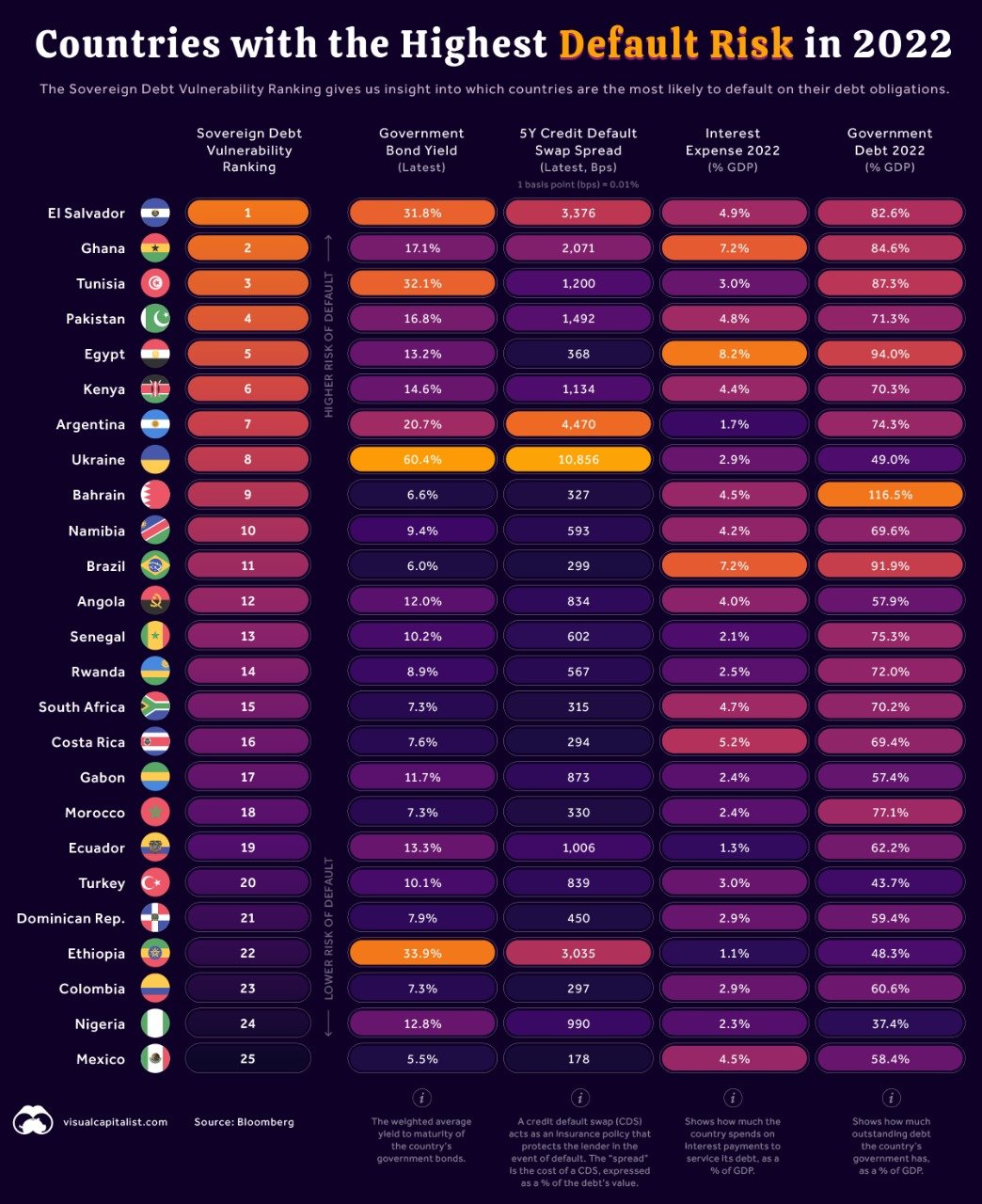

List of countries with highest default risk 2022

Pakistan is also included in countries that are at risk of defaulting this year, according to Bloomberg

July 15, 2022

The South Asian nation Sri Lanka defaulted in May 2022 for the first time on its debt. Its government was given an ultimatum of 30 days to cover $78 million in unpaid interest, however, it failed to do so.

This raises an important question: Which other countries are at risk of default in 2022?

According to Visual Capitalist via Bloomberg, here are countries with a higher risk of default this year. Pakistan is also included in the list.

The Sovereign Debt Vulnerability Ranking — a composite measure of a country’s default risk — by Bloomberg is based on four metrics; government bond yields (the weighted-average yield of the country’s dollar bonds), five-year credit default swap (CDS) spread, interest expense as a percentage of gross domestic product (GDP), and government debt as a percentage of GDP.

In order to have a better understanding, let's take a look at Ukraine and El Salvador.

Ukraine's Bond Yields

Due to the ongoing conflict between Ukraine and Russia, the former has a higher risk of default. If Russia takes control of the country, Ukraine might not be able to repay its existing debt obligations.

This has caused a sell-off of Ukrainian government bonds, resulting in a decrease in their value to 30 cents on the dollar. This means that a bond could be purchased for $30, having a face value of $100.

The average yield on these bonds has increased to 60.4% as it moves in the opposite direction of the price. "As a point of comparison, the yield on a US 10-year government bond is currently 2.9%," according to Visual Capitalist.

CDS Spread

In the case of a default, a lender can get insurance with the help of credit default swaps (CDS), which are a type of financial contract.

A CDS seller represents a third party between the lender (investors) and borrower (in this case, governments).

The buyer pays a fee, which is also known as spread in return. It is expressed in basis points (bps). The investor has to pay $3 per year if a CDS has a spread of 300 bps (3%) to insure $100 in debt.

If this is applied to Ukraine's five-year CDS spread of 10,856 bps (108.56%), the investor would have to pay $108.56 yearly to insure $100 in debt, suggesting the market's less faith in Ukraine to prevent itself from being defaulted.

El Salvador's higher ranking

As compared to Ukraine, El Salvador has a higher ranking due to its "larger interest expense and total government debt."

The data shows that El Salvador's annual interest payments are equal to 4.9% of its GDP, making it higher. Meanwhile, the US has a federal interest cost of about 1.6% of GDP in 2020.

El Salvador has outstanding debts of about 82.6% of GDP when totalled which is high by historical standards.

"The next date to watch will be January 2023, as this is when the country’s $800 million sovereign bond reaches maturity," per the Visual Capitalist.

Research says that El Salvador would face significant but temporary negative effects if it defaults.