Privatisation of state-owned enterprises: Will it serve the purpose?

Pakistan has a long history of a mixed economic system, starting with laissez-faire and the all-out nationalisation of industries and businesses and ending up with experiencing privatisation.

November 27, 2021

Pakistan has a long history of a mixed economic system, starting with laissez-faire and the all-out nationalisation of industries and businesses and ending up with experiencing privatisation. The concept of privatisation can be traced back to the 1950s when the Pakistan Industrial Development Corporation (PIDC) established industrial units and, subsequently, handed them over to the private sector.

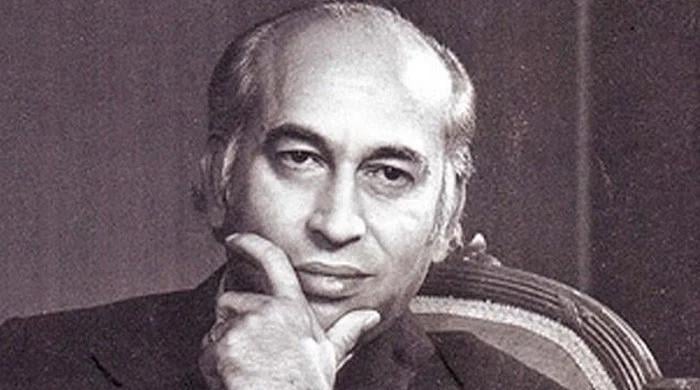

The process of privatisation was reversed with the introduction of the nationalisation policy in the early 1970s by ZA Bhutto when all major industrial undertakings were directly taken under state control. This policy was discontinued when General Zia took control in 1977.

The privatisation process was accelerated with the introduction of economic reforms by Nawaz Sharif in the early 1990s. State-owned enterprises (SOEs) were offered to the private sector as part of the liberalisation of the economy. Later, the Muhammad Khan Junejo government formed a cabinet disinvestment committee in 1985 to identify loss-making units which could be privatised to get rid of the burden on the national exchequer. A proper procedure was devised at the time to evaluate and negotiate with the stakeholders taking part in the disinvestment process. The disinvestment committee which was headed by the then finance minister took the final decision.

The government of Nawaz Sharif vociferously and vigorously pursued the policy of the privatisation of SOEs by declaring privatisation as its prime economic objective. He offered a wide array of industrial units, development finance institutions, tele-communications, infrastructure facilities and banks for privatisation.

The privatisation of SOEs has a mixed bag of results – a combination of successes and failures – in terms of revenue contribution and employment generation. If we look at sector-wise total privatised units in the past, we can easily calculate about a hundred such entities in the industrial, financial and utility sectors. The break-up of these units reveals that automobile companies, cement plants, oil factories, fertiliser plants etc made up for 87 such units. Five commercial banks were part of the privatised units. The process also involved the divestment of shares of about eight utility companies including Mari Gas and Pak Telecom.

It was a great opportunity for the private sector to capture the market by getting hold of rights on an ownership basis. It was a win-win situation for both investors and the government as the units were being offered at throw-away prices to private parties with all sorts of favours, and disfavours, at that time.

That was the period when crony capitalism was gulping down all industrial units including 45 nationalised units, which were initially recommended for disinvestment, ultimately privatising those entities that favoured the favourites. The privatisation process was strengthened and institutionalised by the creation of the Privatisation Commission (PC) in 1991.

The commission was mandated to carry out the privatisation process of all state-owned enterprises, starting with loss-making entities. But the commission had its own shortcomings, and the capacity and capability of its human resource was a point of concern.

The commission is functional even today. The privatisation of state-owned enterprises is a cumbersome process as it involves a competitive bidding process. The sale of shares as part of the disinvestment of financial institutions or banks needs due diligence, and then comes the complex process of determining its true value for privatisation purposes. The privatisation of Muslim Commercial Bank and the methodology adopted for the determination of the value of its shares is still a point of discussion.

The same is the case of other units that were privatised in the 1990s, accusing the government at that time of favouritism. This is one of the reasons for the slow process of the privatisation of SOEs in Pakistan. Fear of NAB is another reason for the laxity that we are observing in the privatisation process.

There are about 212 SOEs out of which 85 are commercial, 44 non-commercial and the remaining 83 are the subsidiaries of commercial SOEs. The 85 commercial SOEs are meant for privatisation through proper processes and procedures devised for such exercise by the privatization commission. These entities are mainly from power, oil and gas, infrastructure, transport and communications, manufacturing, mining and engineering.

In FY 2018-19, the annual revenues from all 212 SOEs were calculated at around Rs4 trillion, and the book value of their assets was worth Rs19 trillion. Commercial SOEs recorded net losses of around Rs287 billion and Rs143 billion in the financial years 2017-18 and 2018-19 respectively. The lacklustre performance of commercial entities has been disturbing and discouraging and also necessitated for an early decision on the privatisation of such entities.

The government has already approved 44 SOEs to be privatised and liquidated. The reforms agenda for SOEs is already in place as part of discussions with the IMF, World Bank and Asian Development Bank. The Ministry of Finance has established a central monitoring unit for SOEs for reforms to be implemented through improved corporate governance management.

Pakistan Railways and Pakistan International Airlines are the first to have experienced restructuring and reforms for improving their financial performance, as both are incurring losses of more than Rs100 billion per annum. The active privatisation list includes the Pakistan Steel Mills, SME Bank, etc along with the divestment of Oil and Gas Development Company (OGDCL) and Pakistan Petroleum Limited (PPL) shares. The PIA-owned Roosevelt Hotel in New York is also part of the list.

Recently, the Cabinet Committee on Privatisation (CCoP) approved the auction of the Services International Hotel, Lahore on the recommendations of the Privatisation Commission which awarded it to the highest bidder offering Rs1.9 billion. Reportedly, the Cabinet has referred back this case to the committee for further due diligence, as some critical loopholes were identified in the process. Further, there are about eight loss-making DISCOs along with State Engineering Corporation, Pakistan Textile City Ltd and Telephone Industries of Pakistan which are ready for privatisation in the coming months.

Zarai Taraqiati Bank (ZTBL), Sui Southern Gas Co (SSGC) and Utility Stores Corporation (USC) are all out for divestment and privatisation, as they are loss-incurring entities. The Industrial Development Bank of Pakistan (IDBP) is already in the process of liquidation to avoid further losses to the exchequer.

As per the World Bank report ‘Hidden Debt: Solutions to avert the next financial crisis in South Asia’, published on June 29, 2021, there is an immediate need for a reform agenda with all-encompassing four principles of purpose, incentives, transparency and accountability to mitigate risks of a financial crisis.

The privatisation of public-sector entities is the need of the hour to get efficiency, improving the overall performance of industries and businesses. The government is making efforts to get rid of loss-making entities by privatising SOEs for economic growth and development. The slow process needs to be expedited. This is the only way forward to avoid the impending financial crisis. The Privatisation Commission needs to be strengthened by recruiting professionals and technocrats in place of old-school bureaucrats.

The writer is an economist.

Originally published in The News