PSX edges lower as IMF optimism fades due to flash floods

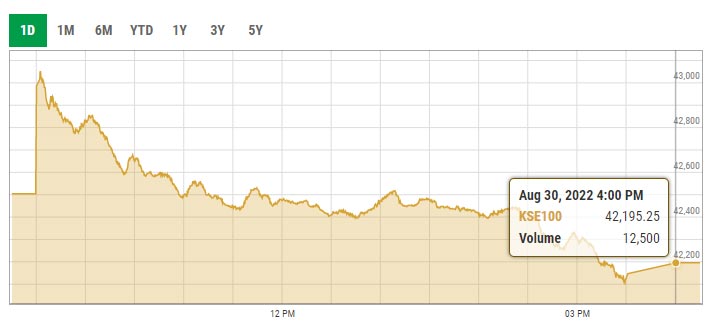

Benchmark KSE-100 index loses 1.73% to close at 42,195.25 points

August 30, 2022

- KSE-100 index loses 309.09 points.

- Benchmark index closes at 42,195.25 points.

- Overall trading volumes decline to 140.21 million shares.

KARACHI: The International Monetary Fund’s (IMF) approval could not restore investor confidence Tuesday as flash floods disrupted the supply chain and caused substantial economic losses, resulting in the stock market shedding points.

Early estimates put the damage from the floods at more than $10 billion, the government has said, adding that the world had an obligation to help the South Asian country cope with the effects of man-made climate change.

The floods have overshadowed the major IMF programme that Pakistan unlocked a day earlier, paving way for a disbursement of $1.17 billion from the money lender.

With the revival of the IMF programme, Pakistan is expected to receive funds from multilateral and bilateral organisations, apart from friendly countries.

At close, the benchmark KSE-100 index settled at 42,195.25 points with a decrease of 309.09 points or 1.73%.

Capital market expert Saad Ali told Geo.tv that the final nod from the IMF board has put an end to the long wait behind programme resumption.

"This will unlock more external inflows, which will support the currency while other macro indicators are showing gradual improvement," the capital market expert said.

The expert added that the market confidence will increase on sustained macro improvement and lack of major political noise, which can extend the present rally.

Arif Habib Limited's Head of Research Tahir Abbas said that IMF's approval has paved the way for Pakistan to get the much-needed funding within the next three days.

In light of this, Pakistan is expected to get multilateral and bilateral financing from the Asian Development Bank (ADB), Islamic Development Bank (IDB), and World Bank.

Abbas added that it would also encourage friendly countries — Saudi Arabia, the United Arab Emirates (UAE), and Qatar — to provide funds to Pakistan, which will help the government fulfil the external financing gap.

"This will help better the situation in the stock and the currency markets, as it has finally provided clarity on the economic front," the analyst added.

Shares of 338 companies were traded during the session. At the close of trading, 122 scrips closed in the green, 189 in the red, and 27 remained unchanged.

Overall trading volumes rose to 237.67 million shares compared with Monday's tally of 229.21 million. The value of shares traded during the day was Rs5.87 billion.

K-Electric Limited was the volume leader with 38.1 million shares traded, losing Rs0.19 to close at Rs3.34. It was followed by Worldcall Telecom Limited with 13.74 million shares traded, gaining Rs0.01 to close at Rs1.28 and Unity Foods Limited with 12.87 million shares traded, gaining Rs0.07 to close at Rs22.99.