Pakistan stocks barely up on the eve of PTI long march

KSE-100 index gains a paltry 62.82 points in a tight trade

October 27, 2022

- Market got off to a good start, but succumbed to selling soon.

- Dullness attributed to rollover week effect, political worries.

- Investors advised to avail downside as buying opportunity.

KARACHI: Stocks on Thursday barely changed as investors hugged the sidelines a day ahead of the PTI’s long march with economic worries gaining traction on fears of hostilities as marchers may face heavy resistance in Islamabad.

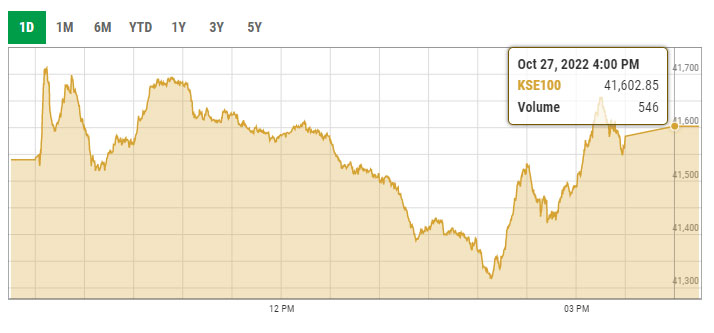

The KSE-100 index, the benchmark of the Pakistan Stock Exchange (PSX), gained a paltry 62.82 points or 0.15% in a tight trade.

Topline Securities attributed this dullness to rollover week and the political uncertainties.

“Range-bound activity was witnessed at the bourse that made an intraday high of 171 points and low of 221 points before the closing bell,” the brokerage house said.

Major positive contributors in today’s trading session were TRG Pakistan, Faysal Bank Limited, and Pakistan Oilfields Limited which cumulatively added 89 points to the index.

On the other hand, Hub Power Company, Pakistan Petroleum Limited, and Searle Company Limited together knocked 54 points off the index.

On the results front,

- Pakistan Petroleum Limited declared earnings per share of Rs9.78 for 1QFY23

- Pak Elektron Limited unveiled earnings per share of Rs0.41 for 3Q2022

- Kohat Cement Company Limited announced earnings per share of Rs8.89 for 1QFY23

- Bank Al Habib Limited’s 3Q2022 earnings per share clocked in at Rs4.9

- Nishat Mills Limited in its financial result for the first quarter of the current fiscal year gave its shareholders earnings per share of Rs11.8

Traded volume and value for the day stood at 203.3 million shares, down by 23%, and Rs6.36 billion, down by 17.5%, day-on-day respectively. WorldCall Telecom led the volume chart after posting a turnover of 22.93 million shares.

Arif Habib Limited (AHL) in its market wrap the index started off with a positive gap, but the continuous political unrest kept investors away, causing the index to hit an intraday low of 221.37 points.

“On the other hand, value-buying was seen in the final hour of trading, which helped the stocks stay afloat. Volumes were decent given the rollover week, with third-tier stocks maintaining a lead in terms of volume,” the AHL analysts said.

Technology and communication (65.5 points), fertiliser (25.9 points), cement (19.4 points), commercial banks (18.5 points), and chemical sector (12.4 points) supported the index.

Stocks that contributed significantly to the volume were WorldCall Telecom, Dewan Farooque Motors Limited, TRG Pakistan, K-Electric Limited, and Hum Network Limited.

JS Research said trading remained lacklustre throughout the day.

“The market is expected to remain bearish till further clarity over political situation emerges. We recommend investors to avail the current downside as an opportunity to buy,” the JS analysts said.