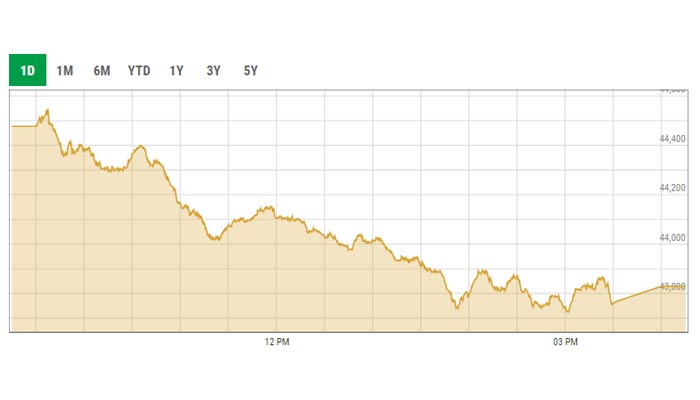

KSE-100 falls below 44,000-mark ahead of MSCI rebalancing

KSE-100 index fell over 400 points as market participants booked profit to safeguard their investments

November 25, 2021

- KSE-100 index fell over 400 points as market participants booked profit to safeguard their investments.

- AHL states the rollover week continued to remain under pressure despite attractive valuations.

- Trading volumes plunged to 195.2 million shares compared with Wednesday’s tally of 310.4 million.

KARACHI: The Pakistan Stock Exchange (PSX) extended its decline for the fourth consecutive session of the rollover week as investor mood remained sombre ahead of Morgan Stanley Capital International’s (MSCI) reclassification next week.

Earlier this month, the MSCI had relocated three leading Pakistani stocks; Lucky Cement, Habib Bank (HBL) and Muslim Commercial Bank (MCB), to its MSCI Pak FM standard cap with effect from December 1, 2021. Resultantly, the benchmark KSE-100 index fell below the 44,000-point mark after a hiatus of nearly one and a half months.

The KSE-100 index fell over 400 points as market participants booked profit to safeguard their investments.

Moreover, the ongoing petroleum dilemma kept the oil scrip investors on the sidelines.

Arif Habib Limited in its post-market commentary stated that the bears ruled over the bulls for the fourth consecutive session in a week due to concerns over the devaluation of the Pakistani rupee and the last leg of the foreign selling spree.

“Rollover week continued to remain under pressure despite attractive valuations in terms of low price-earnings multiples and high dividend yields,” the brokerage house said, adding that technology stocks remained in the limelight throughout the day as traders placed the bet on high-beta stocks to mark quick trading gains.

On the flip-side, institutional investors fetched for value hunting in the last trading hour.

Sectors contributing to the performance included commercial banks (-140 points), power (-59 points), fertiliser (-50 points), cement (-48 points) and pharmaceuticals (-432 points).

At close, the benchmark KSE-100 index fell 427.95 points, or 0.96%, to close at 43,935.75.

A report from Topline Securities noted that Pakistan equities continued their negative trend for the fourth consecutive day of the week.

“Investors were concerned over continues foreign selling over MSCI rebalancing due next week where major laggards were Hubco, HBL, Lucky Cement, UBL and Searle; cumulatively dented the index by 184 points,” the report added.

Shares of 328 companies were traded during the session. At the close of trading, 121 scrips closed in the green, 185 in the red, and 22 remained unchanged.

Overall trading volumes plunged to 195.2 million shares compared with Wednesday’s tally of 310.4 million. The value of shares traded during the day was Rs8.4 billion.

TPL Properties was the volume leader with 16.3 million shares traded, gaining Rs0.34 to close at Rs42.73. It was followed by Byco Petroleum with 12.2 million shares traded, gaining Rs0.13 to close at Rs6.44, and Hubco with 9.5 million shares traded, losing Rs2.25 to close at Rs69.94.