Rupee licks policy-inflicted wounds as dollar remains elusive in 2022

On last business day of 2022, the US dollar traded at Rs226.43 compared to Rs176.51 on January 4, showing a total depreciation of Rs49.92 or 28.28%

The rupee had a disastrous year as it kept hitting new lows for various reasons, including political turmoil, smuggling of dollars to Afghanistan, ballooning current account deficit, a booming black market, and a stalemate in the International Monetary Fund (IMF) loan programme.

On Friday, the last trading day of the year, the dollar traded at Rs226.43 compared to Rs176.51 on January 4, showing a total depreciation of Rs49.92 or 28.28% in the year 2022.

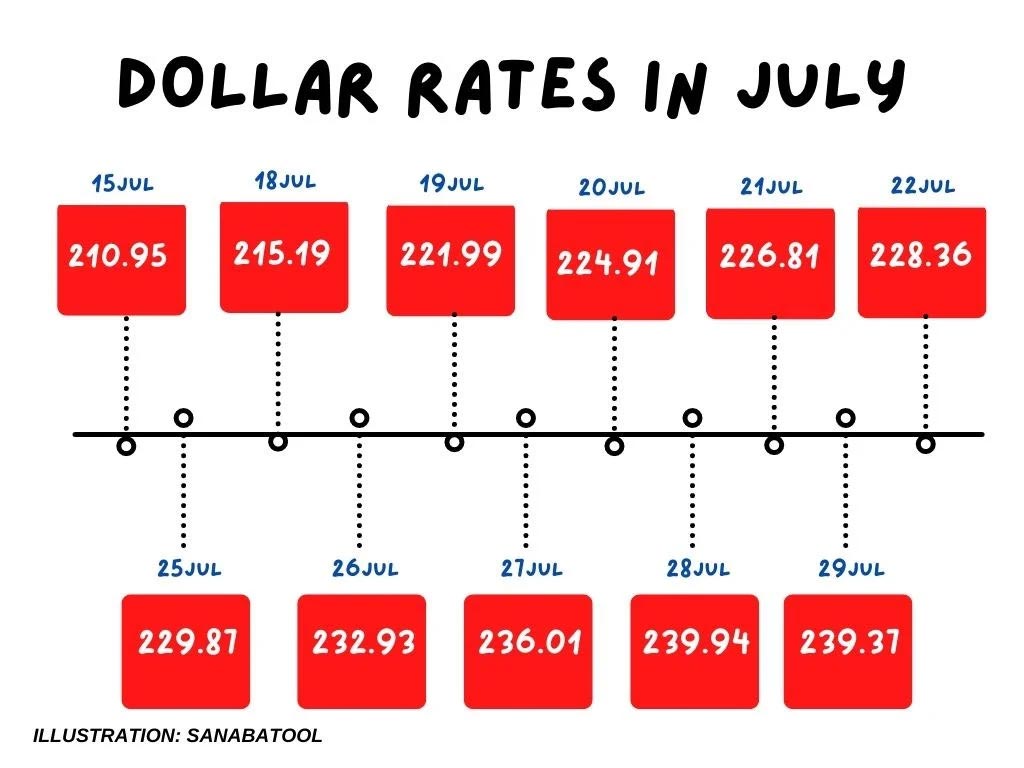

Earlier on July 28, the currency hit an all-time low of Rs239.94 against the greenback, according to the central bank data.

Experts earlier predicted that the rupee could recover to around Rs180 against the dollar after the revival of the IMF programme; however, the impasse continues even to date.

Second-worst month since 1957

Dwindling forex reserves, stalled foreign inflows, and shrinking remittances pushed the currency towards its second-worst month since 1957 in July.

The associated political risks and shifting policy paradigms also took a toll on investor/creditor confidence, mounting pressure on the rupee.

A look-back at the turbulent journey of the rupee from 176 to 226/dollar highlights the failure of three finance ministers and an equal number of the State Bank of Pakistan (SBP) governors.

The year began with Pakistan Tehreek-e-Insaf’s (PTI) finance minister Shaukat Tarin struggling to contain the rupee amid a political tug-of-war between the then Imran Khan-led government and the Pakistan Democratic Movement (PDM). However, the latter managed to pull the rope and sent the former tripping over.

As soon as the PDM-led government came into power in April by ousting Imran Khan through a vote of no-confidence the rupee surpassed the 180 level for the first-time raising concerns for several sectors and masses as the depreciating rupee increased the cost of living of the people.

Karachi-based industrialist Miftah Ismail, who was sworn in as the first finance minister of the coalition government, struggled to get the economy back on track. Miftah introduced new policies to control the damage done by the destructive economic policies of the PTI and he succeeded in reviving the IMF programme, securing loan commitments, and dealing with the initial impact of deadly floods.

However, dissatisfied with his performance, the incumbent government decided to bring in Ishaq Dar — after five years of his self-imposed exile. The 72-year-old seasoned politician, who is also a chartered accountant, was most famous for his tactic of "strong-arming the central bank" to liberally inject foreign exchange into the market in a bid to keep the rupee strong against the dollar.

Ahead of Dar’s formal appointment on September 28, the rupee started recovering, hinting that the markets were relaxed; however, financial pundits and analysts warned that Dar couldn’t do much as the exchange rate was now market-determined, whereby foreign reserves are not used to defend the currency.

In line with the warnings, the rupee continued to stoop to record lows; moreover, Dar’s brashness created hurdles in the IMF review which added more pressure on the already stumbling currency.

The delay in the ninth review of the Fund — which was due in September — delayed the expected inflows from multilateral and bilateral sources due to which the supply of dollars remained dismal compared to the rising demand.

Commenting on how the rupee fared during the outgoing year, the Ministry of Finance’s former adviser Dr Khaqan Hassan Najeeb highlighted that it is important to remember that the US dollar has strengthened against currencies due to aggressive monetary policy tightening of 4.25% since march by Federal Reserve and concerns of a global growth slowdown.

“Domestically, falling SBP reserves by $11.9 billion in 12 months to December, slower dollar inflows, rising trade gap, loss of confidence of markets due to weak economic fundamentals have weakened the rupee,” he said citing major reasons behind the massive plunge of nearly 30% in rupee value.

He further mentioned that Pakistan is in a market-determined exchange rate system and under this regime trade deficit and market-influencing news make a lot of impact on currency changes.

The former adviser was of the view that the recent adjustment of the local unit was partly influenced by uncertainty due to IMF programme delay coupled with a heightened dollar liquidity crunch. Moreover, the export receipts and remittances have also slowed making the dollar dearer.

“Something that is less discussed is deterioration in Pakistan's financial account where inflows have dropped in the fiscal year 2022-23 compared to last year putting pressure on balance of payments,” he pointed out.

Wrapping it up, Dr Najeeb said: “Future is dependent on increasing both debt and non-debt creating inflows as well as resumption of the IMF programme. Slow market adjustment of rupee is visible but we know that in a market-determined exchange rate regime improvement in fundamentals can calm the markets and reverse the downtrend.”

— Thumbnail and banner image: Faiz Iqbal