Dar says SBP, NBP to withdraw pleas against Islamic banking imposition in Pakistan

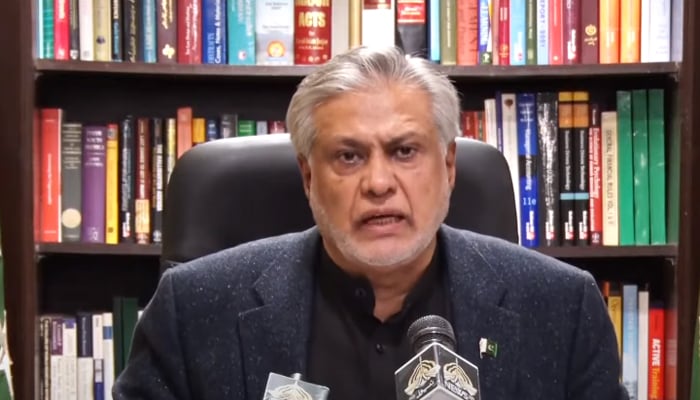

"I am announcing on behalf of government that both appeals will be withdrawn from Supreme Court," Ishaq Dar says

November 09, 2022

- Govt to implement Islamic banking system as soon as possible.

- Announcement made with permission of Prime Minister.

- Governor SBP taken on board in reaching the decision.

ISLAMABAD: The government has decided to call off the central bank and a state-owned commercial bank’s appeals challenging the Federal Shariat Court’s (FSC) directives to completely replace the conventional banking system with a Shariah-compliant one by the end of 2027.

In a press conference, Finance Minister Ishaq Dar — with the permission of Prime Minister Shehbaz Sharif and in consultation with the State Bank of Pakistan (SBP) Governor Jameel Ahmed — announced that the government will withdraw the SBP and National Bank of Pakistan's pleas against the FSC verdict.

He said that once the appeals are taken back from the Supreme Court, the government would try "its best" to implement an Islamic banking system in Pakistan as soon as possible.

The FSC verdict, in this case, came in April 2022. The Shariat court in its ruling had stressed on the federal and the provincial governments to amend the laws to make the banking system free of interest.

Dar said that the government was also determined to overcome all the challenges faced by the introduction of an interest-free banking system and the Centre would take all possible measures to take it forward.

The challenge

In June this year, the SBP and four private banks challenged the decision of the FSC declaring the present interest-based banking system against the Sharia, directing the government to switch to an interest-free economy.

Salman Akram Raja filed an appeal on behalf of the SBP under Article 203F (1) of the Constitution with respect to the judgment passed by the FSC on April 28, 2022.

In its appeal, the SBP appreciated the spirit and the intent that led to the substantive provisions of the judgment delivered by the Shariat Court on April 28, 2022. However, it sought clarifications, as there are certain discrepancies in the judgment.

The SBP submitted that being the premier custodian and regulator of the financial and monetary framework of Pakistan is deeply committed to ensuring compliance with the injunctions of Islam, in particular those pertaining to riba, while protecting the stability and security of the financial sector of the country that functions as part of the global financial system.

The appellant can, with considerable justification, take pride in the furtherance of the Islamic banking sector in Pakistan as a critical and growing part of the financial sector as a whole, the SBP submitted, adding that these efforts are noted by the Federal Shariat Court in its judgment of April in paragraphs 82 to 88.

It further submitted that a gradual approach for the transformation of the banking system into Shariah-compliant banking was adopted at the start of this millennium wherein both the Islamic and conventional banks were allowed to operate simultaneously in the country.

The SBP further said that it has also been taking measures to bring the legal and regulatory infrastructure in compliance with Shariah principles.

The verdict

It is pertinent to mention that on April 28, 2022, a three-member FSC bench headed by Chief Justice Muhammad Noor Meskanzai and comprising Justice Dr Syed Muhammad Anwar and Justice Khadim Hussain M Sheikh declared that the prohibition of riba (interest) was absolute in all its forms and manifestations according to the injunctions of Islam and in accordance with the Holy Quran and Sunnah. Therefore, it should be eliminated from the country in five years.

The bench had held that five years period was enough for the implementation of the decision completely i.e convert the economy of Pakistan into an equitable, asset-based, risk-sharing and interest-free economy.

“Therefore, we would specify the 31st day of December 2027 on which the decision shall take effect by way of the complete elimination of riba from Pakistan,” the FSC had held.