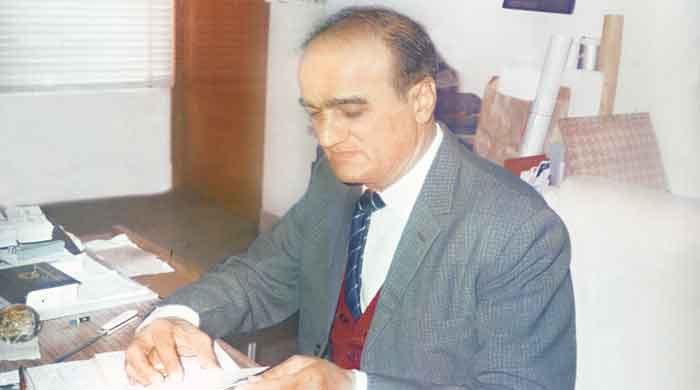

Bank allegations against Mansoor Ijaz false

LONDON: Efforts to malign Mansoor Ijaz, the star witness in this week’s Memogate hearing here in London, moved into high gear over the weekend with revelations that Pakistani origin American...

February 20, 2012

An investigation by The News reveals that the news published in a section of Pakistani media implicating business tycoon Mansoor Ijaz reveals only one side of the story but the facts come out in a different light when read in full detail from both sides.

Pakistan People’s Party (PPP) government, especially the circuit close to former envoy to the United States Hussain Haqqani, and Pakistani media had fallen all but silent in recent days as it was assumed Ijaz had been intimidated into not testifying and that the case was over but the judicial commission’s decision to take Ijaz’s crucial testimony through video link and physical evidence on 22nd February from Pakistan High Commission in London has hot the things up again and knives are already out for Ijaz.

The News has learned exclusively that in the final judgment passed by the Supreme Court of the State of New York County Judge Charles E Ramos, there was never any mention of fraud or nor any wrongdoing on the part of Ijaz. Mansoor Ijaz has been in business for more than 26 years and he has reportedly managed hundreds of millions, even in the billions of dollars of client funds without a single blemish to his record.

The two pages Court Consent Order, the copies of which have been seen by The News, show that a simple demand for repayment of an amount far less than what the bank demanded was entered into the record without any other finding and the matter was settled out of court. Such cases in the west against corporate companies are a routine occurrence.

Banca Sammarinese di Investimento (BSI) is a small regional bank in the principality of San Marino inside Italy. BSI was the plaintiff against Mansoor Ijaz and several of his companies in the case. A major Pakistani businessman in Zurich has confirmed to The News that the bank’s former president was a close friend of Ijaz from his Zurich business circles and that business managers from within the bank had taken a keen interest in Ijaz’s venture projects, including a tower casino resort for Las Vegas and other green energy projects.

BSI made a decision to lend Ijaz, through several corporate entities, up to $2.0 million during 2007 and 2008 against share collateral of one of his public company holdings. The funds were used largely to finance development costs for the Las Vegas tower project and a plug-in hybrid car project, contrary to the bank’s filings.

The court papers show that Ijaz’s records of expenditures were comprehensive, approved at each single stage by the bank’s compliance officers and further that the court’s final determination that no wrongdoing had been found on Ijaz’s part in the out of court settlement was due to the accuracy of Ijaz’s records, which BSI was unable to refute. The court filings show the collateral when originally pledged was worth in excess of Ä4 million and was incrementally increased to as much as Ä8 million as the price of the public company’s shares went up and down.

It was the fall of Lehman Brothers in 2008 that made it impossible for many global venture capitalists, Ijaz included, to pursue financing mega projects anywhere in the world because market liquidity simply dried up. It was then that the BSI’s balance sheet - due to other problem loans - started to become shaky. And Ijaz’s loans outstanding represented a larger than allowed share of the bank’s capital reserves, as determined by San Marino’s central bank. It took BSI an astonishing 3 long years to be able to establish any merit to its claims.

When the facts from both sides in this case are read, it becomes clear that the BSI violated its own capital lending requirements. To prevent loss of its banking license, it had no choice but to file against Ijaz and other large borrowers of the bank. It was in this context that the central bank of San Marino took notice and ordered that the president of the bank be fired and that certain directors of the bank be removed for violating central bank guidelines. It appears that perhaps the bank is the one that committed fraud against its own central bank and was required to repair the damage by demanding repayment from Ijaz and dozens of other borrowers.

Ijaz’s attorneys made repeated demands but the BSI never made clear how they disposed of Ijaz’s shares in the public company and what compensation was received, leaving open the possibility that the bank was in fact repaid by sale of shares and still demanding additional repayment to which it was not entitled.

The full reading of the facts in this case demonstrates that Masnoor Ijaz, while initially accused of wrongdoing, was in the final judgment of the court only ordered to repay a certain amount of the loans ($1.4m) for which he voluntarily admitted liability. There was no trial, no finding of malfeasance or misconduct, and no fraud.

Interestingly, the Supreme Court of the State of New York County ruling entered against Ijaz had nothing to do with the merits of the bank’s claims. It had only to do with the right to file against Ijaz in the United States as the venue of the originating loans was in Italy and Ijaz was at the time of the loans being granted spending time in Zurich and London. It is also clear that any US court never ratified the claims of the Italian bank and only the right to file against Ijaz in the USA was granted, as he was a citizen and permanently residing in the United States.

The papers seen by The News show that Mansoor Ijaz, without any hesitation, consented to the reduced amount being entered in Judgment against his companies, hence no mention of any wrongdoing or fraud finding in the court’s final judgment. If Ijaz had refused to consent to the court order then he could have been found against but that scene never surfaced.