Stronger dollar wreaking havoc globally, with more to come: report

Since mid-2021, US dollar has risen 15% against a basket of currencies

July 28, 2022

- Dollar rises as Fed hikes rates, fear of global recession rise.

- Analyst says 'no kryptonite' in sight to blow up greenback's strength.

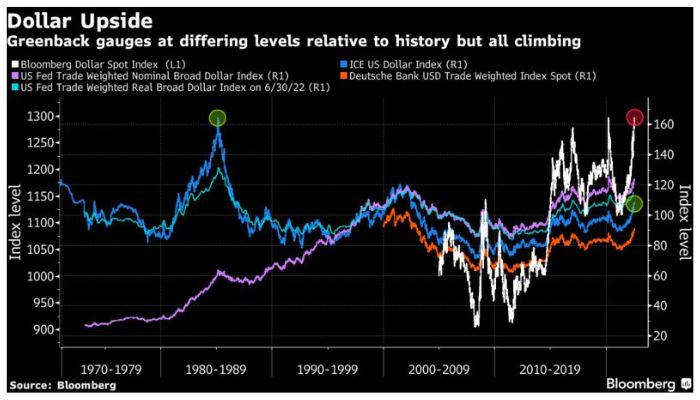

- Since mid-2021, dollar has risen 15% against a basket of currencies.

A currency that powers global trade, the US dollar, — which is strengthening against other currencies because of Federal Reserve’s aggressive rate-hiking — is on a tear with few precedents in modern history and is wreaking havoc globally, Bloomberg reported.

A strong greenback is pushing the cost of food, escalating poverty globally, triggering fears of a debt default that has already toppled the Sri Lankan government and increasing pressure on stock and bond markets.

According to the publication, the greenback is currently trading at all-time highs against several other currencies, including the Pakistani rupee. Since mid-2021, the US dollar has risen 15% against a basket of currencies.

Moreover, the Fed is constantly raising interest rates to fight inflation; however, is pushing several economies across the globe into recession.

Singapore’s Mizuho Bank Limited Head of Economics and Strategy Vishnu Varathan said: “There is no kryptonite to blow up the dollar's strength immediately, with the Eurozone hampered by the war in Ukraine and China’s growth uncertain.

“There is simply no alternative to the dollar no matter where you look and it's pummeling everything else as a result — economies, other currencies, corporate earnings.”

The rapid increase in dollar value is affecting daily life in several economies as it is the main factor for trade and commerce globally. The publication estimated that roughly 40% of the $28.5 trillion in annual global trade is priced in greenbacks.

“Its relentless rise risks creating a self-sustaining doom loop.”

Joey Chew, strategist at HSBC Holdings Plc in Hong Kong, said: “You have recession concerns leading to dollar strength, and then tightening financial conditions leading to more recession concerns. There’s no immediate solution around this.”

Why is dollar demand rising?

There has been a rapid increase in the demand for the greenback as investors are looking for a safe haven because of the crazy movement in global markets.

A lot of investors still consider treasuries as one of the safest ways to store money and the dollar makes up the lion's share of foreign-exchange reserves.

Damage is worse for emerging economies

Bloomberg reported that for several emerging markets the damage has been worse. The Indian rupee, Chilean peso and Sri Lankan rupee have touched record lows this year, despite efforts by some central banks to try to slow the fall.

Meanwhile, Hong Kong’s monetary authority has bought local dollars at a record pace to defend the city’s currency peg, while Chile’s central bank began a $25 billion intervention after the peso sank more than 20% in five weeks.

“It’s not going to work,” said Luca Paolini, strategist at Pictet Asset Management Limited which oversees $284 billion. “This rise in inflation, the dollar is a generation-defining event and it’s not something that central banks in emerging markets can do much about," he added.