‘Pakistan expects $18-20bn inflows in second half of FY23’

We are facing difficulties in generating inflows but there is no possibility of a default, SBP chief says

December 17, 2022

- There is no possibility of a default, SBP chief says.

- Aisha Ghaus Pasha says IMF programme “not suspended”.

- MNAs criticise authorities on three exchange rates in country.

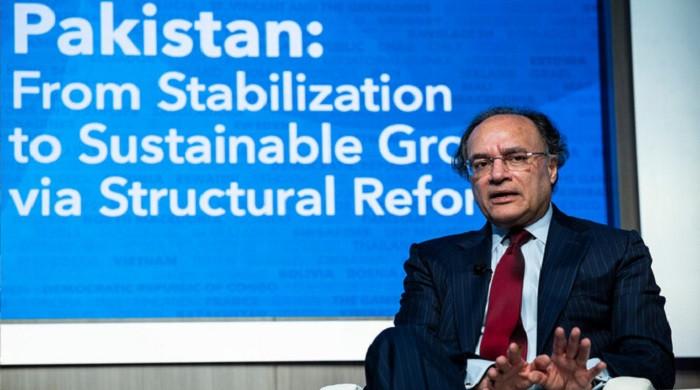

ISLAMABAD: State Bank of Pakistan (SBP) Governor Jameel Ahmed said the country was expecting $18 to $20 billion of inflows from multilateral and bilateral creditors in the second half (January-June) of the current fiscal year 2022-23 to overcome persistent liquidity crunch.

The members of the National Assembly, irrespective of the political divide, pointed out during the proceedings of the National Assembly Standing Committee on Finance that three exchange rates existed and recommended placing a uniform exchange rate.

“We are facing difficulties in generating dollar inflows but there is no possibility of a default on the external front in the ongoing fiscal year," the SBP chief informed the MNAs at a briefing at the Parliament House on Friday.

"It will be difficult to generate dollar inflows in the shape of commercial loans and international bonds. We are expecting to generate $18-20 billion in the second half of the current fiscal year."

The parliamentarians belonging to the treasury benches — including Pakistan Muslim League-Nawaz (PM) -N MNA Ali Pervez Malik and Pakistan Peoples Party (PPP) MNA Dr Nafisa Shah — strongly criticised the government policies for non-materialising of dollar inflows mainly because of the inconclusive International Monetary Fund (IMF) talks for accomplishing the ninth review under the Extended Fund Facility (EFF).

Malik warned that the private sector might plunge into insolvency in the second round of the looming crisis.

He was of the view that the current account deficit was no more the problematic area but the executive was failing in materialising dollar inflows mainly because the IMF was using dillydallying tactics.

‘Pakistan-IMF negotiations struck’

Even the chairman of the Standing Committee on Finance belonging to the PML-N, Qaiser Sheikh, joined hands with the members for criticising the government.

Sheikh said that he could apprise the government about ground realities but Finance Minister Ishaq Dar, the finance secretary, and the Federal Board of Revenue (FBR) chairman did not bother to attend the meeting.

He revealed that he was making efforts to contact the minister for the last several days but failed.

When the members severely criticised the government, Minister of State for Finance and Revenues Dr Aisha Ghaus Pasha said the IMF programme was “not suspended” and they were engaged with it.

Sheikh inquired why the government was not talking openly, which triggered a heated debate between the MNAs and Pasha who said there was no decision yet on combining the ninth and 10th reviews under the IMF programme.

The state minister said that the country had failed to materialise the much-needed structural reforms in the last 75 years. “Pakistan-IMF negotiations were struck mainly because of living beyond our means since the inception of the country.

“The energy sector is a major bone of contention where the IMF recommends recovering the cost of generation. The circular debt of the power and gas sector escalated to Rs4 trillion.

The second reason for the delayed agreement with the IMF is the persistent inability of governments to generate increased tax revenues. Thirdly, the IMF was opposing subsidies and exporters especially textile tycoons of All Pakistan Textile Mills Associations (APTMA) secured subsidies on power and gas tariffs.”

She further added that when the government was pursuing structural reforms even traders protested on roads for not paying Rs3,000 per month fixed tax. “These protesters made structural reforms non-starters in the country,” she added.

Dr Shah said that she was “disappointed” that the government could not withstand the front of protesters. She said the defeatist approach could not provide solutions to existing problems as the Pakistan Democratic Movement (PDM)-led government had come into power to resolve problems instead of presenting excuses.

Malik said he remained chairman of the APTMA and asked the minister to disclose those areas where subsidies were doled out.

‘Current account deficit to touch $10bn by FY23 end’

Earlier, the SBP governor said that out of total external debt servicing requirements, the government had paid back $6 billion and got a rollover of $4 billion.

“The remaining external debt servicing requirements stands at $13 billion,” he said, adding that the current account deficit was hovering around $2.8 billion in the first four months and it was projected to touch $10 billion by the end of the current fiscal year.

He said that the central bank had cleared 30,000 Letters of Credit (LCs) up to October 31, 2022, in the range of $100,000. Now the backlog of the last two months might have accumulated, Ahmad said, adding that he did not have an exact number of stuck-up LCs.

The SBP chief said that he would be holding meetings with the business community the next week to get recommendations for clearing pending LCs as early as possible. He said that he was not happy to see holding up LCs.

The chairman of the panel said that raw material-related consignments had gotten stuck up because of which prices went up by 10% in the last 30 days.

Originally published in The News