Pakistan’s current account deficit narrows to $1.1b in September

"A strong rebound in economic activity, higher int'l commodity prices kept CAD at an elevated level in Q1-FY22": SBP

October 19, 2021

- "A strong rebound in economic activity and higher int'l commodity prices kept CAD at an elevated level in Q1-FY22," SBP reports.

- During September, the balance of trade in goods recorded a deficit of 5.9% year-on-year.

- Samiullah Tariq predicts that exchange rate depreciation will help curtail deficit to manageable levels.

Pakistan’s current account deficit — the gap between foreign payments and inflows — narrowed down to $1.47 billion in September 2021, somewhat in line with the market expectations.

The current account balance recorded a surplus of $27 million in the same period of last, the State Bank of Pakistan (SBP) reported on Tuesday.

In September, the deficit amounted to $1.11 billion. It was 24.48% lower than the deficit recorded in the previous month of August.

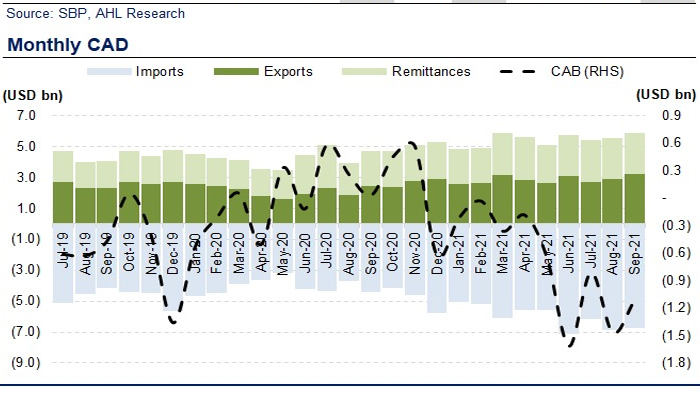

The data showed during 1QFY22, the country’s deficit reached $3.4 billion compared with a surplus of $865 million during the same period last year.

The central bank wrote on Twitter: “A strong rebound in economic activity and higher [international] commodity prices kept the [current account deficit] at an elevated level of $3.4 billion in Q1-FY22.”

Speaking to Geo.tv, Pakistan-Kuwait Investment Company's Head of Research, Samiullah Tariq, said: “The current account deficit came towards the lower range of market expectations.”

According to the post-data commentary by Arif Habib Limited on a year-on-year basis, the primary reason behind the deficit was a 53% year-on-year increase in total imports to $6.7 billion.

However, the brokerage house added that total exports and remittances also increased by 31% and 17% year-on-year, respectively.

Tariq mentioned that contraction in services deficit “was a positive surprise. Meanwhile, month-on-month exports have exhibited an increase, which is good.”

During September, the balance of trade in goods recorded a deficit of 5.9% year-on-year while for the services the deficit narrowed by 65.2% on a year-on-year basis.

Pakistan exported goods worth $2.64 billion compared to the imports worth $6.07 billion, while the value of exports of services clocked in at $551 million compared to $668 million in September last year.

The analyst predicted: “Hopefully exchange rate depreciation, along with other measures taken by the government and SBP, would help curtail deficit to manageable levels.”