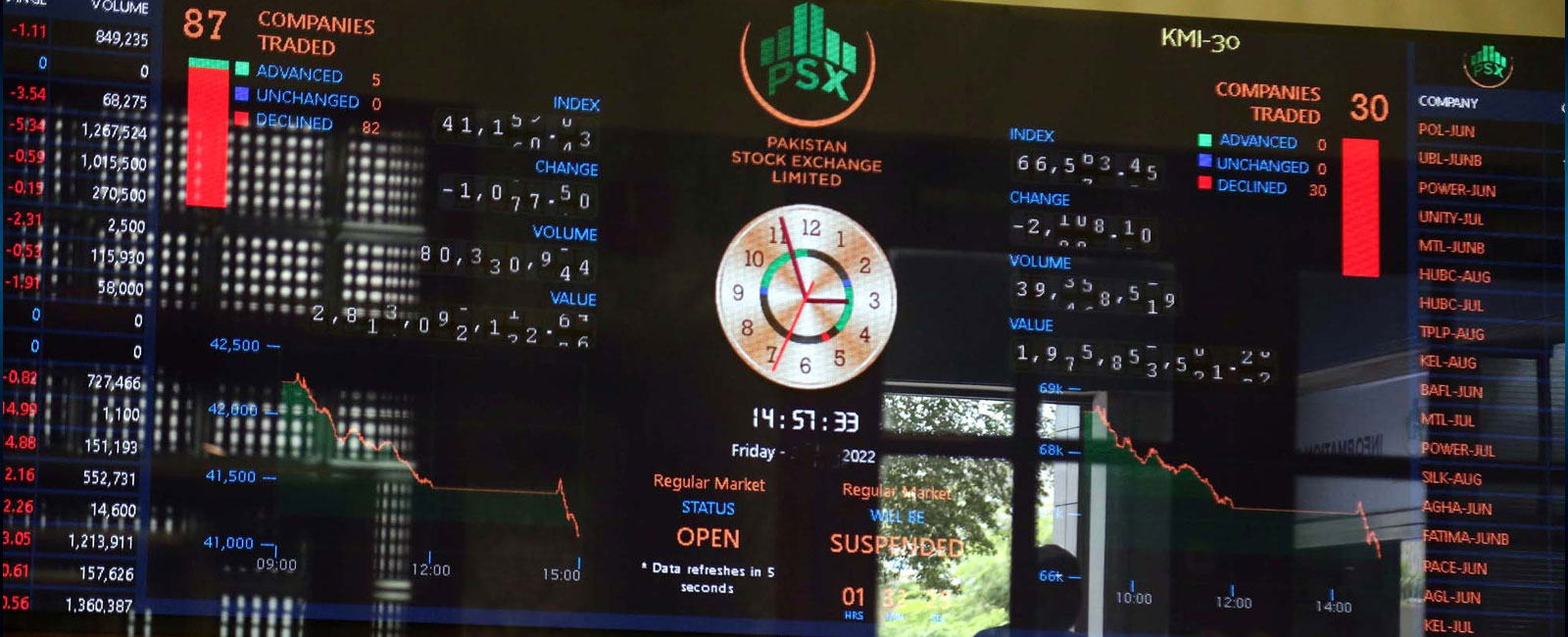

'Twitchy' stocks reel through a riotous 2022 tainted by politics

Benchmark KSE-100 index lost 9.4% in rupee value to date compared to the pre-opening level of the year at 44,596 points on January 1, 2022

The whipsaw stock market staggered through a riotous outgoing year that kept investors on a tightrope, but despite all the red ink splashed over it, the local bourse fared better than broader international markets in terms of local currency returns.

Analysts, closely watching Pakistan Stock Exchange (PSX), believe that for the past few years, the KSE-100 index returns have not caught up with valuations. The cherry on top was that 2022 further eroded the gains achieved over the past three years.

The benchmark KSE-100 index lost 9.4% in terms of rupee value to date compared to the pre-opening level of the year at 44,596 points on January 1, 2022. The market received a battering in wake of the political turbulence, the Russia-Ukraine war, exorbitant global commodity prices and 49-year high inflation in the country.

Arif Habib Limited, in its yearly round-up, said there was an understandable lack of conviction in 2022 as investors awaited clarity.

Stocks jumped on Friday, the last working day of 2022, due to optimism over the resumption of the International Monetary Fund (IMF) loan programme that remains crucial towards fixing the faltering domestic economy.

The equity bourse, however, posted an exceptionally dismal performance during 2022, eroding positive returns realised by the market in the past three years, to close at 40,420 points (down by 4,172 points, -9.4%). In dollar terms, the return was even more disappointing (-29.3% year-on-year) given the relentless pressure on the Pakistani rupee in the outgoing year.

Panic was observed in most stock indexes, which suffered greatly amid uncertainty in the global economic climate stemming from stringent monetary tightening to combat high inflationary readings post commodities’ spikes.

Without price stability, and stable growth in the labour market, the slowdown in aggregate demand compounded fears of an imminent recession in the US and Europe. Whereas a dire geo-political scenario, bearing in mind the Russia-Ukraine war and China-Taiwan conflict, further eroded the sentiment.

While global investors erred on the side of caution, market participants of the domestic bourse also took account of the political impasse in Pakistan, which began well before Pakistan Tehreek-e-Insaf (PTI) Chairman Imran Khan was removed by a vote of no-confidence.

Moreover, a spectrum of economic issues triggered by another external account crisis and an ongoing bout of high CPI, which despite multiple policy rate hikes during the year, also overshadowed any positive news.

Some temporary spikes were seen particularly as the landmark agreement of the Reko Dik was reached between the federal and Balochistan government with Barrick Gold Corporation, and Pakistan made an exit from the Financial Action Task Force's (FATF) Grey List in October 2022 after four years.

The KSE-100 index underperformed other asset classes in 2022, including gold (+45%), one-year US dollar Naya Pakistan Certificate (+36%) and US Dollar (+28%). T-Bills, money market funds and property indices posted returns in the range of 12-14% in 2022, according to the Topline report.

The initial public offering (IPO) market was also impacted due to falling equity values as only three initial offerings IPOs came to raise funds in 2022 as against eight IPOs in 2021. The number of IPOs was also the lowest after 2019 when Pakistan saw just one IPO at PSX.

Foreign corporate selling continued in 2022 with net selling of $127 million. In the last seven years, foreign corporates have sold shares worth $2.5 billion at PSX.

Local mutual funds and insurance companies also trimmed their positions in 2022, where mutual funds sold equities worth of $166 million while insurance companies sold $128 million stocks in 2022.

Selling was absorbed by local individuals, banks and companies with net buying of $138 million, $117 million, and $78 million respectively in 2022.

CEO’s vision for 2023

Commenting on the outlook and vision for 2023, PSX CEO Farrukh Khan told Geo.tv that he was looking forward to improvement in economic conditions in Pakistan — which would open avenues for investors.

The PSX chief said they also encourage the government to utilise the capital market to issue Green Bonds and Blue Bonds for addressing the cause of sustainability, whilst simultaneously meeting the financial needs of the country.

“Steps like these will help us meet the challenges we are beset with today as we move into the new year (2023). Simultaneously, this will provide the impetus for the capital market to perform well as the capital market is the barometer of the economy as per some schools of thought.

“No doubt, there are many challenges on the way. Bringing stability to the exchange rate, reversing rupee depreciation along with augmenting import substitution and increasing exports, reducing the current account and trade deficits will provide a much-needed boost to the industry and economy,” he said.

An undated thumbnail and banner image of the Pakistan Stock Exchange has been taken from APP