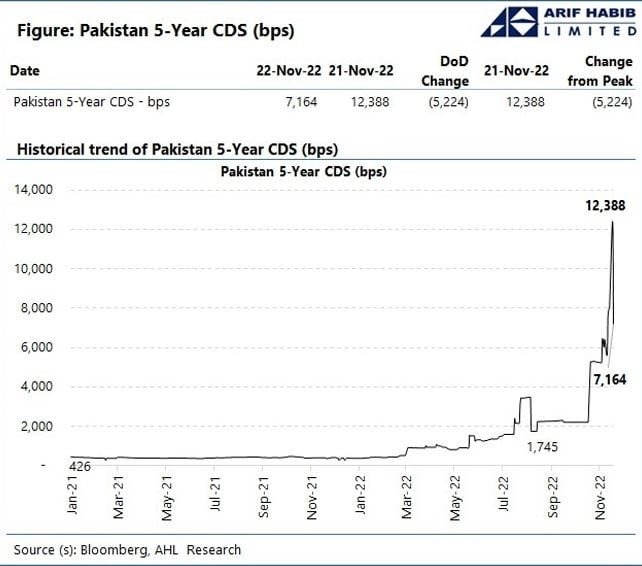

Pakistan's credit default swap slumps to 71%

Cost of insuring exposure to Pakistan’s five-year sovereign debt rises by 1,224 basis points over the weekend

November 23, 2022

- Situation tough but not as grave as reflected by CDS rate.

- Reforms still required to avoid economic mishaps.

- Country’s probability of default only 10%, per analyst.

KARACHI: Pakistan’s benchmark five-year Credit Default Swap (CDS) slumped by a massive 5,224 basis points to 71.64% on November 22, data released by a brokerage house showed.

These numbers were crunched by Arif Habib Limited (AHL).

The cost of insuring exposure to Pakistan’s five-year sovereign debt rose by 1,224 basis points over the weekend, hitting the highest-ever level of 92.53%.

The rate at these levels reflects a certain default, according to analysts, who also warned the country’s sovereign dollar bonds would remain vulnerable until the political standoff between the government and the Imran Khan-led PTI comes to an end.

“The situation on the ground is challenging but not as grave as reflected by the current CDS rate,” an analyst said. “The margin for any misadventure was thin, for sure.”

Khurram Schehzad, CEO of the Alpha Beta Core financial advisory firm, said the country’s probability of defaulting on its obligation was not too high to panic.

“Pakistan's credit default risk, measured appropriately by probability of default, is only around 10%,” Schehzad said in a tweet, citing data from Bloomberg Economics.

He said it was totally opposite to unnecessarily-hyped, wrongly-explained and most-illiquid CDS, and their price distortions.

“CDS is an insurance and there is a lot of difference between probability of default and buying insurance on an asset to protect repayments, which depends on investors,” Schehzad added.

Last week, Federal Minister for Finance and Revenue Ishaq Dar rejected all speculations surrounding oil shortage and widening credit default swap, terming them "baseless rumours being spread on political goals".

Addressing a press conference via video link, the finance minister asserted that Pakistan will “absolutely not” default on its debt obligations.

The country’s next big payment — $1 billion in international bonds — is due in December, and Dar assured the people that payment would be met on time.

“We have never defaulted before. We will not even be close to default … Let me clear this categorically that the bond will be paid and there is no delay in this and even arrangements have been made in principal for upcoming payments in the next year,” he reiterated.

Pakistan’s economy is in upheaval, and its foreign reserves are quickly running out. The central bank’s foreign exchange reserves stand at $7.959 billion as of November 11 and are enough for less than six weeks’ worth of imports.

Despite the recent rollover of Chinese debt and fresh infusions from the World Bank and ADB, reserves have been declining. As talks with the International Monetary Fund (IMF) over the ninth review of the loan facility come to a stalemate, its external financial strains are increasing. Friendly nations have not made any definite funding pledges. After exports, remittances are the second-largest source of income, but those are declining too.

Along with the deteriorating economic fundamentals, Pakistan’s political instability forced the foreign debt markets to see its bonds as risky and politically unstable sovereigns for months.

According to Dr Salman Shah, the former finance minister, “it’s political instability that has heightened anxieties for Pakistan and, in turn, has hiked debt insurance premiums for the country’s bonds.”

Shah claimed that the market was waiting for the government to act to alter how foreign investors saw Pakistani bonds. “First and foremost, the army chief should be named as soon as possible and without controversy. The political environment in the nation will become more stable as a result,” Shah said.

Second, the $1 billion repayment on the Sukuk due on December 5 should be made on schedule. Third, a road map for the elections acceptable to all political parties needed to be announced. The CDS would start falling right away if these actions were adopted, he said.

If not, everything would spiral out of control. The IMF was currently not providing Pakistan with significant support, he added. “Since Pakistan must secure external financing to pay its foreign debt obligations, the economy demands complete attention. Therefore, it is necessary to carry out the IMF’s programme in letter and spirit, conduct structural reforms, particularly in the energy sector, and enhance the investment climate in the nation,” said Dr Shah.

Fahad Rauf, the head of research at Ismail Iqbal Securities said an important event would be the upcoming $1 billion payment on Sukuk, which would give confidence to the market.

“Pakistan is likely to remain in the IMF programme, even after the end of the current programme, which would help Pakistan in managing debt payments. However, serious reforms are required to reduce the increasing debt levels in the economy ie i) conserve energy, ii) increase tax base, iii) focus on exports, and iv) attract FDI,” Rauf said.