The economic cost of ongoing political crisis

Imran Khan’s decision to drop a hammer on Punjab and Khyber Pakhtunkhwa assemblies has plunged the country into an unprecedented constitutional crisis, which in turn is conjuring up economic...

Pakistan Tehreek-e-Insaf (PTI) Chairman Imran Khan’s decision to drop a hammer on Punjab and Khyber Pakhtunkhwa legislative assemblies has plunged the country into an unprecedented constitutional crisis, which in turn is conjuring up economic uncertainty never seen before in the country.

The fallout of the delay in the ninth review of the International Monetary Fund (IMF) programme is confounding the situation manifold.

Since Khan’s announcement, economic concerns have gone through the roof as the foreign reserves have been running lower and lower, while the rupee continues to bleed value versus the dollar and inflation is aiming for the new skies.

Moreover, the ninth review of the IMF programme — meant to stabilise a fragile economy — has been stalemating for months.

The nuclear-armed country has yet not recovered from the shock of the catastrophic floods in late August that killed more than 1,700 people and caused damages worth billions of dollars to the economy, choking the fiscal jugular further.

When Khan pulled the plug on the party’s quasi-comatose long march and laid his plan bare on November 27, the markets skipped a big beat and have been gasping for air since then.

“Political instability always has repercussions on the economic fundamentals,” development economist Maha Rahman told Geo.tv, adding, “It erodes investor's trust and markets respond accordingly”.

The economist explained that political uncertainties “most importantly, disrupt policy continuity”.

Regarding the impact of the ongoing political drama in Punjab on negotiations with the IMF – the lender of the last resort – Rehman said: “I feel they [talks] are at risk of being derailed more so by the Finance Minister Ishaq Dar’s policy decisions. The political instability of course also makes our international partners wary [of dealing with us].”

Foreign exchange reserves held by the central bank stand at $6.7 billion and commercial banks have another $5.9 billion. That covers imports for barely a month, despite multilateral and bilateral funding received as flood aid.

Pakistan's rupee has shed nearly 26% since the start of the year, hitting its weakest level on record in September, manifesting a fragile financial situation and a strengthening dollar.

The rupee devaluation is pushing up the cost of imports, borrowing, and debt servicing, and will further fire up inflation running already at a record high of 23.8%.

All major credit rating agencies have lowered their outlook on Pakistan since June — they all rate the country as highly speculative and risky. And the ongoing political crisis is aggravating the economic challenges.

“It will further shrink the space for the Pakistan Democratic Movement-led government to pursue painful but necessary economic steps critical to stabilising the economy,” Uzair Younus, director of the Pakistan Initiative at the Atlantic Council's South Asia Center said.

“If both assemblies are dissolved and elections called, populist economic choices that will inflict significant pain on the economy will be pursued to the great misfortune of millions of ordinary citizens,” Younus said.

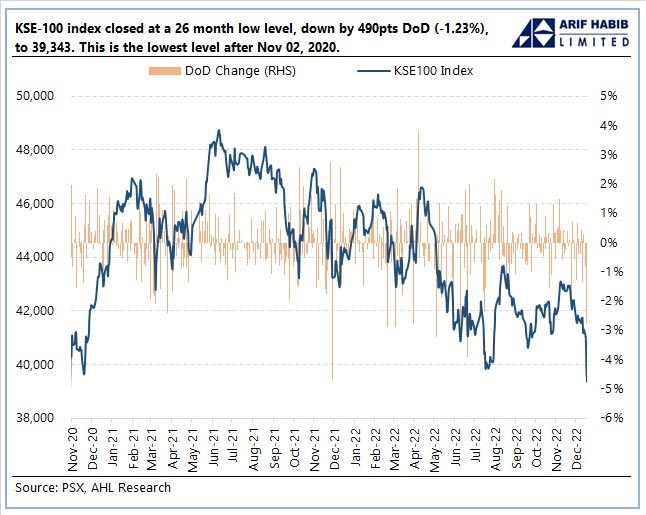

On Wednesday, the KSE-100 Share Index of the Pakistan Stock Exchange (PSX) closed at a 26-month low level of 39,343. This is the lowest since November 2, 2020.

Meanwhile, the widening exchange rate gap in interbank and open markets has also given rise to speculations which led to an abnormal price hike in the local market.

This, along with other indicators, blinking blood-red, is potentially stoking the panic that what would be left of the economy if PTI’s plan to disband the legislative bodies of the country succeeds as perceived.

— Additional input from Reuters