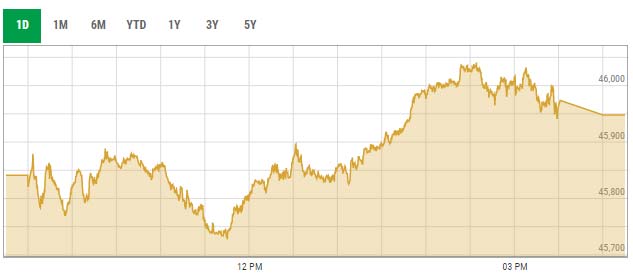

KSE-100 gains over 100 points on encouraging financial results

Investor cheer strong quarterly financial results and positive developments on the economic front

February 08, 2022

- KSE-100 gains 106.7 points to settle at 45,947.95.

- Investor cheer strong quarterly financial results.

- Political uncertainty restrict investors from assuming fresh positions.

KARACHI: The Pakistan Stock Exchange (PSX) staged a rebound on Tuesday and went north because of overall optimism in the wake of encouraging corporate earnings.

Investor cheered strong quarterly financial results and positive developments on the economic front.

However, political uncertainty and rising oil prices in the international market restricted the investors from assuming fresh positions.

At the close, the benchmark KSE-100 index gained 106.7 points, or 0.23%, to settle at 45,947.95 points.

Arif Habib Limited in its post market commentary noted that the market remained volatile today due to “mounting international oil prices.”

The brokerage house stated that the cement sector stayed under pressure due to higher international coal prices.

“In the chemical sector, Engro Polymer and Chemical made the journey to the north as it announced tremendous financial result beating market expectations,” it said, adding that physiological barrier of 46,000 was unable to digest by the investors as profit-taking was witnessed across the board.

Moreover, main board activity remained gloomy. Activity continued to remain side-ways as market witnessed hefty volumes in the third tier stocks.

Sectors contributing to the performance included fertiliser (+80.9 points), chemicals (+32.9 points), investment banks (+28.7 points), textile composite (+23.8 points) and power (+16.7 points).

Shares of 364 companies were traded during the session. At the close of trading, 153 scrips closed in the green, 184 in the red, and 27 remained unchanged.

Overall trading volumes rose to 187.37 million shares compared with Monday’s tally of 150.1 million. The value of shares traded during the day was Rs7.09 billion.

Hum Network Limited was the volume leader with 23.79 million shares traded, gaining Rs0.27 to close at Rs7.77. It was followed by Engro Polymer and Chemical with 14.7 million shares traded, gaining Rs3.70 to close at Rs61.21, and World Call Telecom Limited with 14.21 million shares traded, losing Rs0.03 to close at Rs2.20.