Pakistanis squeezed by inflation face more pain from tax hikes

Govt is preparing to double down on pain with a belt-tightening budget of tax hikes

December 13, 2021

- Govt is preparing to double down on the pain with a belt-tightening budget of tax hikes.

- Pakistani rupee has fallen around 14% since May to reach a historic low.

- Officials have put a brave face on the situation, saying that the impact on the poorest will be softened by welfare cushions.

ISLAMABAD: When Pakistan's annual inflation rate hit 11.5% in November, the statistics office put a number on a phenomenon that was already painfully clear to the poor and the salaried middle-class voters who carried Prime Minister Imran Khan to power three years ago.

Now the government is preparing to double down on the pain with a belt-tightening budget of tax hikes and spending cuts required to release a $1 billion tranche of International Monetary Fund (IMF) bailout cash.

"I never thought it would become so difficult to survive," said Sibte Hasan, a 43-year-old construction supervisor from Pakistan's second-biggest city Lahore.

As consumer price inflation has accelerated into double digits, with staples like flour, sugar, oil and rice doubling in price over recent months, the Pakistani rupee has fallen around 14% since May to reach a historic low.

The government officials are expected to release official figures this week when it presents a special supplementary budget to cabinet.

But already it is clear that a raft of sales tax exemptions will be scrapped and new levies will be raised on fuel as well as some imported goods.

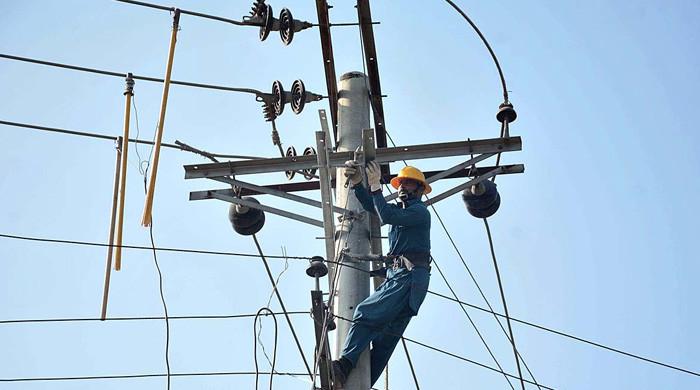

The IMF agreed last month to revive a stalled $6 billion funding programme launched in 2019 but demanded further fiscal measures as part of a broader structural reforms package covering areas from the power sector debt to corporate governance, climate change and trade policy.

Last month the central bank also tightened the screws, raising its key interest rate by 150 basis points to 8.75% to try to stem surging inflation, a slide in the Pakistani rupee and a current account deficit that has widened to $5.2 billion (July-Oct), and trade deficit to $20.59 billion (July-Nov).

The government officials have put a brave face on the situation, saying that the impact on the poorest will be softened by welfare cushions and pointing to progress in addressing Pakistan's chronic tax collection problem.

"Prudent fiscal reforms have helped in improving the tax-to-GDP ratio and improving revenue generation," Finance Adviser Shaukat Tarin told a conference last week.

The government has also had some relief from the immediate pressure on public finances with a $3 billion loan from Saudi Arabia that arrived this month.

Falling production

However, whether the fiscal measures will be enough to stabilise public finances sufficiently to allow the government to address Pakistan's underlying economic problems remains unclear.

While consumers have faced higher household bills, the impact has also been felt in the business sector through high energy prices and raw materials costs as well as the recent sharp rise in interest rates.

"Our production is falling rapidly," said textile mill owner

Sheikh Muhammad Akbar. "My unit is not generating its targeted production because of expensive raw materials and high production costs," he told Reuters.

Pakistan's debt-bound economy has long been hobbled by problems ranging from a wasteful and inefficient power sector to weak tax collection, poor productivity and minimal value added exports.

But loose monetary policy and an over valued exchange rate papered over some of the problems, helping the economy rebound from the coronavirus slowdown to grow 3.9% last year, even while the fiscal and current account deficits widened, threatening the stability of public finances.