PSX bounces back on SHC verdict on super tax

Market oscillates between red and green zones due to mix of positive, negative news

December 22, 2022

- Market oscillates between red and green zones.

- Index closes session with a gain of 495.44 points.

- Investors resort to value hunting.

The Pakistan Stock Exchange (PSX) endured a tumultuous trading week as the benchmark KSE-100 index swung between green and red zones because of a blend of positive and negative news reports.

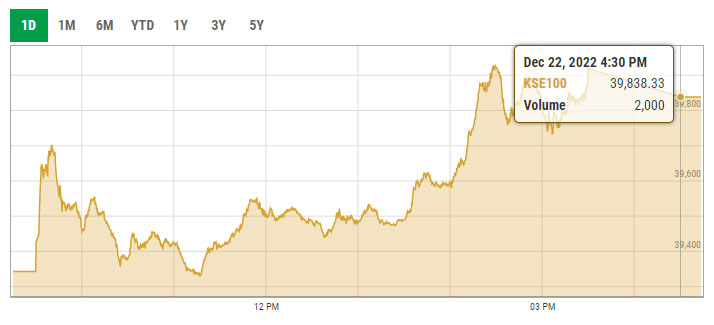

The bulls emerged victorious in the end and the index closed the day with a gain of 495.44 points, or 1.26%, at 39,838.33.

The bourse took a U-turn from its 26-month low level — recorded a day earlier — as market participants resorted to value hunting and purchased stocks that had fallen to attractive valuations on the back of a bearish spell during the start of the week.

The market players reacted positively to the Sindh High Court’s ruling on super tax. The court, in its short order, stated that the petitions are allowed on the ground that such tax cannot be imposed retrospectively as tax levied on past and closed transactions.

“However, such tax/provisions are applicable for coming years,” it read, adding that therefore, the operation of Section 4(C) is declared “ultra vires and unconstitutional for 2021-2022.”

In June, Prime Minister Shehbaz Sharif announced that an additional 10% super tax, also dubbed as “poverty alleviation tax” will be imposed on 13 major segments to augment tax collection which was rejected by the industry owners.

The KSE-100 index fell into negative territory following a brief rally in the initial hour and traded in a narrow band throughout the day. A few attempts made to lift the market proved fruitful. Consequently, the bourse managed to sustain the 39,000-point mark.

The index had been under immense pressure since the last week when former prime minister Imran Khan announced that the Pakistan Tehreek-e-Insaf would dissolve Punjab and Khyber Pakhtunkhwa assemblies on December 23, which was widely seen as a negative for stock market investors.

Subsequent heavy net selling by foreign investors, coupled with the constant depreciation of the rupee and delay in the International Monstery Fund programme, has led to panic selling with the index shedding close to 5% in the last three sessions.

However, the bears took a breather as bulls staged a comeback at the bourse on the back of the resumption of value hunting as blue-chip stocks were available at attractive price levels.

Arif Habib Limited, in its post-market commentary, noted that a positive session was witnessed at the PSX today.

“The bulls drove the index throughout the day which shows signs of recovery after yesterday’s sharp decline,” it stated, adding that the investors’ sentiments were improved due to the super tax reversal by Sindh High Court which has been declared “ultra vires” to the constitution.

Investor participation remained active throughout the day, healthy volumes were observed on the main board although third-tier stocks remained in the limelight.

Sectors contributing to the performance included exploration and production (+92.3 points), commercial banks (+64.4 points), technology and communication (+64.3 points), chemical (+43.5 points), and cement (+40.9 points).

Shares of 329 companies were traded during the session. At the close of trading, 238 scrips closed in the green, 79 in the red, and 12 remained unchanged.

Overall trading volumes rose to 194.53 million shares compared with Wednesday's tally of 166 million. The value of shares traded during the day was Rs5.48 billion.

Cnergyico PK Limited was the volume leader with 17.4 million shares traded, losing Rs0.01 to close at Rs3.85. It was followed by Pakistan Refinery with 13.01 million shares traded, gaining Rs0.27 to close at Rs13.23 and TPL Properties with 10.1 million shares gaining Rs0.69 to close at Rs17.75.