PSX closes flat after massive sell-off on 'Black Thursday'

Today at close, the benchmark KSE-100 index shed 1.32 points to close at 43,232.83 points

December 03, 2021

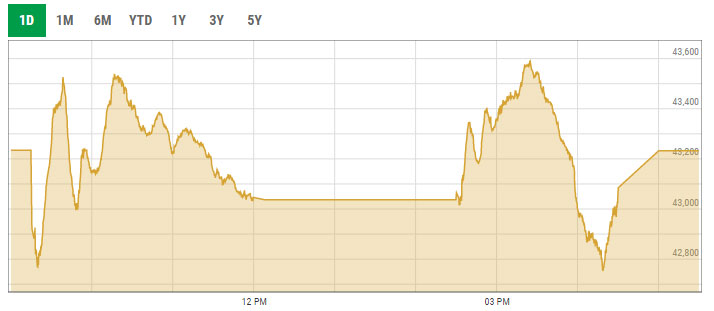

- Benchmark KSE-100 index shed 1.32 points to close at 43,232.83 points.

- The market touched an intra-day high and low of 43,590.52 and 42,752.76 points on the last day of the trading week.

- “Going forward, we expect the market to remain volatile and recommend a cautious approach,” Arif Habib Limited predicts.

KARACHI: The Pakistan Stock Exchange (PSX) on Friday managed to close flattish despite sustained selling in the early hours of trading following a record-breaking loss a day earlier.

In line with the previous session, the KSE-100 index fell below the 43,000-point mark within the first 20 minutes of the trading on Friday. However, the market gradually recovered from the early shock, with the benchmark KSE-100 index creeping back.

The topsy-turvy session had a dull activity amid the economic uncertainty regarding historic-high trade deficit, depreciating currency and soaring inflation.

The market touched an intra-day high and low of 43,590.52 and 42,752.76 points on the last day of the trading week.

Investors’ interest remained subdued as expectation of another massive hike in the benchmark policy rate by the State Bank of Pakistan (SBP), in its meeting scheduled on December 14, forced investors to trade cautiously.

A day earlier, the market saw a carnage of trading some dubbed 'Black Thursday', marking the largest single-day decline in a day's worth of trading at the PSX during the 2021 calendar year, and the third-largest in history.

Today at close, the benchmark KSE-100 index shed 1.32 points to close at 43,232.83 points.

A report from Arif Habib Limited noted that the bears ruled over the bulls today due to concerns over alarming current account deficit number, devaluation of Pakistani rupee and a big jump in cut-off yields of treasury bills indicating a hawkish stance in the upcoming monetary policy.

“Yesterday’s, sharp downfall in the market occurred due to sell-off by mutual funds which eventually created an attractive opportunity for value hunters,” it said, adding that the market opened on a positive note as value hunters did aggressive buying in the first session.

In the second session, across the board selling was witnessed as the Pakistani rupee closed at an all-time low of 176.77.

“Going forward, we expect the market to remain volatile and recommend a cautious approach,” the brokerage house predicted.

Shares of 330 companies were traded during the session. At the close of trading, 115 scrips closed in the green, 205 in the red, and 10 remained unchanged.

Overall trading volumes dropped to 287.7 million shares compared with Thursday’s tally of 386.7 million. The value of shares traded during the day was Rs10.3 billion.

WorldCall Telecom Limited was the volume leader with 24.3 million shares traded, gaining Rs0.04 to close at Rs2.05. It was followed by TPL Properties with 20.5 million shares traded, losing Rs2.43 to close at Rs37.79, and Byco Petroleum with 16.9 million shares traded, losing Rs0.16 to close at Rs5.79.