Pakistan Economic Survey 2021-22 at a glance

Finance Minister Miftah Ismail unveils Economic Survey 2021-22, data shows agriculture, industrial and services sectors helped economy rebound

June 09, 2022

ISLAMABAD: Finance Minister Miftah Ismail Thursday unveiled the Pakistan Economic Survey 2021-22 at a press conference, showing that the agriculture, industrial and services sectors had helped the economy rebound and post GDP growth of 5.97% in the first 11 months of the fiscal year (July to May), significantly higher than the target of 4.8%.

For the first time, the Finance Ministry has released a separate document highlighting the salient features of the Pakistan Economic Survey 2021-22.

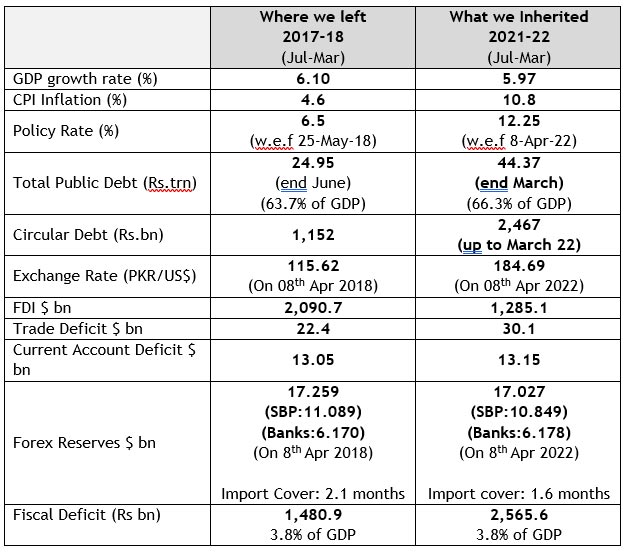

The document highlighted that the present government inherited an economy with "severe macroeconomic imbalances" that have brought Pakistan to the brink of financial collapse.

Read more: Five key things to look out for in the budget tomorrow

The ministry identified shrinking fiscal space, inflationary pressure, mounting current account deficit, growing financing need, exchange rate pressure, and energy sector crisis as challenges inherited by the new coalition government.

It further mentioned that the conflict between Russia-Ukraine has elevated risks for Pakistan’s economy in terms of high international prices, and significant pressure on external and fiscal accounts. In turn, it can have a profound impact on overall economic activities.

The document also compared the economic performance of PML-N and PTI governments.

Salient features

- For FY22, provisional GDP growth has been estimated at 5.97%.

- The agriculture sector posted growth of 4.4% mainly due to 6.6% growth in crops and 3.3% growth in livestock.

- The industrial sector recorded a growth of 7.2% in FY22 compared to 7.8% growth in FY21.

- The services sector grew by 6.19% during the outgoing fiscal year.

- LSM (July-March FY22) posted a growth of 10.4% (4.2% last year).

- Exports (July-May FY22) increased by 27.8% to $ 28.8 billion ($22.6 billion last year).

- Imports (July-May FY22) grew by 44.3% to $72.2 billion ($50 billion last year).

- The trade deficit (July-May FY22) increased to $43.3 billion (a deficit of $27.4 billion last year).

- Remittances (July-April FY22) increased by 7.6% to $26.1 billion ($24.3 billion last year).

- FDI (July-April FY22) decreased by 1.6 % to $1455.6 million ($1480 million last year).

- The current account deficit (Jul-Apr FY22), stood at $13.8 billion ($0.5 billion last year).

- Total liquid foreign reserves exchange reserves as of June 2, 2022 held by the country stood at $15.2 billion ($23.2 billion last year).

- Meanwhile, reserves held by the State Bank of Pakistan (SBP) held $9.3 billion ($16 billion last year), and commercial banks $6 billion ($7.2 billion last year).

- Inflation based on the consumer price index (Jul-May FY22) was recorded at 11.3% (8.8% last year).

- Federal Board of Revenue (FBR) tax collection (Jul-May FY22) grew by 28.4% to Rs5348.2 billion (Rs4164.3 billion last year).

- The fiscal deficit (July-April FY22) was recorded at 4.9% of GDP (Rs3,275 billion) against 3.6% of GDP (Rs2,020 billion last year).

- The primary balance (Jul-April FY22) posted a deficit of Rs890 billion (a surplus of Rs159 billion last year).

- Private sector credit increased to Rs1,312.9 billion from July 1 to April 29, FY22 against Rs454.4 billion last year.