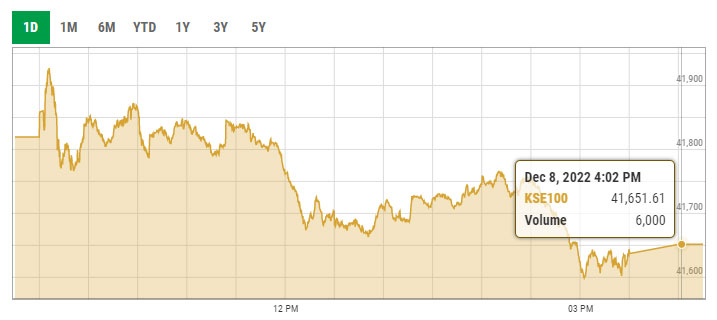

KSE-100 falls as economic uncertainty rattles market

In the backdrop of a dismal economic scenario, coupled with rising political instability, KSE-100 index lost nearly 170 points

December 08, 2022

- Dismal economic scenario take a toll on KSE-100 index.

- KSE-100 index closes at 41,615.61 points with a decline of 0.40%.

- Shares of 330 companies were traded during the session.

The rising economic uncertainty in the country took a toll on the Pakistan Stock Exchange on Thursday as the benchmark KSE-100 index dipped nearly 170 points during a tumultuous session.

In the backdrop of an unsatisfactory economic scenario, coupled with rising political instability, the index reversed the gains registered a day earlier.

Economic uncertainty following the delay in the ninth review of the International Monetary Fund (IMF) programme and depleting foreign exchange reserves impacted the investment climate.

Moreover, the rupee continued to register losses against the US dollar for the fourth consecutive session in the interbank market which also refrained investors from assuming fresh positions.

Market players also reacted to the decrease to negative 4% in September-October 2022 in Pakistan’s business confidence score (BCS), which was at positive 17% in March-April 2022.

Resultantly, the benchmark KSE-100 index closed at 41,615.61 points with a decrease of 167.68 points or 0.40%.

Arif Habib Limited, in its post-market commentary, noted that a range-bound session was witnessed at the PSX today.

“The market opened in the green zone but failed to maintain momentum since the investors chose to remain on the sidelines given the country's current macroeconomic situation, resulting in the benchmark KSE-100 index closing in the red,” it stated.

Volumes on the mainboard dried up as activity remained subdued, though third-tier stocks remained in the spotlight.

Sectors contributing to the performance included technology and communication (-55.8 points), commercial banks (-36.7 points), cement (-35.8 points), power generation and distribution (-24.2 points), and pharmaceuticals (-21.2 points).

Shares of 330 companies were traded during the session. At the close of trading, 104 scrips closed in the green, 205 in the red, and 21 remained unchanged.

Overall trading volumes rose to 227.83 million shares compared with Wednesday's tally of 221.48 million. The value of shares traded during the day was Rs4.05 billion.

Kohinoor Spinning Mills was the volume leader with 25.27 million shares traded, gaining Rs0.42 to close at Rs3.57. It was followed by Hum Network with 23.68 million shares traded, gaining Rs0.49 to close at Rs6.03 and Hascol Petroleum with 13.05 million shares losing Rs0.20 to close at Rs7.71.