Bears once again pull stocks below 40,000 points

Cautious investors stay on sidelines as confidence weakens in Pakistan’s economy

December 27, 2022

- Bourse closed with a loss of 352 points.

- Cautious investors opted to stay on sidelines.

- Shares of 322 companies were traded.

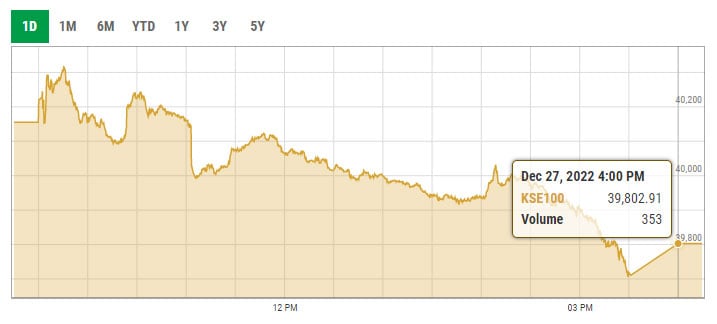

The Pakistan Stock Exchange (PSX) endured a tumultuous session on Tuesday and the benchmark KSE-100 index recorded multiple ups and downs as investors awaited news that could set the direction of the market.

The bears managed to overpower the bulls as the bourse finally closed with a loss of 352 points.

Cautious investors opted to stay on the sidelines as their confidence in Pakistan’s economy is ebbing lower, owing to a number of negative indicators i.e., surging current account deficit and depreciating rupee. All these factors prevented the market players from taking fresh positions.

Moreover, continued delay in the ninth review of the International Monetary Fund (IMF) programme also piled up pressure on the participants.

In early trading, the KSE-100 index rose, however, it soon registered a steep fall as jittery investors resorted to profit-taking owing to the negative triggers. However, the bulls managed to wipe off some of the losses soon after.

Later, bears and bulls locked horns with the index showing minor ups and downs throughout the day.

Before the close of the market, bears managed to win the battle, pushing the index into negative territory.

At close, the benchmark KSE-100 index recorded a decrease of 352.25 points, or 0.88%, to settle at 39,802.91.

A report from Topline Securities noted that a lack of confidence in Pakistan’s economy and delay in the IMF programme led to profit-taking.

Shares of 322 companies were traded during the session. At the close of trading, 98 scrips closed in the green, 212 in the red, and 12 remained unchanged.

Overall trading volumes rose to 153.74 million shares compared with Monday's tally of 146.88 million. The value of shares traded during the day was Rs5.5 billion.

Bank Alfalah was the volume leader with 16.33 million shares traded, losing Rs0.04 to close at Rs29.96. It was followed by Pakistan Petroleum Limited with 12.46 million shares traded, losing Rs0.67 to close at Rs61.11 and Bank of Punjab with 7.7 million shares losing Rs0.30 to close at Rs4.63.