Stocks brace for cold week as politics heats up

Pakistan Stock Exchange closed the week at 41,856 points, gaining 716 points or 1.7% in last five sessions

November 05, 2022

- PSX expected to remain range-bound next week.

- Any positive outcome of IMF’s ninth review can aid the index.

- Weekly gains credited to upbeat trade deficit numbers.

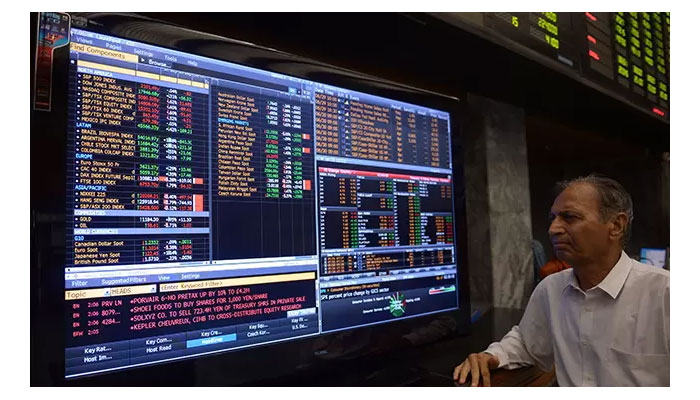

KARACHI: Stocks are poised for a cold week as political mercury spiked after the life bid on PTI chief Imran Khan and later his scathing allegations on the government and institutions, whipping up nationwide unrest.

The market closed at 41,856 points, gaining 716 points, up 1.7% week-on-week. Average volumes swelled by 7% to 229 million shares, while average value dropped by 11% to $25 million.

Arif Habib Limited expects the trade to remain range-bound next week as the participants are largely cautious owing to the political noise in the country.

“Furthermore, any positive outcome of the International Monetary Fund's (IMF) ninth review can aid the index,” the brokerage said.

The KSE-100 is currently trading at a PER of 4.0x (2023) compared to Asia Pac regional average of 12.4x while offering a dividend yield of ~10.2% versus ~2.9% offered by the region.

“The market got off to a positive start in the outgoing week. The momentum continued throughout the week; however, towards the end of the week, the market went down because of an attack on the former prime minister Imran Khan,” the Arif Habib report said.

Foreigners selling during the week under review clocked in at $1.58 million compared to a net buy of $0.97 million last week. Major selling was witnessed in banks ($0.9 million), fertiliser ($0.8 million) and other sectors ($0.3 million).

Topline Securities attribute these gains to a decline in trade deficit number for the month of October, which cemented the investor optimism

“Another important economic number that came in during the week was of CPI for October that increased to 26.6% year-on-year compared to 23.2% in September 2022,” the brokerage house added.

On the local front, buying was reported by individual funds ($4.7 million) and banks ($0.8 million).

The country’s trade deficit narrowed down by 26.59% to $11.469 billion during the first four months of the current fiscal year compared to $15.624bn during the same period of last year.

The rupee ended the week slightly higher against the greenback, closing at Rs221.95, strengthening 0.2% week-on-week. In addition to this, State Bank of Pakistan's reserves went up by $1.5 billion to $8.9 billion in the outgoing week compared to $7.44 billion on October 14, reflecting inflows from Asian Development Bank.

Major gainers and losers of the week

Sector-wise positive contributions came from technology and communication (168 points), oil and gas exploration companies (144 points), fertilisers (107 points), power generation and distribution (85 points), and cement (66 points).

Whereas, sectors that weighed the index down were insurance (10 points), food and personal care products (9 points), and paper and board (8 points).

Companies that supported the index were TRG Pakistan (101 points), Pakistan Oilfields Limited (89 points), Hubco (74 points), Systems (53 points) and Engro Corporation (43 points).

Meanwhile, major laggard stocks included Meezan Bank (31 points), Nestlé Pakistan (15 points), Habib Bank Limited, (12 points), Pakistan Services Limited, (12 points) and Adamjee Insurance Limited (10 points).