India MPC shifts focus to inflation control; rate hikes seen

India's central bank restores its liquidity adjustment facility corridor to pre-COVID-19 levels

April 22, 2022

- Central bank restores liquidity adjustment facility corridor to pre-COVID levels.

- MPC votes unanimously to retain its accommodative monetary policy.

- India's retail inflation accelerated to near 7% year-on-year in March.

MUMBAI: Almost all members of India's monetary policy committee argued in favour of action to curb inflationary pressures at their April 6-8 meeting despite continuing risks to economic growth, minutes released on Friday showed.

Although it chose to keep its key lending rate at a record low, the Reserve Bank of India said after the meeting that it would shift away from its ultra-loose monetary policy stance to focus on inflation, which has surged due to the Ukraine war.

In a surprise move, the central bank restored its liquidity adjustment facility corridor to pre-COVID-19 levels, which was seen as a first step in moving away from pandemic emergency measures.

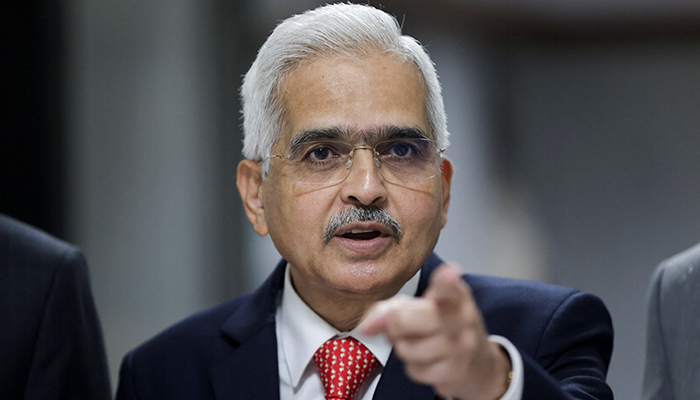

"Circumstances warrant prioritising inflation and anchoring of inflation expectations in the sequence of objectives to safeguard macroeconomic and financial stability while being mindful of the ongoing growth recovery," Governor Shaktikanta Das wrote in the minutes.

The MPC voted unanimously to retain its accommodative monetary policy stance and added that it would shift focus to the withdrawal of accommodation going ahead.

Several market participants and economists now expect the MPC to change its stance to 'neutral' in June and start raising the repo rate in August — and potentially even in June — if inflation continues to surprise on the upside.

India's retail inflation accelerated to near 7% year-on-year in March, its highest in 17 months and above the upper limit of the central bank's tolerance band for a third straight month.

"The policy will still stay accommodative as rates, even after lifting nominal rates, will stay below real neutral rate for foreseeable future," RBI executive director and MPC member Mridul Saggar said at the meeting, according to the minutes.

Future policy actions will either be a pause or a raising of rates, said MPC member Ashima Goyal.

"Rebalancing of liquidity started in 2021, and has now reached a level, with new facilities to absorb liquidity, that is compatible with raising policy rates. Short rates are set to rise to make the repo rate the operational policy rate again," she added.

As long as rates remain below the neutral rate, it is still not a tightening regime, Goyal said.

"The narrative is very clear. The focus is on inflation and inflation containment. June policy will see both stance change to neutral and a repo rate hike," said Rupa Rege Nitsure, chief economist at L&T Financial Holdings.

Nitsure expects a 25 bps hike if global crude oil prices stay around $100 a barrel but said more aggressive action would be warranted if oil prices shoot further up.