Stocks rise on renewed IMF tranche hopes on first day of 2023

KSE-100 index gains nearly 0.98% or 395.45 points to close at 40,815.90 points

January 02, 2023

- Expectations of positive development on IMF front boost PSX.

- Hopes of early resolution of circular debt stoke energy stocks.

- PPL leads volume chart with 14.9 million traded shares.

Stocks headed into the year 2023 boldly, packing solid gains on Monday; however, with the macroeconomic backdrop unchanged, the spectre of a default haunts investors as foreign reserves are depleting and lenders continue to remain close-fisted.

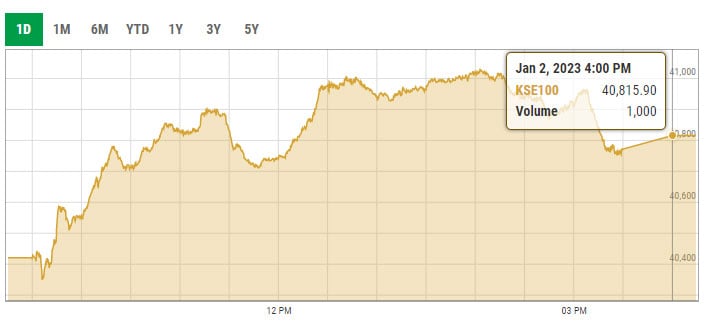

The KSE-100 index of the Pakistan Stock Exchange (PSX) closed at 40,815.90 points, up by 395.45 points or 0.98%.

Arif Habib Limited in a report said the market opened in the red but the bulls quickly took charge making an intraday high of 607.06 points.

“Investors remained affirmative during the trading session due to positive news on the ninth review of the International Monetary Fund (IMF) tranche, while the exploration and production sector remained in the limelight on the news of circular debt resolution,” the brokerage said.

Volumes were good across the board with refineries and the energy sector remaining in the limelight.

Sectors contributing to the positive performance were commercial banks 149.0 points), fertiliser (147.2 points), energy (+108.3 points), oil marketing companies (+33.8 points), and refinery (+21.8 points).

Volumes decreased from 284.5 million shares to 242.2 million shares (-14.9%). The average traded value also decreased by 8.6% to $32.1 million as against $35.1 million.

Stocks that contributed significantly to the volumes were Pakistan Petroleum Limited, Pakistan Refinery Limited, Hascol Petrol, Cnergyico PK Limited, and WorldCall Telecom Limited.

Topline Securities in a note said the buying momentum could be attributed to the market expectation regarding some breakthrough on the circular debt front as the government was ready to increase the gas tariff to meet IMF precondition for the resumption of dialogues to unlock the next tranche.

During the day, fertiliser, exploration and production, and banking sector stocks contributed positively to the index whereas Engro Corporation, Pakistan Petroleum Limited, United Bank Limited, Engro Fertiliser, and Fauji Fertiliser contributed 260 points to the index.

On the flip side, Hub Power Company, Lucky Cement, and System Limited lost 65 points collectively. PPL led the volumes chart with a trade of 14.9mn shares.