Profit-booking cuts early rally short at PSX

"Going forward, we recommend investors to stay cautious at current levels and wait for dips for any fresh buying," JS Research advises

October 24, 2022

- Stocks opened in green on FATF grey list exit.

- It was a range-bound day for the apex bourse.

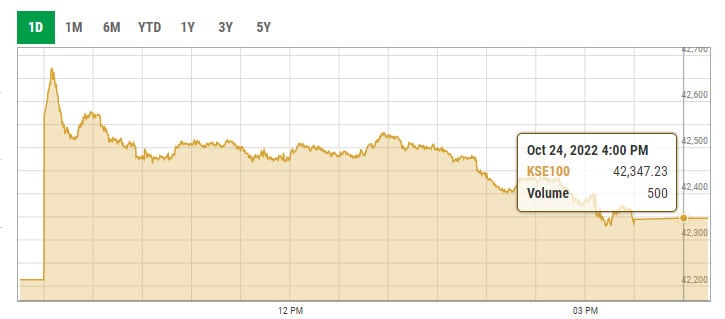

- Profit-taking ensued after intraday high of 42,672 points.

KARACHI: Stocks printed modest gains on Monday after profit-selling cut an early rally short despite Pakistan’s exit from the international money-laundering and terror-financing watchdog’s list of extensively monitored countries, as political noise remains a concern.

Topline Securities in a note said equities commenced the trading week on a celebratory note due to the approval of $1.5 billion from the Asian Development Bank and the country’s reclassification into Financial Action Task Force's (FATF) whitelist.

“The index initially opened in the green, made an intraday high at 42,672, up 459 points or 1.08%, where profit-taking ensued, wiping out early gains,” the brokerage said.

The benchmark KSE-100 share index gained 133.75 points or 0.32% to close at 42,347.23 points.

During the day, technology, fertiliser, power, and exploration and production stocks contributed positively to the index where The Resource Group, Engro Fertilisers, Hub Power Company, Mari Petroleum, and Fauji Fertiliser added 112 points, cumulatively.

On the flip side, Habib Metro Bank, Lotte Chemical Pakistan, and the National Bank of Pakistan together lost 26 points.

The FATF in its statement said: “It has decided by consensus that Pakistan has completed all substantial, technical and procedural requirements of both 2018 and 2021 Action Plans, encompassing 34 action items in total”.

“Subsequently, Pakistan has been taken out of the list of jurisdictions under increased monitoring with immediate effect,” it added.

Arif Habib Limited in its market wrap said it was a rangebound day for the apex bourse.

“Despite having the astounding news that Pakistan has been taken off from the “grey list” of the FATF, the PSX was unable to capitalise from it because of political upheaval as investor’s participation remained thin,” it reported.

“The mainboard had reasonable volumes, although the top volume leaders remained the third-tier stocks.”

Sectors contributing to the performance included technology and communication (46.9 points), fertiliser (40.9 points), exploration and production (24.4 points), power generation and distribution (22.6 points) and automobile parts and accessories (7.2 points).

JS Research in its daily market analysis said: “Going forward, we recommend investors to stay cautious at current levels and wait for dips for any fresh buying”.

Shares of 343 companies were traded during the session. At the close of trading, 160 scrips closed in the green, 149 in the red, and 34 remained unchanged.

Overall trading volumes declined to 226.74 million shares compared with Friday's tally of 289.58 million. The value of shares traded during the day was Rs6.05 billion.

Worldcall Telecom was the volume leader with 68.78 million shares traded, gaining Rs0.07 to close at Rs1.59. It was followed by Dewan Farooque Motors with 12.41 million shares traded, gaining Rs0.92 to close at Rs11.21 and Pakistan Refinery with 9.54 million shares gaining Rs0.10 to close at Rs17.91.