PSX weekly review: Stock market ends three-week rally, falls 679 points

Concerns over IMF executive board meeting, growing political noise and rupee depreciation keep market under pressure

August 27, 2022

- Concerns over IMF meeting keep market under pressure.

- KSE-100 closes week at 42,592 points.

- AHL expects the market to be positive in the upcoming week.

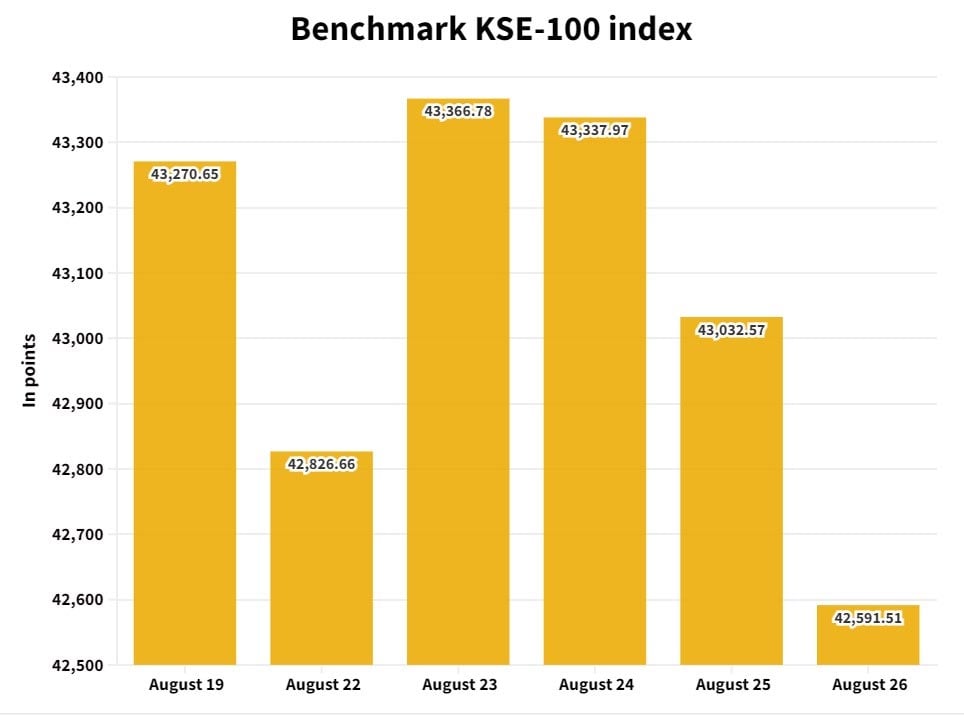

KARACHI: The Pakistan Stock Exchange (PSX) endured a relatively volatile week as the winning streak of the past three weeks came to an end. The equity market shed 679 points or 1.57% in the outgoing week and settled at 42,592 points as external woes and fast depleting foreign exchange reserves kept the benchmark index under pressure.

The week kicked off on a negative note as stocks came under massive selling pressure with over 400 points being wiped off on the first day of the rollover week as the market players refrained from taking fresh positions ahead of the monetary policy announcement.

The tables turned and the market posted gains on Tuesday following improved investor sentiments on the back of the State Bank of Pakistan's (SBP) decision to maintain a status quo in the monetary policy rate for the next seven weeks. Moreover, Qatar’s announcement regarding its $3 billion assistance for Pakistan triggered an uptrend in the market.

However, a dramatic turn of events was witnessed as bears once again reigned supreme on Wednesday as the euphoria over inflows from Qatar and Saudi Arabia died down and investors offloaded overbought stocks. With no apparent development ahead of the International Monetary Fund’s (IMF) board meeting, scheduled to be held on August 29, concerns over the economic situation added to the sombre mood and the market remained in the red zone till the end of the rollover week.

Other major developments during the week were: current account deficit during July shrank by 45% month-on-month to $1.21 billion, the rupee lost over Rs6 against the US dollar during the week, SBP reserves fell by $87 million, to settle at $7.8 billion, Pakistan Oilfields found hydrocarbons in Tolanj West-2 in Khyber Pakhtunkhwa, Asian Development Bank approved $0.7 million in technical assistance, international institutions announced $500 million assistance for floods, foreign direct investment dropped to $59 million in July, and Rs36 billion tax imposed on cigarettes.

Meanwhile, foreign selling continued this week, clocking in at $1.9 million against a net sell of $2.8 million recorded last week. Selling was witnessed in commercial banks ($3.7 million), and exploration and production ($0.7 million).

On the domestic front, major buying was reported by banks, and development finance institutions ($4.1 million), followed by individuals ($3.8 million).

During the week under review, average volumes clocked in at 250 million shares (down by 52% week-on-week), while the average value traded settled at $37 million (down by 35% week-on-week).

Major gainers and losers of the week

Sector-wise negative contributions came from banks (-143 points), miscellaneous (-138 points), power (-101 points), oil marketing companies (-80 points), and chemicals (-59points).

On the flip side, positive contributions came from fertiliser (+70 points), and cement (+28 points).

Scrip-wise major losers were Pakistan Services (-137 points), Hubco (-104 points), Pakistan State Oil (-79 points), HBL (-48 points), and TRG Pakistan (-48 points).

Meanwhile, major gainers were Lucky Cement (+75 points), Systems Limited (+75 points), TGL (+26 points), Fauji Fertiliser (+25 points), and Pakistan Oilfields (+19 points).

Outlook for next week

A report from Arif Habib Limited stated that with IMF and Pakistan meetings scheduled in the coming week, it is expected that IMF will approve the $1.17 billion tranche enabling the disbursement within a week or so.

“Keeping in view the ongoing result season, some sectors and scrips are expected to stay in the limelight,” it said, predicting that the market is expected to be positive in the upcoming week.

“The KSE-100 is currently trading at a PER of 4.2x (2022) compared to the Asia-Pacific regional average of 12.7x while offering a dividend yield of 9.6% versus 2.7% offered by the region,” the brokerage house stated.