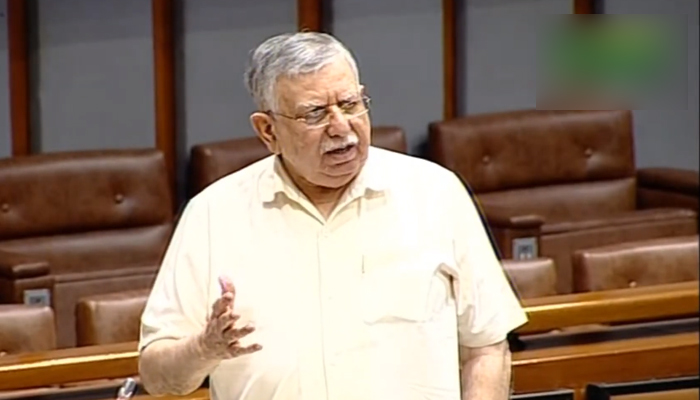

IMF has asked Pakistan to impose further taxes of Rs440 billion, claims Shaukat Tarin

“The actual budget will be unveiled now,” former finance minister Shaukat Train says

June 23, 2022

- “The actual budget will be unveiled now,” Train says.

- Ex-finance minister says Senate debating budget for formality.

- Miftah will wrap up federal budget in NA speech tomorrow.

ISLAMABAD: Former finance minister Shaukat Tarin said Thursday the International Monetary Fund (IMF) has asked the Pakistani government to impose further taxes of Rs440 billion.

“The actual budget will be unveiled now,” the ex-finance minister told the Senate after the money lender and Pakistan reached a “broad agreement” on the budgetary and fiscal measures for the next fiscal year (FY) 2022-23.

The PTI leader, speaking on the floor of the Senate, said the Upper House of the Parliament is fulfilling formalities by debating the budget as the “actual budget” will be presented in the National Assembly — after it is tuned in line with the IMF’s demands.

The statement came hours after Finance Minister Miftah Ismail revealed in a press conference that the coalition government had imposed taxes on the rich in the budget for the next FY23.

Miftah said another 1% supertax would be imposed on people earning more than Rs150 million, 2% on income of more than Rs200 million, 3% on people earning more than Rs250 million and 4% on income of more than Rs300 million per annum.

He revealed that he would wrap up the federal budget for the next fiscal year 2022-23 tomorrow with his closing speech in the Lower House of the Parliament.

Although the finance minister did not disclose further details about the agreement with the IMF, according to details available with Geo.tv and Ismail Iqbal Securities, here is a list of some other proposed changes in the federal budget.

Item | Budget | Revised |

| Budget outlay increased | Rs9,502 billion | Rs9,900 billion |

| Change in FBR's collection base in FY22 | Rs7,004 billion | Rs7,442 billion |

| Poverty tax to be imposed in slabs | >Rs300 million, 2% tax | >Rs150 million, 1% tax >Rs200 million, 2% tax >Rs250 million, 3% tax >Rs300 million, 4% tax |

| Pension target revised | Rs530 billion | Rs609 billion |

| Civilian govt expenditures revised | Rs550 billion | Rs600 billion |

| Gas Infrastructure Development Cess collection target reverted due to litigation | Rs200 billion | No target set |

| Custom duty collection target revised | Rs953 billion | Rs1,005 billion |

| Increase in personal income tax target | Rs47 billion relief | Not available |

| Annual tax exemption limit revised | Rs1.2 million | Rs600,000 |