‘Drastic’ tax reforms imperative in upcoming budget

A business-friendly tax policy with the certainty of punishment can bring traders into the fold of tax contributors

Pakistan’s narrow tax base, increased reliance on indirect and withholding taxes and the low rate of tax compliance call for drastic tax reforms in the upcoming federal budget scheduled to be announced on Friday (June 10).

The fundamental element of tax reforms is providing a simple and fair tax system that is complemented by an efficient and competent administration. It is clear that successive governments have failed to bring any meaningful and lasting reforms in tax policies and administration.

In a scorecard that my think-tank, Policy Research Institute of Market Economy (PRIME), developed, we gave a score of 20% to the PML-N government on tax reforms during its tenure from 2013 to 2018. The recent PTI government scored somewhat better at 40% but fell way short of desirable structural reforms.

Here is an overview of the main problems that our tax policy features:

Rates are high and encourage evasion

Our corporate tax effectively goes up to 39%, though even the standard 29% is quite high when compared to the regional average of 23%. Our sales tax is 17% — also very high — which means more revenue but keeps our system regressive and anti-poor. Our custom duties were decreased but this was undone by an increase in the additional custom duties and regulatory duties, making Pakistan’s economy one of the most protective economies in the world.

Taxation system is discretionary and unpredictable

Despite its commitment otherwise, the PTI government issued more than 300 Statutory Regulatory Orders (SROs). Our sales tax act probably has a longer list of exemptions than the tax clauses. It encourages business lobbies to keep pressurising the government to get exemption on one pretext or another.

Our tax system is burdensome for taxpayers

Effectively, our direct tax system has become dysfunctional and has been ‘withholdised’ with more than 60 types of withholding taxes that contribute at least 70% to direct tax revenue. Dichotomies in the sales tax administration between federal and provincial governments continue to be painful and costly. Our taxpayers spend a considerable amount of time in compliance despite technological improvement.

Our tax policy has a strong anti-export bias

Our reliance on import taxation, that includes not just custom duties but also advance collection of income and sales tax, has touched unprecedented heights. In 2020-21, 45% of our tax revenue came from import taxes, by far the world’s highest. It has put our importers in a permanent liquidity crisis, whereas 95% of our imports are “essential” in nature.

Our tax policy encourages tax evasion

Our tax policy has announced amnesties so many times that it has lost the trust of honest taxpayers. Moreover, by creating a distinction between the filers and non-filers, the policy has actually created an alibi for tax evaders to stay out of the tax net by paying extra — which they can easily do.

Read more: IMF tax proposals to increase burden on salaried class

While this is a list of main problems in the tax policy, there are separate problems in tax administration, which continue to frustrate taxpayers, owing to arbitrary administrative measures and countless legal battles. These issues notwithstanding, we have seen some improvement in recent years through the use of technology, but policy reforms have remained elusive.

How can we, then, transform this regressive, anti-poor and anti-business tax policy into a progressive, pro-poor and pro-business tax policy?

I argue that the solution lies in a low-rate, flat, broad-based and predictable tax system that my colleagues Huzaima Bukhari and Dr. Ikram ul Haq have elaborated on and continue to advocate.

A business-friendly tax policy in upcoming budget with certainty of punishment can bring traders into the fold of tax contributors

We need to reduce tax rates in all categories, remove or minimise exemptions, abolish or reduce slabs in personal income tax, and guarantee the stability of such a system for at least the next five years. This will lead, with the help of technology and better compliance, to a broadening of the base, which will then result in progress in the system.

Read more: Plan to jack up govt officials' salaries by 5-15% under consideration

We estimate that in a country like Pakistan, at least 5% of the population should ideally be direct taxpayers, which translates into 10 million taxpayers, whereas currently we have hardly three million taxpayers.

A large majority of the missing taxpayers belong to the trader community, numbering at least four million. A business-friendly tax policy in the upcoming federal budget, as outlined here, with the certainty of punishment can bring traders into the fold of tax contributors.

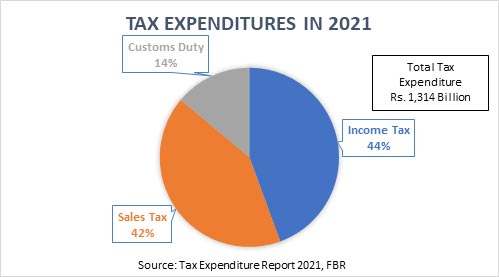

To explain how simplification, rate reduction and removal of exemptions can work without altering anything else consider this: In 2020-21, our tax exemptions and expenditures amounted to Rs1,314 billion — almost 26% of tax revenue collected. Income tax exemptions amounted to 44%, custom duty exemptions 14%, whereas sales tax exemptions contributed 42%.

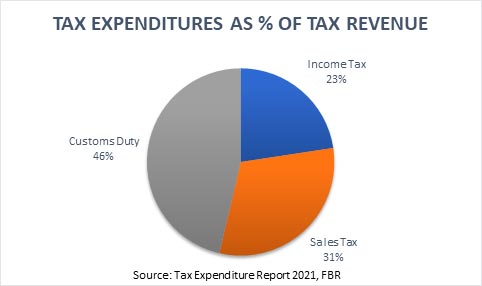

Seen from another lens, customs duty exemptions as a percentage of total customs duty were almost 46%, that of income tax 23%, and of sales tax 31%.

To put it simply, out of every Rs100 due as income tax, the government gave up Rs23, out of every Rs100 due as sales tax, the government gave up Rs31 and out of every Rs100 due as custom duty the government gave up Rs46.

It is acknowledged that some of these exemptions may be justified. For example, capital goods exemption can be justified on the grounds that it will help to manufacture, and pulses and medicines can be exempted as this will help in curbing inflation.

An alternative recommendation is to bring the overall applicable rates of tax down at a revenue-neutral level, i.e. without even changing the tax base.

One could start from a zero-exemption base and add only those items which directly affect poor households. The bulk of exemptions should be withdrawn which will lead to a significant increase in the tax revenue.

Read more: Tough decisions not stopgap measures need of hour in budget

Looking at the tax expenditures for 2021, income tax can be reduced from 29% to 22% and all kinds of exemptions can be withdrawn without changing the base in the upcoming budget. The sales tax can be reduced from 17% to 11% in a similar fashion and custom duties can be halved without any loss to the government.

Once the rates are brought down, the variations across these rates should also be gone. Such a system will be far easier to manage, and it will increase compliance thus ultimately increasing the base in the medium to long run.

A flat, low-rate and broad-based system is good for everyone.

A flat, low-rate and broad-based system is good for everyone. It is good for society as it is progressive. It is good for the government as it yields more revenue by increasing the base. It is good for businesses as it increases their savings and reduces compliance cost. It is good for the economy as it increases disposable incomes for households and firms. It is good for Federal Board of Revenue (FBR) as it discourages tax evasion by making it costly and risky. It also simplifies tax calculations and collections.

Finally, it is good for democracy as it incentivises more people to demand accountability by becoming taxpayers.

Salman is the founder and executive director of PRIME, an independent economic policy think-tank based in Islamabad.

For Geo.tv's latest news, updates and analysis of the Federal Budget 2022-23, visit: https://geo.tv/trending/budget-2022-23