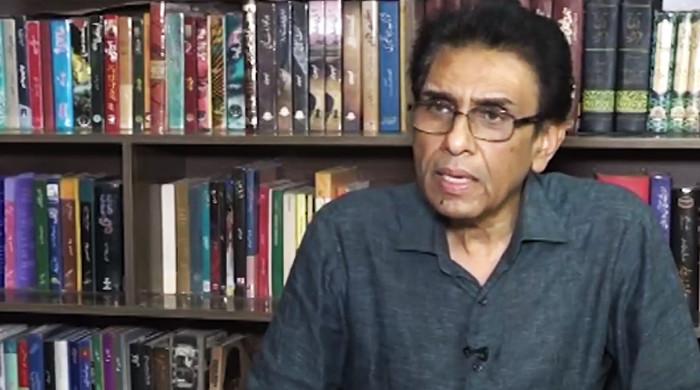

FBR not to extend deadline: SAPM

Special Assistant to Prime Minister (SAPM) on Revenue Dr Waqar Masood maintained that the FBR will not extend the deadline for filing of tax returns.

The SAPM, while speaking to Geo News on Saturday, said that the government decided not to extend the filing date as delays have become common over the last seven or eight years.

Read more: FBR sends 'very polite' tax notice to 70,000 potential tax evaders

“In the last 7 or 8 years, the trust on the last date was lost,” said Dr Masood, adding that it was necessary to develop trust about the deadline to revive tax discipline.

“Now this is a trusted date and we are getting new returns and we are confident that our performance will be better compared to last year,” said the SAPM.

The former finance secretary said that the FBR had given the authority to its tax commissioners in the field to grant extensions due to coronavirus.