Fitch, Moody’s expect IMF to disburse funds to Pakistan in third quarter

IMF loan may unlock more financing from other sources says, Fitch

July 27, 2022

- Pakistan expected to receive $1.2 billion the IMF in third quarter.

- IMF loan may unlock more financing from other sources, says Fitch

- Moody’s says risk that Pakistan will not complete its IMF bailout package is on downside.

Pakistan is expected to receive $1.2 billion from the International Monetary Fund, which may help alleviate strain on the country's currency and bonds, according to Fitch Ratings and Moody's Investor Service, Bloomberg reported on Wednesday.

"We assume IMF board approval of Pakistan's new staff-level agreement," said Krisjanis Krustins, a Hong Kong-based Fitch director. "This will unlock significant additional financing from the IMF and other multilateral and bilateral sources, as well as provide a significant boost to market confidence."

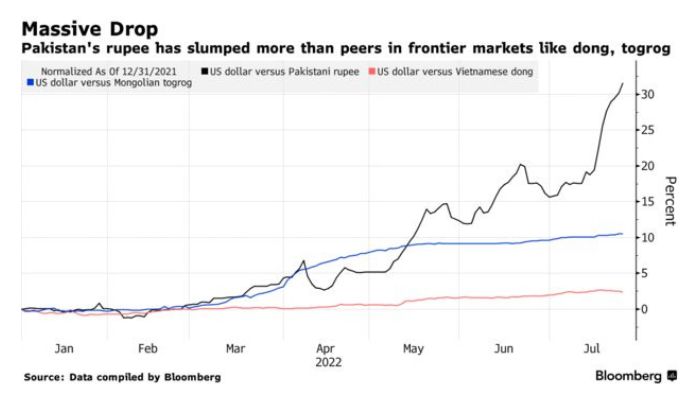

Pakistan's rupee has fallen more than its peers in frontier markets such as dong and togrog.

Pakistan's currency and bonds have taken a beating this month, as investors are concerned that political turmoil will delay IMF support for the country. The nation is trying hard to prevent fears it will follow Sri Lanka into a default this year, with the government working to secure billions of dollars from the Washington-based lender and countries like China and Saudi Arabia.

According to Grace Lim, a sovereign analyst with Moody's in Singapore, the IMF will disburse the funds in the third quarter. Still, the risk that Pakistan will not complete its IMF bailout package is on the downside, as the government may find it difficult to implement revenue-raising measures, she said.

"Pakistan's ability to complete the current programme and maintain a credible policy path that supports additional financing remains highly uncertain," Lim told Bloomberg, "while elevated inflation and a higher cost of living add to social and political risks."

Meanwhile, Prime Minister Shehbaz Sharif's government is dealing with other obstacles. The Supreme Court cancelled an election that would have elected the ruling alliance's candidate as chief minister of the country's largest province, giving reason for Opposition led by former premier Imran Khan to renew calls for early elections.

Dollar bonds due in 2031 were indicated 0.4 cents lower at 50.67 per dollar, while the rupee fell to a new low, falling 1.5 per cent to 236.34 per dollar.

According to people familiar with the situation, the IMF is seeking assurances from Saudi Arabia and other countries that they will follow through on their funding commitments before approving the loan to Pakistan. Fitch Ratings downgraded Pakistan's credit rating outlook to negative last week, and Moody's did the same in June.

“The IMF loan is a high probability event,” said said Carl Wong, head of fixed income at Avenue Asset Management in Hong Kong. “But the odds that Pakistan can get itself out of the trouble is 50:50 as the IMF is just a part of the equation.”