7th NFC: Should provinces bear federal expenditures?

If provinces are to pay for their share of federal expenditures, then the rationale for federal collection of revenues disappears

January 28, 2022

The National Finance Commission (NFC) is locked in a stalemate. Constitutionally mandated to give an Award for distribution of federal tax revenues, it has succeeded only sporadically. The last successful NFC Award was arrived at vide the 7th NFC in 2010.

The 8th NFC expired on account of inaction. The 9th NFC went into freeze after the federal government put a proposal on the table for the provinces to finance some of federal expenditures — which the provinces unanimously opposed.

The fate of the 10th NFC is uncertain. However, there appears to be a move to revive the federal government’s case and an op-ed in The News (Is the NFC Award sustainable? published on January 22, 2022) has made a case in that regard.

It begins by laying out four considerations: fairness, equity and flexibility to ensure financial functionality of the federal system.

There can be no dispute with any of the considerations; the problem arises with the interpretation of the federal income-expenditure balance sheet. The fiscal case is presented as follows: Budget 2021-22 estimates the Federal Board of Revenue (FBR) tax collection at Rs5.8 trillion, of which Rs3.3 trillion is the provincial share vide the NFC Award, leaving the federation with Rs2.5 trillion. Adding Rs2.0 trillion of non-tax revenues, net federal revenues amount to Rs4.5 trillion.

Out of this amount, the federation has to undertake expenditures of Rs4.4 trillion for debt servicing and defence, leaving a balance of Rs0.1 trillion to cover a gap of over Rs3.5 trillion of expenditures on civil government, pensions, subsidies, PSDP and grants — all of which have to be covered from loans.

The conclusion drawn is that the 7th NFC Award is neither fair nor sustainable and the 18th Amendment has rendered it inflexible, resulting in a financially non-functional federal system.

Thenceforth, the novel argument: the federation encompasses the provinces, which — it is implied — renders them liable for sharing federal expenditures.

To quote, “the Rs3 trillion in ‘debt service payments’ are made on debt taken by the state of Pakistan, not just Islamabad…the Rs1.4 trillion for ‘defense’ is to defend the state of Pakistan, not just Islamabad...”.

All the above arguments are problematic. The 18th Amendment and the 7th NFC were concluded almost simultaneously. The understanding in the NFC – where the federal government is also represented and is the chair — was that the abolition of the Concurrent List would reduce federal expenditures and increase that of the provinces.

Consequently, the change in the vertical shares — reduction of the federal share and the concomitant increase in the share of the provinces — was made on that understanding. However, the federal government has not followed up on that constitutional requirement. Accordingly, it is itself responsible for its financial dysfunctionality.

Rather, there is no restraint in federal fiscal profligacy. The first half of the current year shows double-digit growth in revenues and slowdown in development spending — and yet a 29% jump in the budget deficit due to growth in current expenditure. The provinces cannot be asked to bear the burden of irresponsible federal fiscal mismanagement.

The argument that federal expenditures are not just for Islamabad is facetious and dangerous. If provinces are to bear their part of federal development expenditures, then there has to be an accounting over the last 50 years of the inter-provincial distribution of development expenditures and the corresponding debt service burden created thereof. If provinces are to bear their part of defence expenditures, then there can be a call for an accounting of inter-provincial composition of personnel.

Rather, if provinces are to pay for federal outlays, they can ask for the right to audit federal accounts. And if provinces are to pay for their share of federal expenditures, then the rationale for federal collection of revenues disappears and the case emerges for provinces to collect all tax and non-tax revenues and pay a percentage to Islamabad for its upkeep. In the event, the state of Pakistan will, de facto, convert from a federation into a confederation.

Any attempt to roll back the 18th Amendment or the 7th NFC Award also can be dangerous. The Sindh case offers an insight, where there has existed a nationalist movement with elements of secessionism, largely rooted in anti-Punjab sentiment.

The 2010 devolution served to demolish this aspect of Sindh’s politics. Evidence for this change emerges from the fact that post-2010, almost all nationalist parties and groups in Sindh aligned themselves with the Punjab-based PML-N and one of them even merged with it.

Any undermining of the 18th Amendment or the 7th NFC Award is likely to provide fresh oxygen to the nationalist politics of yore.

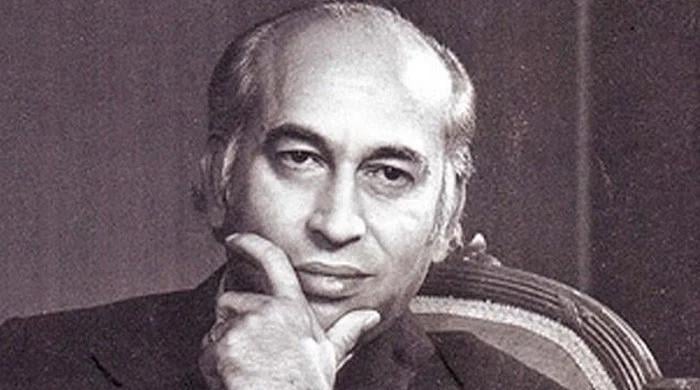

The writer was a member of the 7th NFC and is now a member of the 10th NFC. He tweets @kaiserbengali

Originally published in The News

Originally published in The News