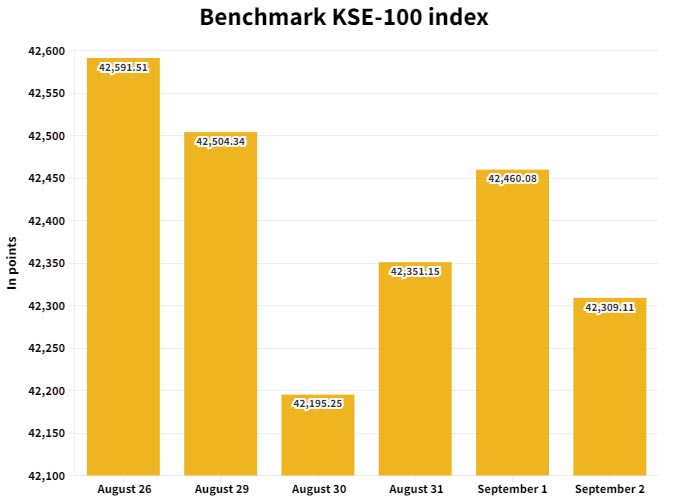

PSX weekly review: KSE-100 in grip of bears as index falls for second successive week

KSE-100 closes week at 42,309.11 points as concerns over flood devastations kept market under pressure

September 03, 2022

- Concerns over flood devastations keep market under pressure.

- KSE-100 closes week at 42,309.11 points.

- AHL expects the market to remain range-bound in upcoming week.

KARACHI: Volatility marred trading in the stock market in the outgoing week despite the revival of the much-awaited multi-billion loan programme with the International Monetary Fund (IMF) and rupee appreciation.

The benchmark KSE 100-share index shed 282 points or 0.7% during the week to settle at 42,309.11 points.

The week commenced on a negative note as investors reacted to the devastations caused by the catastrophic floods in the country and their overall impact on the economy. Moreover, a cautious stance was adopted as the executive board was supposed to meet later in the day to take final decisions regarding Pakistan’s Extended Fund Facility (EFF).

The following session also saw the index finish slightly in the red with participants remaining on the sidelines. In line with expectations, the Washington-based lender successfully resumed Pakistan’s stalled programme, which helped create positive momentum in the stock market. However, the floods have overshadowed the massive development as flash floods have disrupted the supply chain and caused substantial economic losses.

Wednesday saw a turn of events and the index advanced as the government’s decision to allocate over Rs103 billion for the provision of urgent relief to 4.1 million flood-affected people revived investors. Investors resumed buying stocks at attractive valuations.

Bulls held control on Thursday as well as Pakistan received funds from the IMF which also strengthened the rupee value. Receipts worth $1.16 billion from the IMF sparked optimism among market participants, who resorted to making fresh purchases.

However, bears returned to the bourse on the last day of the trading week owing to the absence of positive triggers and fears of massive flood losses. However, decade-high inflation based on consumer and sensitive price indices put pressure on the market players.

The KSE-100 closed on a negative note for the second consecutive week.

Other major developments during the week were: exports jump by 11.6% in August, the govt increased petrol price by Rs2.07, takes it to Rs235.98 per litre, Nepra to increase Discos’ tariffs for July by Rs4.35 per unit, the US announced $30 million in support for Pakistan flood response, Pakistan Suzuki announced further extension in automobile plant shutdown.

Meanwhile, foreign selling continued this week, clocking in at $0.74 million against a net sell of $1.87 million recorded last week. Selling was witnessed in commercial banks ($1.8 million), and power ($0.8 million).

On the domestic front, major buying was reported by banks, and development finance institutions ($3 million), followed by individuals ($2.4 million).

During the week under review, average volumes clocked in at 211 million shares (down by 15% week-on-week), while the average value traded settled at $31 million (down by 15% week-on-week).

Major gainers and losers of the week

Sector-wise negative contributions came from banks (-118 points), exploration and production (-90 points), automobile assembler (-61 points), miscellaneous (-40 points), and textile composite (-31 points).

On the flip side, positive contributions came from cement (+110 points), and leather and tanneries (+25 points).

Scrip-wise major losers were HBL (-73 points), TRG Pakistan (-47 points), Pakistan Services (-41 points), Engro Fertiliser (-39 points), and Pakistan Oilfields (-36 points).

Meanwhile, major gainers were Systems Limited (+76 points), Engro Fertiliser (+48 points), Kohat Cement (+32 points), Faysal Bank (+31 points), and Service Fabrics (+25 points).

Outlook for next week

A report from Arif Habib Limited stated that following the disbursement of the tranche by the IMF, the government is expected to unlock further foreign economic assistance from various international creditors, in addition, to flood relief aid from friendly countries and other financial institutions.

“However, investor will remain cautious given the current overall socio-economic situation of the country,” it said, predicting that the market is expected to remain range-bound in the upcoming week.

“The KSE-100 is currently trading at a PER of 4.2x (2022) compared to the Asia-Pacific regional average of 12.5x while offering a dividend yield of 9.6% versus 2.7% offered by the region,” the brokerage house stated.