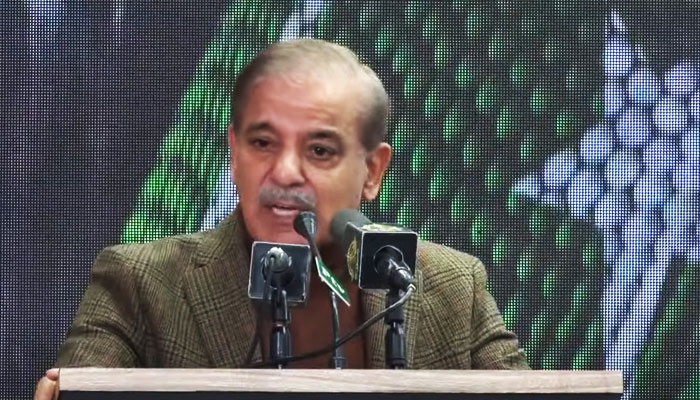

PM unveils ‘Youth Business and Agricultural Loan Schemes’

“We have to sacrifice politics if we want to save Pakistan,” says Premier Shehbaz Sharif

January 24, 2023

- Loans of up to Rs1.5m can be availed on personal guarantee of borrower.

- There will be no interest rate on loan of up to Rs0.5 million.

- 25% quota has been reserved for women.

In a bid to facilitate the youth to become entrepreneurs, Prime Minister Shehbaz Sharif on Tuesday launched Youth Business and Agricultural Loan Schemes in Islamabad.

The loan schemes are aimed at promoting self-employment and entrepreneurship amongst the youth.

People in the age group of 21 and 45 years can avail the loan facility of up to Rs7.5 million under these schemes. For IT and E-commerce businesses, the lower age limit is 18 years.

Microfinancing through small business loans will promote a norm of job creation rather than job seeking among the country's youth bulge.

The addition of agricultural loans will help the rural youth in bringing innovation to farming which can include mechanised farming, the creation of agricultural value chains and the solarisation of farming equipment to create more sustainable energy resource management in a climate-challenged country like Pakistan.

25% quota has been reserved for women. Islamic banking facilities can also be availed on the loan scheme.

Addressing the ceremony, Premier Shehbaz said that the loan “schemes are aimed at making the youth self-reliant”.

“In the past, the PML-N-led government provided Rs40 billion loans to youth and its recovery ratio was 90%. The Nawaz Sharif-led government issued laptops worth Rs15 billion to the youth.”

The prime minister also added that under the schemes, loans of up to Rs1.5 million can be availed on the personal guarantee of the borrower.

“There will be no interest rate on the loan of up to Rs0.5 million. 5% interest will be charged on the loan of over Rs0.5 million to 1.5 million,” he said, adding, “7% interest rate will be charged on the loan of over Rs1.5 million to Rs7.5 million.”

While talking about the international creditor, the premier said that the government asked the International Monetary Fund (IMF) that it "wants to complete the programme for 9th review".

“In a clear message, the IMF has said it stands with Pakistan,” the prime minister quoted the global lender as saying.

The IMF further said “together, we will steer the country out of the crisis”, he added.

Expressing his displeasure over Punjab and Khyber Pakhtunkhwa (KP) governments’ refusal to comply with the federal government’s decision about closing shops by 8pm under its conservation plan to save energy, PM Shehbaz said that a “provincial government” obtained a stay order against the decision.

“We have to sacrifice politics if we want to save Pakistan,” he added.

PM Shehbaz said that they “are ready to sacrifice their political earnings to save the state”. He added that everybody “will have to take the responsibility for the prevailing situation” in the country.

“The martial law governments are also responsible for the current situation of the country.”

The prime minister went on to say that he would lay down his life — take all measures — to save the country.

Speaking on the occasion, State Bank of Pakistan (SBP) Governor Jameel Ahmad lauded the coalition government for launching the initiative of the easy loan programme for youth. “The government is committed to empowering the youth despite financial issues.”

The governor added that special instructions had been issued to the banks for issuing loans to the youth.

Provision of loans to the "agriculture sector is the top priority" of the government and the central bank, he added. The SBP governor said that every possible assistance would be provided to farmers in flood-hit areas. "The limit of agricultural loans has been increased by 44%."

He urged all institutions to play a positive role in connection with the youth loan scheme.