IMF may delay release of next tranche as talks in limbo

Pakistan and IMF yet to decide on start of policy-level parleys to conclude pending ninth review

November 29, 2022

- Pakistan and IMF yet to decide start of policy-level parleys to conclude pending ninth review.

- Background discussions suggest talks in limbo because of differences over revised macroeconomic/fiscal framework.

- IMF objecting to Pakistan's revised framework for 2022-23 as it believes targets are unrealistic and contrary to ground realities.

ISLAMABAD: Pakistan and the International Monetary Fund (IMF) talks are continuing, with both sides yet to strike a broader agreement on a revised macroeconomic framework for the current financial year, reported The News, citing sources.

The lingering of the talks may delay the conclusion of the ninth review and release of $1 billion tranche till next calendar year 2023.

The talks continued for weeks but the two sides could not decide to start policy-level parleys to conclude the pending ninth review within November.

Both Pakistan and the global lender are tight-lipped and no one is willing to say anything on record but background discussions suggest that the talks were in limbo because of differences over revised macroeconomic/fiscal framework prepared by Islamabad and shared with the IMF.

Now, Pakistan will have to work hard to conclude the review by the first week of December, 2022. If the talks conclude next month the IMF will eventually release the next tranche in January 2023 as the Christmas and New Year holidays would commence after December 20, so the global lender’s Executive Board will meet next year to approve Pakistan’s next tranche.

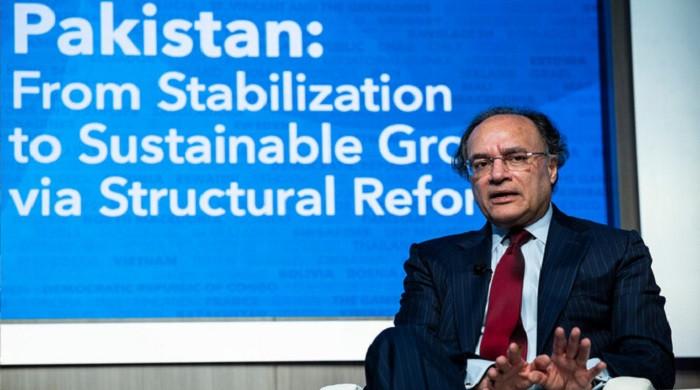

The News had approached both IMF and Finance Ministry officials to inquire about the exact schedule for conclusion of the pending review. One close aide of Minister for Finance Ishaq Dar stated that “discussions were going on Zoom. Insha Allah soon (the review will be concluded).”

The IMF is objecting over the revised macroeconomic/fiscal framework for 2022-23 as it believes the targets were unrealistic and contrary to ground realities.

The government envisaged nominal growth in the range of 25%, with two percent real GDP growth and 23% inflation on average but the remaining figures did not match with the revised nominal growth numbers.

The government has kept Federal Board of Revenue (FBR)’s annual target of Rs7.47 trillion unchanged. However, IMF believes that the tax collector may face a shortfall due to the compression of imports. Secondly, FBR figure did not match the nominal growth figures of 25%, so if FBR achieved its target, the tax-to-GDP ratio would further fall. Third, non-tax revenue target of Rs2 trillion might not be materialised as well.

The IMF noted that the petroleum development levy might not be fully materialised as the government envisaged a target of Rs855 billion before next budget. Now the levy target might be revised downward to Rs500 billion mainly because of the government’s inability to slap Rs50 per liter in diesel and reduction in petroleum products consumption by 21%.

Energy sector reforms and inability of the government to legislate changes were also stumbling blocks in striking consensus.

The delay in finalising the IMF agreement might compound the economic woes being faced by the country amid dwindling foreign exchange reserves as reserves held by the State Bank of Pakistan (SBP) stand at $7.8 billion.

SBP is going to repay $1 billion on the maturity of the Sukuk bond within the ongoing week. The Asian Infrastructure Investment Bank is going to provide a $500 million loan as its board had already granted an approval. The central bank reserves will further fall and will be standing at around over $7 billion within the next couple of weeks.